2022 Gmc Canyon Elevation on 2040-cars

Engine:V6

Fuel Type:Gasoline

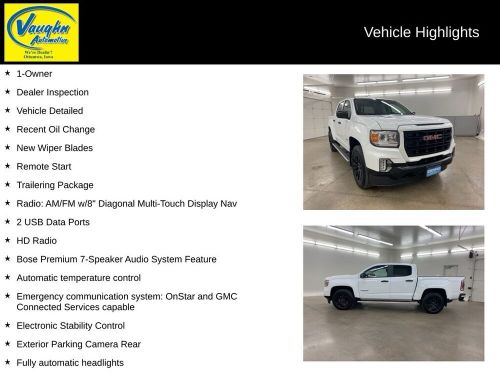

Body Type:4D Crew Cab

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 1GTG6CEN0N1297176

Mileage: 18424

Make: GMC

Trim: Elevation

Features: --

Power Options: --

Exterior Color: White

Interior Color: Black

Warranty: Unspecified

Model: Canyon

GMC Canyon for Sale

2016 gmc canyon sle1(US $24,999.00)

2016 gmc canyon sle1(US $24,999.00) 2018 gmc canyon slt(US $32,668.00)

2018 gmc canyon slt(US $32,668.00) 2019 gmc canyon sle1(US $21,500.00)

2019 gmc canyon sle1(US $21,500.00) 2019 gmc canyon 4wd denali(US $26,900.00)

2019 gmc canyon 4wd denali(US $26,900.00) 2022 gmc canyon 2wd crew cab short box elevation(US $32,810.00)

2022 gmc canyon 2wd crew cab short box elevation(US $32,810.00) 2016 gmc canyon 4wd crew cab 140.5" slt(US $22,977.00)

2016 gmc canyon 4wd crew cab 140.5" slt(US $22,977.00)

Auto blog

2014 Chevy Silverado High Country spied wearing trappings of new luxury trim

Wed, 03 Apr 2013Spy photographers have spotted the new Chevrolet Silverado High Country and GMC Sierra Denali out on public streets for a little testing. From the looks of things, the Silverado will receive a much-differentiated front fascia along with special badges and those honking 20-inch chrome wheels. Expect to find a more posh interior as well. Likewise, the Sierra Denali will wear a tweaked nose with the familiar Denali bling. The one of the GMC trucks spotted here rolls on 21-inch gunmetal wheels instead of the 20-inch chrome pieces of the High Country.

Word has it both trucks will go on sale after the Texas State Fair this summer. While General Motors hasn't said for certain what we can expect to find under the hood, we'd be surprised to see anything outside of the range of engines found in the standard Silverado and Sierra models. That means buyers should be able to get their hands on the efficient, 23-miles per gallon 5.3-liter V8.

Chevy's 6.6-liter Duramax is pretty much all new

Thu, Sep 29 2016To say there's a heated battle in heavy-duty pickups is an understatement, with Chevrolet, Ford, and Ram constantly trading blows of increased torque, horsepower, and towing capacity. The latest salvo is the revised, more powerful turbo diesel 6.6-liter Duramax V8 in the 2017 Chevy Silverado. It has 910 pound-feet of torque, an increase of 145, putting it nearly level with the Ford Super Duty. Here's a closer look at where those gains come from. How exactly did Chevrolet add all that torque plus 48 horsepower? The automaker essentially took a fine-tooth comb to the entire engine. Chevy says it changed 90 percent of the V8, and the cumulative effect of those small changes adds up to big increases. As you might guess, the turbocharger is updated. The larger unit features electric actuation of the variable nozzle turbine (VNT), and what Chevy calls a double axle cartridge mechanism that separates the VNT moving parts from the housing. That helps with heat performance as well, with a claim that the exhaust side of the turbo can run continuously up to 1,436 degrees Fahrenheit. Helping that cause are six exhaust gaskets made of Inconel - an nickel alloy that contains chromium and iron – and upgraded stainless steel for the exhaust manifold. Despite having the same cast iron cylinder block, albeit with some minor enhancements, the engine has new cylinder heads, pistons, piston pins, connecting rods, and crankshaft, which have all been upgraded to handle 20 percent higher cylinder pressures. Alongside the increase in pressure, Chevrolet also increased the cylinder head's structure with a honeycomb design. The pattern features high-strength aluminum with dual layer water jackets that not only improve strength, but also optimize water flow for better cooling. For 2017, the cylinder head also benefits from integrated plenum that aids the engine in getting more air under heavy loads. The cylinder head isn't the only component to get a minor update, as the pistons have a larger diameter pin for improved oil flow. The same detailed improvements has been bestowed to the humble connecting rods (second in our hearts only to the inanimate carbon rod). The new design has the bolts oriented roughly 45-degrees to the rod instead of parallel. The angle split design, as it's called allows for easier passage through the cylinder.

GMC Canyon AT4 OVRLANDX concept previews potential Bison-like model

Fri, Aug 27 2021GMC is signaling a move into serious off-road territory with this Canyon AT4 OVRLANDX concept. As its name suggest, this one-off was put together as a demonstration of what an overland-style GMC midsizer could potentially look like, but a glance beneath the surface reveals the bones of what we expect to be the forthcoming Canyon AT4X. While "AT4" has been trickling down through the GMC lineup for the past few model years, AT4X kicks the basic off-road formula up a notch, a la Chevrolet's Colorado ZR2, which gains extra underbody protection, locking front and rear differentials and Multimatic's phenomenal DSSV dampers. GMC Canyon AT4 OVRLANDX Off-Road Concept View 23 Photos OVRLANDX takes that to the next level, borrowing (and building upon) cues from the even-more-rugged ZR2 Bison, including rocker panel guards, cast-iron control arms, a custom front bumper with an integrated winch, built-in front recovery points, wheel arch trim with integrated LED task lighting, and guy lines for protecting the windshield from low-hanging branches. The custom rear bumper is even from American Expedition Vehicles (AEV), with whom Chevy partnered to produce the Bison's unique exterior bits. Does that seem like a wink and nod to you? “We wanted to showcase GMC Canyon with this concept and punctuate GMCÂ’s commitment to premium, off-road capable vehicles,” said Buick & GMC Global Vice President Duncan Aldred. "Consumer reaction to this conceptÂ’s design will help us further serve the growing market of buyers leading authentic outdoor lifestyles." This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. To that end, they threw a few more goodies at the concept. In a way, the roof-mounted tent, awning, cooler and kitchenette are just there to disguise the fact that GMC will likely build a production pickup with much these same specs when the new model debuts for the 2023 or 2024 model year – or perhaps even sooner. While this concept is built around GM's existing 3.6-liter V6 powertrain, the redesigned Canyon is expected to be offered with just one engine: a 2.7-liter turbocharged four-cylinder lifted from the Silverado and Sierra pickups. Rumors have pointed to a GMC variant of the Colorado ZR2 since the midsize pickup adopted the AT4 branding for its off-road variant.