13 Used 3.7 V6 Roush Rs Clean Autocheck 1 Owner 16k Low Miles Mykey on 2040-cars

Salina, Kansas, United States

Ford Mustang for Sale

2012 ford mustang gt premium 5.0 htd leather 19's 8k mi texas direct auto(US $28,980.00)

2012 ford mustang gt premium 5.0 htd leather 19's 8k mi texas direct auto(US $28,980.00) 2012 ford mustang boss 302 wrecked salvage rebuildable damaged runs tons of susp

2012 ford mustang boss 302 wrecked salvage rebuildable damaged runs tons of susp 14 used 3.7l v6 one owner automatic gotta have it green low miles cruise(US $24,900.00)

14 used 3.7l v6 one owner automatic gotta have it green low miles cruise(US $24,900.00) 2006 ford mustang gt base coupe 2-door 4.6l(US $22,000.00)

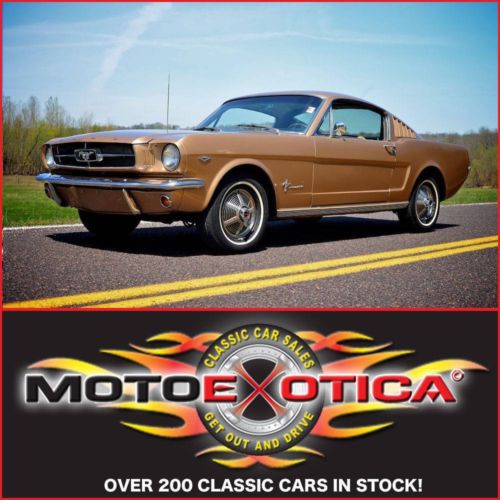

2006 ford mustang gt base coupe 2-door 4.6l(US $22,000.00) 1965 mustang fastback - 2+2 - stunning restoration - pony interior - lqqk !!!!!!

1965 mustang fastback - 2+2 - stunning restoration - pony interior - lqqk !!!!!! 2014 steeda gt500 wide-body conversion(US $134,900.00)

2014 steeda gt500 wide-body conversion(US $134,900.00)

Auto Services in Kansas

Ward`s Mobile Mechanics ★★★★★

V Werks ★★★★★

Terry`s Auto Sales & Salvage ★★★★★

Sutton-Kauffman Transmission ★★★★★

Showroom Automotive ★★★★★

Riley`s Rescue ★★★★★

Auto blog

Aussie Ford Falcon GT shows its rear end to Lamborghini Gallardo

Sun, 27 Apr 2014When Ford Australia announces, as it did recently, that it wants to celebrate the end of its Ford Performance Vehicle division with a Falcon FPV GT-F that celebrates big-bore origins of the nameplate, it's talking about the kind of car in this video.

At some point the classic Falcon GT - said to be an XY series - was invited to a test of acceleration against a Lamborghini Gallardo. At the very least, the Falcon GT had a 351 cubic-inch motor and 300 horsepower, but whatever this guy's got under the hood of his yellow sedan makes has him so confident that he doesn't even move his elbow from its resting place on the door.

You'll find a reminder of Ford Australia's heyday, a raucous exhaust note and some NSFW language in the short video below.

The fascinating forgotten civil defense history of Mister Softee trucks

Mon, 26 Aug 2013Hemmings came across an interesting article from the Throwin' Wrenches blog about the intersection of ice cream, cars and civic duty in America's late 1950s. In particular, it focuses on the Mister Softee trucks, which criss-crossed neighborhoods of the eastern US serving ice cream. Looking past the ultra-durable vehicles used - heavy-duty Ford-based chassis, for what it's worth - the article delves into some deeper national-security territory.

See, Mister Softee truck owners were voluntary members of the Civil Defense, thanks to all the useful stuff (potable water, generators, freezers and fridges) that the machines carried with them for serving ice cream. Click over to Throwin' Wrenches for the full run down of how Mister Softee would have stepped in to help fight if the Cold War ever turned a little hotter.

Ford Explorer gets appearance pack for 2015

Sat, 14 Jun 2014Remember when Ford launched the totally new Explorer in late 2010, and people were skeptical about how the now-crossover would fare, after ditching its traditional SUV roots? Well, we're several years in, and I think we can assuredly say that Ford made the right decision. Sales are better than ever (in fact, May was the current Explorer's best month yet), and the crossover is finding its way into the hands of a whole host of new Ford buyers.

A wholly refreshed Explorer is still forthcoming, but to keep its strong-selling crossover fresh, Ford is offering a host of improvements for the 2015 model year, including the attractive appearance package available on the XLT trim level, pictured above. Outside, the pack gets you goodies like 20-inch machined aluminum wheels, black bodyside cladding and roof rack rails. Contrasting Magnetic Metallic accents are found on the grille, mirror caps and liftgate appliqué, and there's an "Explorer" hood badge and body-colored door handles. Inside, there are new Miko suede inserts in the seats, and the package includes the automaker's Sync connectivity with MyFord Touch infotainment.

Elsewhere in the Explorer range, the Class III trailer tow pack is now standard on the Sport, base models get new 18-inch aluminum wheels, and there are three new colors on offer: Bronze Fire Metallic and Magnetic Metallic.