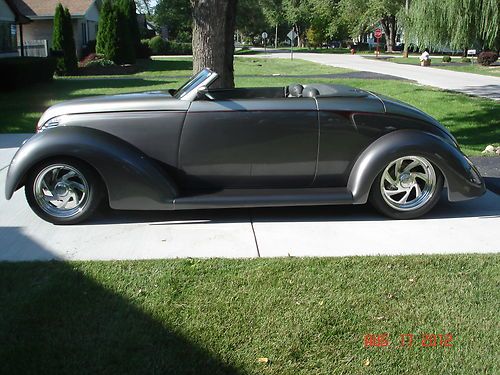

1929 Ford Model A on 2040-cars

Saint Louis, Missouri, United States

Body Type:Sedan

Vehicle Title:Clear

For Sale By:Dealer

Make: Ford

Model: Model A

Warranty: No

Mileage: 500

Exterior Color: Brown

Interior Color: Tan

Ford Model A for Sale

Auto Services in Missouri

Total Tinting & Total Customs ★★★★★

The Auto Body Shop Inc. ★★★★★

Tanners Paint And Body ★★★★★

Tac Transmissions & Custom Exhaust ★★★★★

Square Deal Transmission ★★★★★

Sports Car Centre Inc ★★★★★

Auto blog

Meet Shelby Mustang GT500 Miller, Iowa's latest hatchet-wielding criminal

Fri, Jul 11 2014Well, we've found the long-lost cousin of yesterday's Bentley-tattooed criminal from Florida. This is Shelby Mustang GT500 Miller. No, seriously. While his name seems just like the sort of thing we'd expect the Sunshine State to produce, he actually hails from Iowa. Despite coming from the Hawkeye State, Miller was arrested for a decidedly Floridian offense – getting in a bar fight and then returning with a hatchet. The only way this story could be more Florida is if meth, a manatee or bath salts were involved. The fight, which was at the Cheap Seats Sports Bar, started off typically enough, with a verbal argument in the parking lot (please, please let his nemesis be named "Chevrolet Camaro Z/28 Smith"). This, naturally, attracted passing police officers. Things were broken up and some friends took Miller to his home, which was apparently just behind the bar. That's when he returned with the hatchet tucked under his shirt. Miller promptly proceeded to take out the implement of destruction in the bar's bathroom and... forget about it entirely. Fortunately, the police hadn't left the area yet. Not surprisingly, Miller was arrested for a parole violation, as well as public intoxication and going armed with intent. Still, cool name, bro. News Source: Iowa City Press CitizenImage Credit: Polk County Sheriff's OfficeTip: Mike Government/Legal Ford crime shelby iowa

Focus ST Tuner, Traffic Deaths, Audi EV SUV | Autoblog Mintue

Sat, Aug 22 2015Autoblog senior editor Greg Migliore gives the highlights from the week in automotive news.

TRANSLOGIC 147: CES 2014 Autonomous Vehicles

Wed, Jan 15 2014We head back to CES in Las Vegas to check on the progress of autonomous vehicles in 2014. We go hands-free on the highway with Audi, narrowly avoid a collision with Ford and hear all about BMW's drifting driverless car. But first we take a ride on Induct's self-driving Navia shuttle.

1931 ford model a tudor

1931 ford model a tudor 1930 ford roadster

1930 ford roadster 1929 ford model a roadster restored aaca winner

1929 ford model a roadster restored aaca winner 1928 ford roadster project

1928 ford roadster project Classic roadster garage kept

Classic roadster garage kept Hot rod

Hot rod