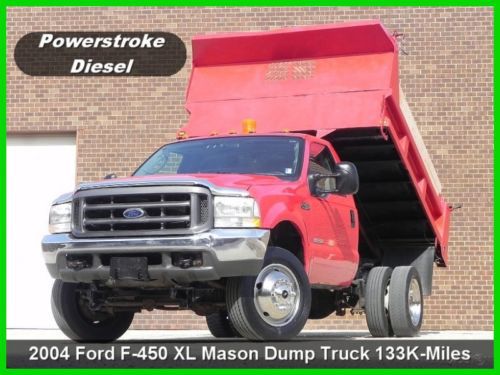

2004 Ford F-450 F450 Xl Regular Cab Mason Dump Truck 4x4 6.0l Powerstroke Diesel on 2040-cars

South Weymouth, Massachusetts, United States

Ford F-450 for Sale

2000 ford f-450 super duty power stroke diesel utility tire truck body bed ca

2000 ford f-450 super duty power stroke diesel utility tire truck body bed ca 2011 ford f450 xl super duty diesel 4x4 with convenience package.

2011 ford f450 xl super duty diesel 4x4 with convenience package. 2008 ford f450 wrecker tow truck self loader vulcan 810 no reserve

2008 ford f450 wrecker tow truck self loader vulcan 810 no reserve 2013 ford f-450 lariat crew cab dually w/ 5th wheel(US $58,990.00)

2013 ford f-450 lariat crew cab dually w/ 5th wheel(US $58,990.00) Utility service truck power stroke diesel

Utility service truck power stroke diesel 1997 ford f-450 utility truck with 35' onan bucket lift(US $7,800.00)

1997 ford f-450 utility truck with 35' onan bucket lift(US $7,800.00)

Auto Services in Massachusetts

Woodlawn Autobody Inc ★★★★★

Tri-State Vinyl Repair ★★★★★

Tint King Inc. ★★★★★

Sturbridge Auto Body ★★★★★

Strojny Glass Co ★★★★★

Sonny Johnson Tire ★★★★★

Auto blog

Equus Bass 770 | Autoblog Minute

Wed, Feb 8 2017Equus Automotive combines a Ford Mustang and a Dodge Challenger into one. Dodge Ford Luxury Autoblog Minute Videos Original Video 5g Connectivity Detroit supercar transportation mobility challenger luxury vehicle

Ford's simple suit makes you feel like a drunk driver

Tue, Mar 25 2014We've all heard about the dangers of drunk driving for practically our entire lives. Whether it's from PSAs on TV or lectures in school, no one can claim ignorance of drunk driving being extremely dangerous. However, that doesn't prevent some people from still doing it. Ford is trying to take the safety message directly to young drivers with a special suit that allows them to simulate driving under the influence. It is all part of Ford's Driving Skills for Life program that gives free driving education to young people. The program is meant to "train kids in skills they don't learn in driver's ed," said Kelli Felker, Ford Safety Communications Manager, to Autoblog. The drivers don a few items to impair their senses and make them off-balance to simulate having a few too many drinks and then go out on a closed course with an instructor to see the effects. Felker said that the suit is a new part of the program, and Ford just received the outfit in the US. It will be incorporated into the training here in the late spring or early summer. Scroll down to see the effect it has on drivers in Europe. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

VW, Rivian, Nissan, BMW, Genesis, Audi and Volvo lose EV tax credits starting tomorrow

Mon, Apr 17 2023The U.S. Treasury said Monday that Volkswagen, BMW, Nissan, Rivian, Hyundai and Volvo electric vehicles will lose access to a $7,500 tax credit under new battery sourcing rules. The Treasury said the new requirements effective Tuesday will also cut by half credits for the Tesla Model 3 Standard Range Rear Wheel Drive to $3,750 but other Tesla models will retain the full $7,500 credit. Vehicles losing credits Tuesday are the BMW 330e, BMW X5 xDrive45e, Genesis Electrified GV70, Nissan Leaf , Rivian R1S and R1T, Volkswagen ID.4 as well as the plug-in hybrid electric Audi Q5 TFSI e Quattro and plug-in hybrid (PHEV) electric Volvo S60. The Swedish carmaker is 82%-owned by China’s Zhejiang Geely Holding Group. The rules are aimed at weaning the United States off dependence on China for EV battery supply chains and are part of President Joe Biden's effort to make 50% of U.S. new vehicle sales by 2030 EVs or PHEVs. Hyundai said in a statement it was committed to its long-range EV plans and that it "will utilize key provisions in the Inflation Reduction Act to accelerate the transition to electrification." Rivian declined to comment and the other automakers could not immediately be reached for comment. Treasury also disclosed General Motors electric Chevrolet Bolt and Bolt EUV will qualify for the full $7,500 tax credit. GM said earlier it expected at least some of its EVS would qualify for the $7,500 tax credit under the new rules, including the 2023 Cadillac Lyriq and forthcoming Chevrolet Equinox EV SUV and Blazer EV SUV. Treasury said all GM EVs will qualify. Earlier, Ford Motor and Chrysler-parent Stellantis said most of their electric and PHEV models would see tax credits halved to $3,750 on April 18. Treasury confirmed the automakers' calculations. The rules were announced last month and mandated by Congress in August as part of the $430 billion Inflation Reduction Act (IRA). The IRA requires 50% of the value of battery components be produced or assembled in North America to qualify for $3,750, and 40% of the value of critical minerals sourced from the United States or a free trade partner for a $3,750 credit. The law required vehicles to be assembled in North America to qualify for any tax credits, which in August eliminated nearly 70% of eligible models and on Jan. 1 new price caps and limits on buyers income took effect.