Ford F-350 Superduty Xlt 6.0l Diesel 4x4 Auto 8ft Bed on 2040-cars

La Salle, Illinois, United States

Vehicle Title:Clear

Engine:6.0 Liter diesel

Fuel Type:Diesel

For Sale By:Private Seller

Transmission:Automatic

Model: F-350

Cab Type (For Trucks Only): Crew Cab

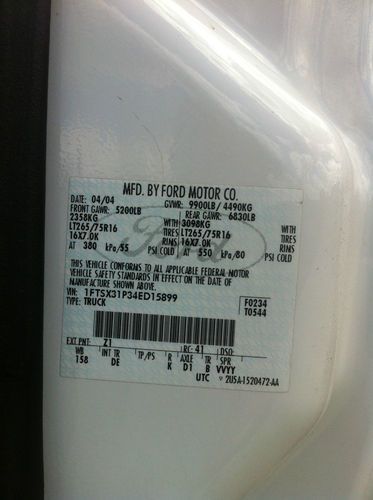

Year: 2004

Warranty: Vehicle does NOT have an existing warranty

Trim: XLT FX4

Options: 4-Wheel Drive, CD Player

Drive Type: Automatic

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 158,000

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Exterior Color: White

Interior Color: Gray

Number of Cylinders: 8

Disability Equipped: No

2004 Ford F-350 XLT FX4 6.0L diesel 158,000 miles, 8ft bed, locking tailgate, towing package.

About the truck: I'm the 2nd owner. Used as a work truck. Pulled 14ft dump trailer with skidsteer. I no longer do landscape work so truck and trailer must go (skid steer sold). There are some minor dings and scratches, the two turn indicator lenses on the mirrors are cracked and broken (I have a narrow garage). Will need tires in next year or two. Other than that the truck is in excellent running condition. Easy starts, no smoke, no problems people seem to have with the 6.0 liters. Interior is very clean for a work truck and has no foul odors.

The 2012 14' PJ dump trailer is for sale as well. I don't have an ebay listing for it but it's mint.

Email or call me if you have any questions. I can take more detailed photos of anything you wish.

Ford F-350 for Sale

Used ford f 350 powerstroke turbo diesel 4x4 pickup trucks 4wd truck we finance

Used ford f 350 powerstroke turbo diesel 4x4 pickup trucks 4wd truck we finance **no reserve** 00 f350 crew cab 4x4 lariat lifted 7.3 l power stroke diesel

**no reserve** 00 f350 crew cab 4x4 lariat lifted 7.3 l power stroke diesel 2005 ford f250 f350, f-250, f-350, super duty, 4x4, crew cab, long bed, diesel

2005 ford f250 f350, f-250, f-350, super duty, 4x4, crew cab, long bed, diesel 2002 f350 4x4 superduty

2002 f350 4x4 superduty Ford f-350 4x4 5sp 62,052 orig. miles(US $13,500.00)

Ford f-350 4x4 5sp 62,052 orig. miles(US $13,500.00) 2001 ford f350 7.3 power stroke diesel dually quad-cab 4wd(US $12,500.00)

2001 ford f350 7.3 power stroke diesel dually quad-cab 4wd(US $12,500.00)

Auto Services in Illinois

USA Muffler & Brakes ★★★★★

The Auto Shop ★★★★★

Super Low Foods ★★★★★

Spirit West Motor Carriage Body Repair ★★★★★

South West Auto Repair & Mufflers ★★★★★

Sierra Auto Group ★★★★★

Auto blog

Ford Mustang GT350R adds a lot more than just a new letter [w/videos]

Mon, Jan 12 2015Okay Chevrolet, the ball is in your court. Ford served up one hell of a rebuttal to the track-focused Camaro Z/28, introducing the limited-production Mustang GT350R, complete with over 500 horsepower, over 400 pound-feet of torque and freaking carbon-fiber wheels. Carbon-fiber wheels. Seriously. It's because of those 19-inch hoops, along with some other changes, that Ford was able to slice 130 pounds from the already lightweight GT350 Track Pack. The wheels are responsible for a 13-pound reduction in unsprung weight per corner, while the removal of such superfluous things like the air conditioning, stereo, rear seats, trunk carpet, backup camera and tire inflator accounts for the rest of the weight reduction. Along with the lower weight, Ford has thoroughly reworked the GT350's aerodynamics, adding a simply monstrous rear wing and diffuser, along with vented wheel wells, a new hood vent that both extracts heat and reduces lift. Beside the aero aids, Ford has shod the carbon-fiber wheels in ultra-grippy Michelin Pilot Sport Cup 2 tires, just to guarantee the shiny side remains up. View 21 Photos Ford retained the standard GT350's 5.2-liter, flat-pane V8, Torsen limited-slip differential (complete with a 3.73 rear axle ratio), although as power figures haven't been published for the standard car, there's no way to know whether the GT350R received a power bump. What we do know, though, is that the GT350R will not be limited to the track. While that's certainly its natural habitat, owners will be able to register and drive this monster on public roads. Take a look at the official press release on the GT350R, available below. And also be sure to have a peek at both Ford's stock photos of the new car, as well as our full gallery of live images, direct from the Blue Oval's Detroit Auto Show press conference home at Joe Louis Arena. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Ford's Explorer-based Police Interceptor to get 365-hp EcoBoost option

Tue, 20 Aug 2013Speeders beware, the police are going to be getting quite a bit faster. Ford has just announced that it will be offering its 3.5-liter, twin-turbocharged, EcoBoost V6 in the Explorer Police Interceptor. The new engine will be joining the existing 3.7-liter V6. The 365-horsepower, 350-pound-foot mill should be familiar to consumers as the powerplant that's found in the Ford Taurus SHO (and its LEO equivalent, the Taurus Police Interceptor) and the Ford Explorer Sport. It should also provide quite a kick in the pants to officers used to the naturally aspirated 3.7 and its 304 ponies and 279 pound-feet of torque.

The move to the more potent powerplant was born out of all the equipment officers need to carry on a day-to-day basis. These days, there's so much stuff that police need on a regular basis, that there's a genuine market for a faster Police Interceptor Utility, as it's known officially. The Explorer-based cruiser has already accounted for 68 percent of Ford's LEO sales in 2013, and that's with just the 3.7, and we'd only expect that number to increase once the twin-turbo, 3.5-liter V6 is available. Ford won't offer up any indication of what the take rate will be on the new engine, but we're guessing it'll be fairly high.

The success of the Explorer PI couldn't have come at a better time for Ford. The decision to end Crown Victoria production was not a popular one with police, and combined with Chevrolet and Dodge diving into the LEO market feet first, Ford hasn't been performing as well as it's wanted to. The Explorer has been helping it turn around, though. And with the inclusion of the EcoBoost, Ford also has a legit competitor for the Chevrolet Tahoe on the big utility side of the police market.

eBay Find of the Day: Mk1 Ford GT40 with interesting history

Sat, 03 May 2014You might expect a rare Ford GT40 to cross the block at some sort of prestigious auto auction from RM or Gooding, not show up on eBay for over $2 million. However, that's exactly what we have here. The seller claims the car is a late-build Mk1 GT40 from 1969, and it's currently owned by the director of the Hublot watch company in Switzerland.

According to the listing, GT40 #P1108 started life as Mk1 car that was built from factory spares in 1969 and was first sold in 1971. However, the auction is somewhat confusing. According to an image in its gallery, the vehicle was actually built from one of the seven spare Mk3 tubs when production of the iconic racers ended.

This GT40 was never built as a racecar - it lived on the streets its whole life. After assembly finished, it was sent to Germany and was eventually registered for the road. The first owner kept the car until 2005 and sold it with 7,300 miles on the odometer. The current owner bought it in 2012.