1930 Ford * Model A * 5 Window Coupe * Hotrod * Chopped * Channeled * 392ci * on 2040-cars

Brooklyn, New York, United States

|

Time has come to sell my 1930 Model a 5 window coupe. It has been a long and extensive build - the car is definitely over-built with lots of custom work everywhere...

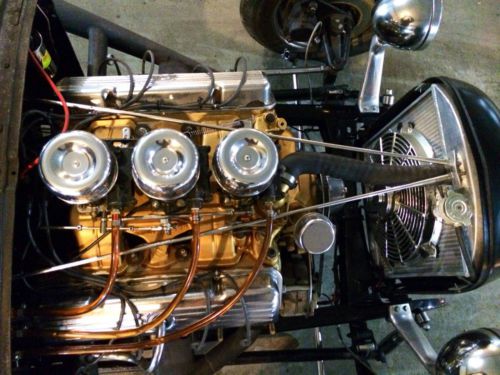

The body has been professionally chopped and channeled onto the frame with a custom firewall, trans tunnel and floor The frame is custom and is fully boxed and has been Zzed in the Rear with a beautiful glossy finish The motor is a 392 Oldsmobile with the matching Hydramatic transmission (reverse is all the way at the end) Offenhauser Intake Manifold w/ a Progressive Tri-Power Setup (center carb at idle and other 2 open at about half throttle) Custom Headers with Baffles (you can have a conversation at idle inside the car, but when you stomp on it everybody knows you're there!) 10 Bolt Rear with highway gears and Coil Cprings Disc Brakes on the Front (stops on a dime) Aluminum Radiator w/ Electric Fan Front window folds out like it is meant to Fuel Cell in the trunk w/ electric fuel pump Chrome Pulleys Reverse Lip Chrome Wheels with Baby Moons and Bullets Wide White Wall Tires all around (wider in rear) Front Grill, Firewall, and Frame are gloss black - the body is painted satin black Chrome Front Shocks Chrome Steering Arms The list goes on and on.......

It's basically a turn-key hotrod, get in and have a blast all day long. Drives great, runs cool, feels awesome on the road, steering is very precise and easy to control, etc... No rust on the body (started with a very clean car), motor and transmission were gone through about couple of years ago and it has always been well taken care of. The amount of chop is perfect - I am 5'11 170lbs and I fit very comfortably inside, even with a friend of similar size there is more than enough room for both of us (steering wheel comes off to get in and out easier but I never do). Call with any questions or to come see the car in person. 347-753-3891

|

Ford Model A for Sale

Auto Services in New York

Tones Tunes ★★★★★

Tmf Transmissions ★★★★★

Sun Chevrolet Inc ★★★★★

Steinway Auto Repairs Inc ★★★★★

Southern Tier Auto Recycling ★★★★★

Solano Mobility ★★★★★

Auto blog

Car-crazy 5-year-old boy writes automakers for treasures, gets big response

Fri, Jan 25 2019Part of the beauty of children is that they can find worth in something adults might deem unworthy or overlook entirely. Five-year-old Patch Hurty didn't see garbage or a broken piece of a car when he spotted a Ford badge lying on the side of a road. He saw an artifact, a souvenir, a start to a collection he could only dream of. Ezra Dyer of Popular Mechanics tells the story of Patch and his quest to turn that one lost badge into a museum of manufacturer logos. According to the article, Hurty is a car fanatic through and through, even using car names as a way of learning to read. After finding the Ford badge near his Connecticut home, he and his mom put together a plan to reach out to dozens of automakers, confessing his love of things on four wheels. In each letter, Patch assembled a picture of himself standing next to one of the cars, and a penny to pay for whatever he hoped was sent his way. The response was unexpectedly and overwhelmingly positive. Of the more than 50 letters he sent out, including to obscure or defunct companies such as Bugatti, Suzuki, and Saturn, a majority responded with warm notes and some type of souvenir. Two of the coolest responses came from Lincoln and Bentley. Lincoln sent a sketch of a Continental (all car lovers enjoy drawing cars, right?), and Bentley sent a wheel center cap. How awesome is that? The story reminds us of something that can easily be lost in all of the negativity involved with the auto industry: Everybody is in this because of a common infatuation with automobiles. For more details on the souvenirs Patch received and accompanying photos, read the rest of the story. Related Video: News Source: Popular Mechanics Read This Bentley Bugatti Ford Lincoln Saturn Suzuki

Ford wins second consecutive International Van of the Year award with Transit Connect

Wed, 18 Sep 2013The redesigned 2014 Ford Transit Connect isn't even on sale yet, but it's already making its presence felt around the world. At a commercial vehicle expo in Russia, the Transit Connect was named the International Van of the Year.

Ford's small work van edged out the new Mercedes-Benz Sprinter by just seven points to allow Ford to grab this honor for the second consecutive year, which it won last year with the Transit Custom. Not only does this make Ford the first to ever win the award in back-to-back years, but it's also the fifth time the automaker has won this award since 2003 (two with the Transit Connect, two with the fullsize Transit and once with the Transit Custom). Ford congratulates itself for the accomplishment in a press release posted below.

2015 Ford F-150 enters production

Wed, 12 Nov 2014Ford has given the F-150 a dramatic makeover for 2015, switching to an aluminum body that helps reduce weight by about 700 pounds. Because the truck is dramatically different, Ford also had to change the way it makes the F-150, so we went inside its sprawling factory in Dearborn, MI, this week to see the Blue Oval's new manufacturing techniques in action.

The company has added 850 jobs at the site and upgraded its stamping and tool and die facilities. The body shop is also modernized, and it has been fitted with 500 new robots that join the structures together. The first 2015 F-150 rolled off the line on Tuesday, and the trucks will begin arriving in dealerships in December. Get a closer look at the F-150's unique assembly process in our video.

2 door sedan

2 door sedan 30 ford coupe steel street rod custom model a wow

30 ford coupe steel street rod custom model a wow 1929 ford model a phaeton 4 door touring car

1929 ford model a phaeton 4 door touring car Model a 1930 coupe

Model a 1930 coupe 1929 chevrolet tudor sedan 4" chop v8 sbc rolling chassis hot rod rat chevy ford

1929 chevrolet tudor sedan 4" chop v8 sbc rolling chassis hot rod rat chevy ford 1928 ford roadster, hemi powered, all steel

1928 ford roadster, hemi powered, all steel