Engine:--

Fuel Type:Gasoline

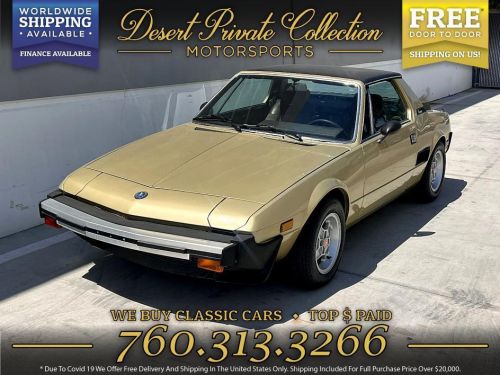

Body Type:Coupe

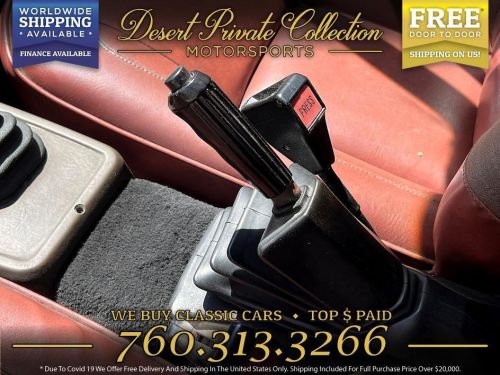

Transmission:Manual

For Sale By:Dealer

VIN (Vehicle Identification Number): 128AS10104649

Mileage: 94670

Make: Fiat

Model: X1/9

Trim: Targa

Features: --

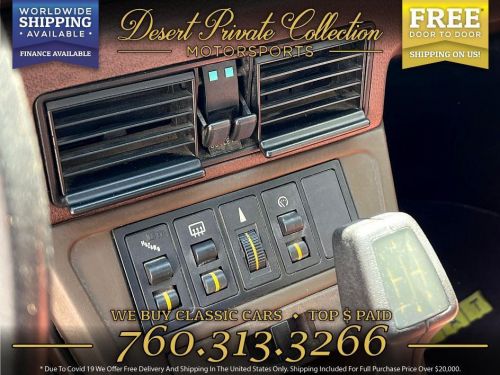

Power Options: --

Exterior Color: --

Interior Color: --

Warranty: Unspecified

Fiat X1/9 for Sale

1980 fiat x1/9 targa(US $17,950.00)

1980 fiat x1/9 targa(US $17,950.00) 1978 fiat x1/9(US $17,500.00)

1978 fiat x1/9(US $17,500.00)

Auto blog

Fiat 124 Coupe could join Spider line next year

Wed, Aug 24 2016While Mazda's content to tease coupe lovers with the last-gen MX-5 Power Retractable Hardtop and the upcoming RF, the company is loath to offer a version of its lovable roadster with a permanent hardtop. But Fiat isn't so fickle. According to Autocar, the Italian brand could unveil a proper hardtop Fiata as early as next year. Likely called the 124 Coupe – duh – Autocar reports the addition of a fixed roof will spice up the current Spider. But what kind of spice is more difficult to predict. AC reports that FCA could stay the course, offering the new hardtop with the same powertrain lineup as the Spider – 138 horsepower in the UK and 160 hp (164 hp in Abarth trim) in the US – or drive the 1.4-liter turbocharged four-cylinder higher. As for how the car will look, Autocar points to the handsome 124 Abarth Rally Concept from the 2016 Geneva Motor Show. Don't expect integrated rally lights or a standard yellow-on-red paint scheme, but the new model will likely borrow that concept's roofline – more notchback than the MX-5 RF's fastback-like look. That'd fit with the 124 Coupe's ancestors, which wore a traditional notchback roofline. Fiat offered a 124 hardtop between 1967 and 1975, giving a new hardtop Fiata much more historical precedence than a comparable MX-5. AC reports the new 124 Coupe will likely carry a 10-percent premium across the pond, with a similar increase in the US. But predicting the impact of that price hike is a little bit trickier than multiplying the 124 Spider's price by 1.1, since we don't know what trims the Coupe will come in. The Abarth is likely a shoe-in, starting around $31,000. If, and it's a big if, Fiat sells a 124 Coupe Classica, expect a $27,500 starting price, while a hardtop Lusso would be a smidge over $30,000. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Baby Jeep to join Renegade in FCA's plan for new Italian-built models

Tue, Nov 27 2018FCA is boosting its European production, introducing new models that will be built in currently under-utilized manufacturing facilities. Among the new models is a new small Jeep, smaller than the current Renegade, as Automotive News reports. FCA's Mike Manley mentioned the entry-level Jeep model earlier this year, also saying that the vehicle is targeted to European and possibly Latin American customers; in the summer, Autocar placed the launch date in 2022. The new "baby" Jeep would be made in the same factory in Pomigliano, Italy, as the small Fiat Panda, which is a top seller in Italy. The current generation Panda was introduced in 2011; if it gets a replacement in 2022, it could possibly share a platform with the Jeep model — or, the Jeep could be an eventual outright replacement for the Panda. One of Fiat's earlier core products, the Punto hatchback, was canned in August, and that production capacity will be used to make the Jeep Compass instead, at the Renegade-producing Melfi factory in southern Italy. The Compass has not previously been built in Europe. The Fiat model portfolio would be shrunk to just the 500 model family and the Panda — the 500 would also be FCA's key electric vehicle offered in Europe. It is not yet clear whether the electric 500 would be made in Turin, Italy, or in Poland; Turin might also get a Giardiniera-badged wagon version of the refreshed 500. As for the Alfa Romeo brand, it is set to gain an even bigger SUV model than the Stelvio, based on the Maserati Levante's platform. The Levante's sales have suffered recently in China, but Maserati does have light in the horizon: The Alfieri 2+2 grand tourer is still in the cards, with a launch expected for 2020 and both a convertible and an electrified version planned to follow. The Alfieri would be made in Modena, Italy, according to Automotive News' sources. None of these plans namedrop the storied Lancia brand, which has been shrunk to just the Ypsilon hatchback, based on the same platform as the current 500 and Panda. Despite that, the Ypsilon was again the second-bestselling car in Italy after the Panda in October. It is unlikely that FCA will be able to ignore this, but it is just as unlikely that any development money will be afforded to come up with a replacement for the Ypsilon, which is as similarly old as the Panda. Perhaps official announcements expected on Thursday will also clarify what will happen to Lancia.

Ford CEO told Trump 1 million jobs at stake because of fuel economy regs

Sat, Jan 28 2017Bloomberg is reporting that Mark Fields, Ford's CEO, pushed President Donald Trump for market-driven national fuel economy standards, and that up to a million jobs could be at stake if those national regulations didn't take consumer expectations into account. Fields was reporting on his conversation with Trump in remarks made at the National Automobile Dealers Association in New Orleans, Bloomberg reports. The report also states that he and fellow CEOs Mary Barra of GM and Sergio Marchionne of FCA aren't seeking to eliminate fuel economy standards altogether, but rather to make them more flexible. Bloomberg reports that Fields didn't cite the studies he was referring to in support of his job loss figures, so we can't independently verify Fields' math at this time. But his push to stop selling cars consumers don't want – that is to say, more hybrids and EVs than consumer demand supports right now – is clear. We've already reported on that. To level an educated guess at what will happen next, Trump seems likely to reduce the stringent 2025 fuel economy targets, perhaps freezing them at current levels. The automakers are already invested in producing vehicles that meet current standards, and they also have to think about foreign markets like Europe that aren't likely to relax standards below current levels. If you consider economies of scale, automakers are likely to ask for federal standards that match global standards for their largest markets as closely as possible. We'll see if Trump buys Fields' math, but Ford isn't hedging its bets. Backing out of the Mexican assembly plant cost the company $200 million – not a huge sum compared to the total value of Ford, a massive company which had its second best year ever, but still an important gesture to Trump about Ford's priorities. Related Video: News Source: BloombergImage Credit: Bloomberg via Getty Images Government/Legal Green Fiat Ford GM Sergio Marchionne Mary Barra Mark Fields