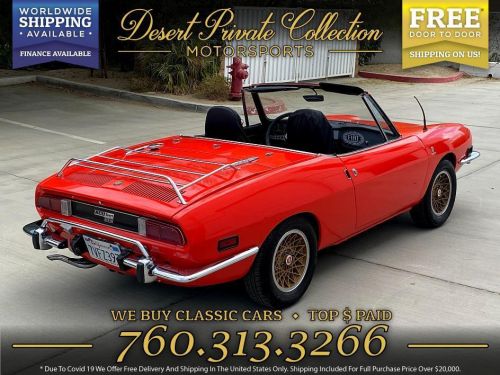

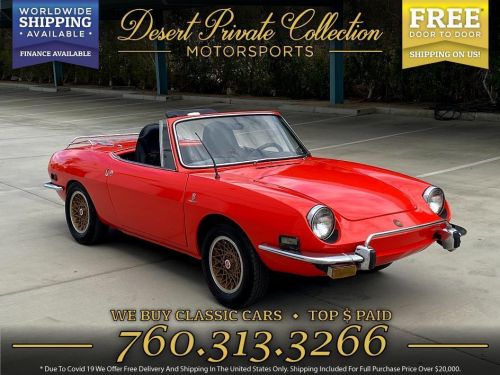

1973 Fiat 850 Spider on 2040-cars

Engine:--

Fuel Type:Gasoline

Body Type:Convertible

Transmission:Manual

For Sale By:Dealer

VIN (Vehicle Identification Number): 100GBS10124273

Mileage: 55142

Make: Fiat

Model: 850 Spider

Drive Type: --

Features: --

Power Options: --

Exterior Color: Red

Interior Color: Black

Warranty: Unspecified

Auto blog

Ferrari officially files SEC paperwork to register future IPO

Thu, Jul 23 2015Late last year FCA announced plans to spin off Ferrari into a separate company, and after a long wait that process has finally become official. The Prancing Horse has now filed the necessary prospectus and other documents with the Securities and Exchange Commission to hold an initial public offering on The New York Stock Exchange. The paperwork doesn't mention a specific date for the Italian sportscar maker's IPO, but it's expected sometime in October. At this point, the documents also don't include some other vital data about the IPO. Ferrari lists neither the number of shares being offered nor their price. The company also doesn't have a stock symbol yet. UBS, BofA Merrill Lynch and Santander are acting as joint book runners for the deal. As part of the IPO, FCA initially intends to sell 10 percent of Ferrari's shares on the stock market. Another 10 percent of the company still belongs to Piero Ferrari. FCA is holding onto the remaining 80 percent in the short term for financial reasons but intends to distribute them to shareholders in early 2016. After the spin-off, about 24 percent of Ferrari would be owned by Exor, 10 percent by Piero Ferrari, and 66 percent by public shareholders, according to the SEC documents. FCA boss Sergio Marchionne believes that Ferrari could be worth over $11 billion. Although, his estimate might be slightly high. According to Reuters, Wall Street is actually putting the value somewhere between $5.5 billion and $11 billion. If you're thinking about investing in the company or just want to read the nitty-gritty about the brand's financial health, the entire SEC filing can be read here. Ferrari Files for Initial Public Offering LONDON, July 23, 2015 /PRNewswire/ -- Fiat Chrysler Automobiles N.V. ("FCA") announced today that its subsidiary, New Business Netherlands N.V. (to be renamed Ferrari N.V.), has filed a registration statement on Form F-1 with the U.S. Securities and Exchange Commission ("SEC") for a proposed initial public offering of common shares currently held by FCA. The number of common shares to be offered and the price range for the proposed offering have not yet been determined, although the proposed offering is not expected to exceed 10% of the outstanding common shares. In connection with the initial public offering, Ferrari intends to apply to list its common shares on the New York Stock Exchange.

Stellantis ó seriously? Exploring the pros and cons of Chryslerís new name

Fri, Jul 17 2020I took Wednesday off. I came in Thursday and Chrysler was renamed Stellantis. Aside from lighting Twitter on fire and drawing a lot of snarky responses from car journalists, the name is actually decent. Letís look at it from a few angles. For starters, Chrysler, the 95-year-old automaker founded in Detroit by Walter P. Chrysler (his name still adorns everything from a major freeway in Michigan to an iconic art deco skyscraper in New York), isn¬ít actually Chrysler. It¬ís FCA, which stands for Fiat Chrysler Automobiles. The name change actually happened in 2014, which you might have easily missed. The American unit, formerly Chrysler, is known as FCA US in some legal matters, but does not operate independently.¬†¬† The Stellantis name takes effect in 2021. Here¬ís why it¬ís needed: Fiat Chrysler is merging with Group PSA. (Peugeot and Citroen) to form a transatlantic alliance that will be larger than even Ford. Stellantis sounds a lot better than FCA-PSA. Or PSA-FCA. You might poke fun at it, but it beats the alternatives. Or at least it could be worse. Stellantis is the name for the corporate entity that will house Chrysler, Fiat, Peugeot, Citroen, and oh by the way, Opel and Vauxhall, which PSA bought in 2017 when GM unloaded its European arm.¬† Your Jeep will not say Stellantis on the fender. Your Hemi Hellcat won¬ít say ¬ďpowered by Stellantis¬Ē under the hood. Your Fiat 500 or Alfa Romeo Giulia will not have a script ¬ďStellantis" crest. Speaking of that, roll call: Here¬ís all of the brands that will be housed under the Stellantis umbrella: Chrysler, Dodge, Jeep, Fiat, Fiat Professional, Mopar, Alfa Romeo, Maserati, Abarth, Ram, Lancia, Peugeot, Citroen, DS, Opel and Vauxhall. There¬ís also a couple of lesser-known subsidiaries, Comau and Teksid, that sell parts. That¬ís 18 brands. They have origins in Detroit, Paris, Turin, Chalton (England), Russelsheim (Germany) and several other places. All of these carmakers have deep histories. No one was going to agree on using someone else¬ís name. You might notice Chrysler is still in there. Chrysler as the brandname for the 300 sedan and Pacifica minivan lives on. Stellantis replaces FCA, which replaced Chrysler, as the name of the parent company. Yes, it's a little confusing. Here¬ís more perspective. Chrysler was once owned by Cerberus, a three-headed dog that guards the gates of hell, according to mythology.

Fiat Chrysler's Marchionne is done talking about alliances

Sat, Apr 15 2017AMSTERDAM (Reuters) - Fiat Chrysler Chief Executive Sergio Marchionne rowed back on his search for a merger on Friday, saying the car maker was not in a position to seek deals for now and would focus instead on following its business plan. Marchionne had repeatedly called for mergers in the car industry and a tie-up has long been seen as the ultimate aim of his relaunch of Fiat Chrysler, which he is due to leave in early 2019 after 15 years at the helm. He sought a merger with General Motors two years ago but was rebuffed. Only last month he said Volkswagen - the market leader in Europe - may agree to discuss a tie-up with FCA in reaction to rival PSA Group's acquisition of Opel. Marchionne told the annual general meeting in Amsterdam he still saw the need for car companies to merge to better shoulder the large investments needed, but said Fiat Chrysler was not talking to Volkswagen. "On the Volkswagen issue, on the question if there are ongoing discussions, the answer is no," he said. He added, without elaborating, that Fiat Chrysler was not at a stage where it could discuss any alliances. "The primary focus is the execution of the plan," he said. FCA has pledged to swing to a 5 billion euro net cash position by 2018, from net debt of 4.6 billion euros at the end of 2016 - an achievement that Marchionne has said would put it in a better position to strike a deal in the future. Volkswagen, which is still reeling from an emissions scandal that hurt its profits, initially spurned FCA's approach. However, CEO Matthias Mueller said last month the group had become more open on the issue of tie-ups and invited Marchionne to speak to him directly rather than with the press. Fiat Chrysler Chairman John Elkann underlined the message that finding a merger partner was not a priority. "I'm not interested in a big merger deal," he said. "Historically, deals are struck at times of difficulty ... we don't want to be in trouble." Elkann is the scion of Fiat's founder and top shareholder the Agnelli family. He has said in the past he was prepared to have the Agnelli's stake severely diluted in exchange for a minority holding in a larger auto group. "I believe the priority for FCA is to press ahead with this ambitious (business) plan despite the difficult environment," he said. FCA pledged in January to nearly halve net debt this year, as part of the 2018 plan. Doubts remain about its exposure to a peaking U.S.