2015 Fiat 500 Pop on 2040-cars

Andover, Massachusetts, United States

Body Type:Hatchback

Engine:1.4L Gas I4

Transmission:Automatic

Fuel Type:Gasoline

For Sale By:Private Seller

VIN (Vehicle Identification Number): 3C3CFFAR4FT696096

Mileage: 68944

Make: Fiat

Model: 500

Number of Cylinders: 4

Drive Type: FWD

Trim: POP

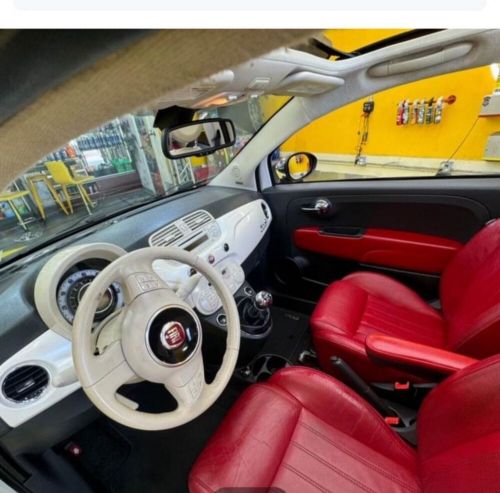

Interior Color: Black

Number of Seats: 4

Fuel: gasoline

Exterior Color: mint

Car Type: Modern Cars

Number of Doors: 2

Fiat 500 for Sale

2017 fiat 500 lounge(US $15,999.00)

2017 fiat 500 lounge(US $15,999.00) 2012 fiat 500(US $8,500.00)

2012 fiat 500(US $8,500.00) 1971 fiat 500(US $17,000.00)

1971 fiat 500(US $17,000.00) 1949 fiat 500 transformable topolino b(US $1,000.00)

1949 fiat 500 transformable topolino b(US $1,000.00) 2016 fiat 500 2dr hatchback abarth(US $14,700.00)

2016 fiat 500 2dr hatchback abarth(US $14,700.00) 2017 fiat 500 abarth(US $15,999.00)

2017 fiat 500 abarth(US $15,999.00)

Auto Services in Massachusetts

Westgate Tire & Auto Center ★★★★★

Stewie`s Tire & Auto Repair ★★★★★

School Street Garage ★★★★★

Saugus Auto-Craft ★★★★★

Raffia Road Service Center ★★★★★

Quality Auto Care ★★★★★

Auto blog

Chrysler officially rebrands as FCA US LLC

Tue, Dec 16 2014Detroit's third-largest automaker has had a lot of names over the years. It was founded as the Chrysler Corporation in 1925, a name it held until 1998 when it was bought by ze Germans in 1998 to form DaimlerChrysler AG, then it went independent in 2007 under the name Chrysler LLC before being retitled once again as Chrysler Group LLC in 2009. And now the automaker headquartered in Auburn Hills, MI, is getting yet another new name. Announced today and effective immediately, the company formerly known as Chrysler will now be called FCA US LLC. That's a lot of letters, but they make a lot of sense, too: FCA stands for Fiat Chrysler Automobiles, the US telling us this is the company's American division and the LLC tells us it's a limited liability company – a legal classification similar to (but not quite the same as) a corporation. The announcement comes shortly after the company decided to phase out its long-serving Pentastar logo. The sum total is that the once-independent industrial giant is now formally part of a larger European parent company, owned by Fiat and (for taxation purposes, anyway) based in the Netherlands. What the company formerly known as Chrysler wants to emphasize, however, is that FCA US LLC will remain based in Auburn Hills and retain its "holdings, management team, board [and] brands." Chrysler Group LLC Announces New Company Name: FCA US LLC U.S.-based Automaker's New Name Aligns With Global Parent December 16, 2014 , Auburn Hills, Mich. - Chrysler Group LLC, the Auburn Hills, Michigan-based automaker, today announced that it has changed its company name to FCA US LLC. The name change is effective immediately and follows the naming convention of its global parent company, Fiat Chrysler Automobiles N.V. (FCA), which officially adopted its new name in October when it listed on the New York Stock Exchange. The name change to FCA US LLC does not affect the company's headquarters location in Auburn Hills, Michigan, its holdings, management team, board or brands. FCA US, together with parent FCA, continues to work toward the business plan presented on Investor Day in May 2014. Additionally, the Company remains proud of its joint heritage. FCA US continues to build upon the solid foundations first established by Walter P. Chrysler in 1925 as well as a rich Fiat heritage that dates from 1899. FCA US employs more than 77,000 employees worldwide, with 96 percent of its workforce based in North America.

Junkyard Gem: 1974 Fiat X1/9

Fri, May 5 2017There was a time when the Fiat X1/9 was a fairly common sight on California roads, alongside Triumph Spitfires, MGBs, and other cheap European sports cars. The little two-seater got good fuel economy, could find parking spots on crowded city streets, and had Italian good looks. The X1/9 wasn't so robust, though, and most of them were gone by the dawn of the 1990s. This rusty, battered survivor managed to avoid the fate of most of its brethren until age 42, but now its time has come. Judging from the sun-bleached paint and rust inside the air cleaner, though, this car hadn't been a runner for quite a while, perhaps decades. My guess is that it sat in a Northern California back yard for many years, awaiting a restoration that never came. I have put in some time daily-driving an X1/9, back in the middle 1980s, and I recall it being very enjoyable to drive in the city and on twisty mountain roads. It was much less enjoyable on freeway onramps, thanks to the Fiat 128-sourced 1.2-liter four-cylinder engine behind the seats (the X1/9 got a 1.5-liter engine later on). In 1974, this car was rated at 66.5 horsepower. Yes, Fiat claimed the half-horse, just as British Leyland did with the 62.5 hp MGB later in the 1970s. This one is nowhere near worth restoring, though some of its pieces will find new life in nicer X1/9s (or 128s). This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Pretty much the same thing as a Lamborghini Countach!

Fiat introduces new Fullback pickup

Wed, Nov 11 2015Fiat has unveiled its first foray into the mid-size pickup truck market, the Fullback, at the Dubai Motor Show. It's not an entirely new product, confirming earlier reports. It's closely related to the Triton pickup (also known as the L200) that Mitsubishi builds in Thailand for markets in Europe, Asia, and Africa. Moreover, it's not likely ever to make it to North American showrooms. Riding on a 118-inch wheelbase, it measures 208 inches long, 71 inches wide and 70 inches tall. Those are identical measurements to the Mitsu, and give it roughly similar dimensions to the Chevy Colorado/GMC Canyon we get here. The Fullback can carry up to 2,300 pounds, and is powered by a 2.4-liter turbo diesel engine available in either 150- or 180-horsepower states of tune, and mated to a six-speed manual or five-speed automatic transmission. Fiat Professional will roll out the Fullback in markets across Europe, the Middle East, and Africa, where it will compete against the likes of the Toyota Hilux, Ford Ranger, and Volkswagen Amarok. FIAT PROFESSIONAL DEBUTS NEW FULLBACK PICK-UP TRUCK AT THE DUBAI INTERNATIONAL MOTOR SHOW - New FIAT Professional pick-up truck to be named Fullback – a name derived from the cornerstone position in rugby and American football - Available in the UK in autumn 2016, the FIAT Fullback will combine a practical double-cab body style with a spacious load area and competitive payload of 1,045kg - Powered by a 2.4-litre turbo-diesel engine, with 150hp or 180hp outputs, the FIAT Fullback will have four-wheel drive as standard, combined with a manual or automatic transmission - More details, including pricing and final specifications, will be announced closer to the launch of the FIAT Fullback in the UK FIAT Professional has unveiled the all-new FIAT Fullback pick-up truck at the 2015 Dubai International Motor Show. The new, medium-duty pick-up will join the award-winning FIAT Professional range in autumn 2016 and will be available only with a practical double cab body style configuration in the UK making it an ideal vehicle for both commercial and leisure time activities. Measuring up to 1,780mm in height, 1,815 mm in width and 5,285mm in length, with a wheelbase of 3,000mm, the new FIAT Fullback will offer a competitive payload of 1,045 kg and will be powered by a 2.4-litre, aluminium, turbo-diesel engine with a power output of either 150hp or 180hp.