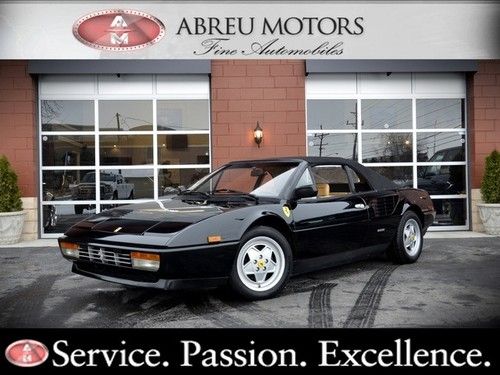

1987 Ferrari Mondial Convertible 5 Speed Manual 2-door Convertible on 2040-cars

Carmel, Indiana, United States

Body Type:Convertible

Engine:3.2

Vehicle Title:Clear

For Sale By:Dealer

Make: FERRARI

Model: Mondial

Warranty: No

Mileage: 44,945

Sub Model: Convertible

Doors: 2

Exterior Color: Black

Fuel: Gasoline

Interior Color: Other

Drivetrain: RWD

Ferrari Mondial for Sale

1985 ferrari mondial quattrovalvole coupe 2-door 3.0l

1985 ferrari mondial quattrovalvole coupe 2-door 3.0l 1988 ferrari mondial 3.2 cabriolet 4seater a/c only 22k texas direct auto(US $34,980.00)

1988 ferrari mondial 3.2 cabriolet 4seater a/c only 22k texas direct auto(US $34,980.00) 1985 ferrari modial cabriolet(US $21,000.00)

1985 ferrari modial cabriolet(US $21,000.00) 1982 ferrari mondial 8(US $9,700.00)

1982 ferrari mondial 8(US $9,700.00) 1990 ferrari mondial t cabriolet with 22492 original miles(US $35,000.00)

1990 ferrari mondial t cabriolet with 22492 original miles(US $35,000.00) 1988 ferrari mondial salvage repairable rebuilder only 63k miles runs!!(US $14,900.00)

1988 ferrari mondial salvage repairable rebuilder only 63k miles runs!!(US $14,900.00)

Auto Services in Indiana

western metals ★★★★★

Webb Ford Inc ★★★★★

Weatherford Auto & Truck Service ★★★★★

Watson Automotive ★★★★★

Wagner`s Auto Service ★★★★★

Tom O`Brien Chrysler Jeep Dodge -Greenwood ★★★★★

Auto blog

Second day of RM's Monterey auction continues the million dollar madness

Sun, 18 Aug 2013RM Auctions' two-day event during the Monterey car week is pretty much a matter of appetizer and main course. Friday night's appetizer saw a trio of multi-million-dollar Ferraris, along with a pre-war Mercedes-Benz and a Jaguar D-Type. You can read all about those beauties right here. But as we said in that post, the action would really happen on Saturday night. The prices listed below include RM's ten-percent commission fee, and, as you'll see, the auction house did pretty well for itself.

We've already told you about the $27.5 million winning bid for the 1967 Ferrari 275 GTB/4 NART Spyder, with all the profits headed to charity. While there were more seven-figure winners on night two, the overall prices weren't quit as high as we saw on Friday night. The Ferrari F50 (pictured above) shown during the car's Geneva debut back in the 1990s and with only 1,100 miles on the clock took $1,677,500 (on a $1.25 to $1.6 million estimate). Another winner was a 1935 Hispano-Suiza K6 Cabriolet, which brought in $2,255,000 on a $1.5 to $2 million estimate. A 1974 McLaren M16C Indianapolis, the race winner of the 1974 Indy 500, brought home $3.52 million, essentially doubling its expected price of $1.25 to $1.75 million.

The night wasn't a success for everybody, though. The 1928 Mercedes-Benz 680S Torpedo Roadster, which took Best In Show at the 2012 Pebble Beach Concours d'Elegance failed to reach its $10-million expectations, selling for $8.25 million. That's not peanuts by any stretch, but a car that only goes for about 80 percent of its expected price isn't something to be enthusiastic about. A 1960 Maserati Tipo 61 Birdcage, which was expected to go for $3 to $4 million only took in $2,090,000.

Previewing the 2014 Paris Motor Show

Fri, 26 Sep 2014

Don't let the shiny objects detract from the serious side of the show. Sales, fuel economy and regulations are part of the conversation.

The Paris Motor Show is one of the glitziest events on the automotive calendar. Yes, it helps that it's in the City of Light, but the glamorous surroundings only enhance the spectacular wares that automakers bring to the show. This is where Europeans debut their best new cars for the coming year, both as eye-catching concepts and in production trim.

Harry leaves his Garage to drive Ferrari 488 in Maranello

Fri, Feb 12 2016Harry Metcalfe doesn't need to go anywhere these days. He's handed over the reins of the Evo magazine he founded and gone into retirement, enjoying some quiet time with the many drool-inducing cars in his expansive garage. In other words, it would take quite the car to get him to leave the serenity of the English countryside and fly all the way down to Italy and its industrial north. The Ferrari 488 GTB is just such a car. The Prancing Horse marque's latest mid-engined V8 supercar should require no introduction. It's the successor to the celebrated 458 Italia and a long line that stretches back through the F430, 360 Modena, F355, 348, and 328 straight through to the 308 GTB that debuted in 1975. Only unlike its naturally aspirated predecessors, the 488 has gone twin-turbo to reconnect more with the likes of the F40 and 288 GTO. That leaves the atmospheric sector of this particular territory to the Lamborghini Huracan and its unassisted V10, while cozying up closer to the McLaren 650S. But does it make it any less of a Ferrari, or a less-than-worthy successor to the 458? That's what Harry set out to find out on the roads in and around the factory's home town of Maranello. Watch the video above to find out how it stacks up in his esteemed opinion. Related Video: X News Source: Harry's Garage via YouTube Ferrari Coupe Supercars Videos ferrari 488 gtb harry metcalfe harrys garage