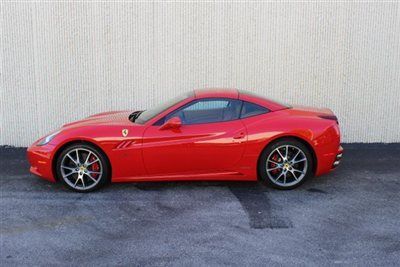

Ferrari California Carbon Fiber Loaded Call Today. on 2040-cars

The Woodlands , Texas, United States

For Sale By:Dealer

Engine:4.3L 4308CC V8 GAS DOHC Naturally Aspirated

Body Type:Convertible

Fuel Type:GAS

Transmission:Automatic

Make: Ferrari

Model: California

Disability Equipped: No

Trim: Base Convertible 2-Door

Doors: 2

Drivetrain: Rear Wheel Drive

Drive Type: RWD

Number of Doors: 2

Mileage: 22,335

Exterior Color: Red

Number of Cylinders: 8

Interior Color: Tan

Ferrari California for Sale

2011 ferrari california 7,800 miles novitec rosso wheels & options(US $180,000.00)

2011 ferrari california 7,800 miles novitec rosso wheels & options(US $180,000.00) 2013 ferrari california 500 miles ,salvage !!!!(US $129,500.00)

2013 ferrari california 500 miles ,salvage !!!!(US $129,500.00) 2010 ferrari(US $179,900.00)

2010 ferrari(US $179,900.00) 2010 ferrari california for $1399 a month with $34,000 down(US $169,000.00)

2010 ferrari california for $1399 a month with $34,000 down(US $169,000.00) 20 inch diamond finish sport wheels- powered daytona style seats- carbon fiber s

20 inch diamond finish sport wheels- powered daytona style seats- carbon fiber s

Auto Services in Texas

Your Mechanic ★★★★★

Yale Auto ★★★★★

Wyatt`s Discount Muffler & Brake ★★★★★

Wright Auto Glass ★★★★★

Wise Alignments ★★★★★

Wilkerson`s Automotive & Front End Service ★★★★★

Auto blog

Incredible $12 million Ferrari collection up for auction

Tue, Dec 8 2015Ferraris come up for auction all the time, but in Scottsdale next month Gooding & Company will be auctioning off an entire collection of Maranello's finest projected to fetch around $12 million. The collection belongs to one Tony Shooshani, described as "a widely published and renowned Ferrari collector." He's the proprietor of a 599XX Evo, a LaFerrari, and one of only six Pininfarina Sergio roadsters made. They'll remain in his collection, along with his prized 288 GTO and his thoroughbred Arabian stallion named Enzo. But he's liquidating some other notables from his garage, giving other collectors a chance to bring them home instead. This includes a trio of supercars. There's an Enzo tipped to fetch between $2.4 and 2.8 million, an F50 ($2.5-2.9m), and an F40 ($1.3-1.6m). The more classically inclined may be more enticed by the 1960s-era 250 GT Lusso ($2.2-2.5m), 250 GT Series II Cabriolet ($2-2.3m), and Dino 206 GT ($700-800k), and there's a pair of 80s models as well in a 512 BBi ($400-475k) and 328 GTS ($125-150k). The Berlinetta Boxer was Ferrari's first mid-engined twelve-cylinder supercar, and the 512 BBi was the ultimate incarnation thereof. It was never officially sold in the United States, but some still made it over here. This particular example was once owned by racing legend AJ Foyt. Those pre-sale estimates place the value of the collection altogether at $10.3 million on the low side, and as high as $13.5 million. That's a whole lot of cash, but there's a whole lot of machinery here – in both quantity and quality. So if you've had a good six or seven figures burning a hole in your proverbial pocket and have been looking for the right place to invest it, this could be your chance. Related Video: Gooding & Company is Thrilled to Announce The Tony Shooshani Collection to be Auctioned at the Scottsdale Auctions Headlining the historic collection, a trio of rare Ferrari supercars from an astute collector – the 1990 Ferrari F40, the 1995 Ferrari F50 and the 2003 Ferrari Enzo SANTA MONICA, Calif. (November 30, 2015) – Gooding & Company, the auction house acclaimed for selling the world's most significant and valuable collector cars, is pleased to announce an outstanding array of Ferraris at its annual two-day Scottsdale Auctions on January 29 and 30, 2016.

What's the smarter investment, Ferrari stock or a Ferrari?

Sun, Jul 26 2015Fiat Chrysler Automobiles is gearing up to spin Ferrari off into its own company, and float some of its shares on the stock market. But buying and trading in Ferrari stock could face a rather unlikely competitor from within. As Bloomberg points out, the values held by classic Ferraris keeps going up, and by no small margin. Even something as relatively humble as the 80s-era Testarossa, for example, has nearly doubled in value over the past year alone. Meanwhile the value of some models – particularly those built in the 1950s, 60s, and 70s – have skyrocketed nearly seven-fold since 2006. Just look at the 250 GTO, one of the most coveted of classic Ferraris among collectors: not taking inflation into account, they were worth thousands in the late 60s, were already selling for hundreds of thousands in the 1980s, and by now are trading hands – on the rare occasion when they do trade hands – for tens of millions. One sold in 2004 for $10 million, and another in 2013 for over $50 million. Those kinds of increases can make a vintage Ferrari seem like a sound investment. That might make it difficult for Ferrari's stock to compete. The company hopes investors will view it as a luxury goods manufacturer along the likes of Prada, Hermes, or Louis Vuitton Moet Hennessy, the stocks of which tend to increase in value at a greater rate than those of most automakers. But even the best of those luxury stocks have merely doubled in value since 2006, compared to the aforementioned seven-fold increase enjoyed by some classic Ferraris over the same period. Add to that the prospect of actually getting to enjoy owning a classic Ferrari – albeit at the risk of damaging it and hindering its value – and the idea of investing in Maranello's products instead of its stock can seem like a much more enticing prospect. Related Video:

BMW, Ferrari, VW cars use tungsten mined by terrorists

Thu, 08 Aug 2013Bloomberg Markets is reporting that BMW, Volkswagen and Ferrari have been using tungsten ore sourced from Columbia's FARC rebel terrorists. The extensive story focuses on Columbia's illegal mining trade and calls into question the provenance of the rare ore that is used not only in crankshaft parts production, but is also found in the world's computing and telecommunications industry for use in screens.

The ore is mined by the FARC (Fuerzas Armadas Revolucionarias de Colombia, or Revolutionary Armed Forces of Colombia - People's Army), and exported to Pennsylvania, where it is refined. The refined ore is then sent over to Austria, where a company called Plansee turns it into a finished product. Now, it's important to note that we aren't talking about the world's supply of tungsten here. In 2012, Plansee's American refinery purchased 93.2 metric tons of tungsten, valued at $1.8 million. That's peanuts, with the entire Colombian tungsten mining industry producing just one percent of the world's supplies.

That doesn't make indirectly supporting FARC any more acceptable, though. BMW, VW and Ferrari are all committed to not accepting mineral supplies from the Democratic Republic of Congo, which is also in the grips of a guerrilla insurrection funded, in part, by illegal mining. The same commitment would figure to extend to Colombian mining, but as BMW points out, it's difficult for a multi-national manufacturer to know where every item in its supply chain comes from. A company spokesperson says as much, telling Bloomberg, "These few grams out of the billions of tons of raw materials passing through the BMW supply chain are of no practical relevance."