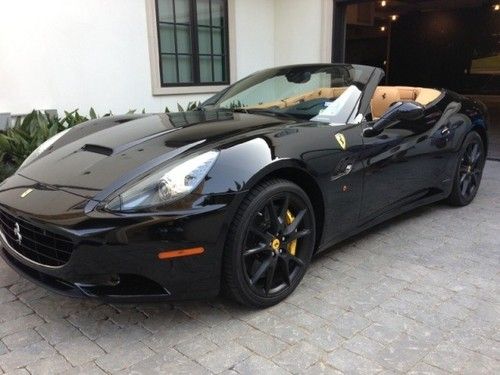

2011 Ferrari California -magneride,carbon Trim,power Daytonas,afs System,wow! on 2040-cars

Atlanta, Georgia, United States

Vehicle Title:Clear

Engine:4.3L 4308CC V8 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Convertible

Fuel Type:GAS

Make: Ferrari

Warranty: Vehicle has an existing warranty

Model: California

Trim: Base Convertible 2-Door

Options: Leather Seats

Power Options: Power Windows

Drive Type: RWD

Mileage: 4,416

Sub Model: 2DR CONV

Number of Cylinders: 8

Exterior Color: Gray

Interior Color: Black

Ferrari California for Sale

2010 silver california 2+2(US $175,000.00)

2010 silver california 2+2(US $175,000.00) 2010 california * only 3k mi * f1 * shields * calipers * navigation * bk up cam.(US $187,900.00)

2010 california * only 3k mi * f1 * shields * calipers * navigation * bk up cam.(US $187,900.00) 2010 ferrari california(US $187,995.00)

2010 ferrari california(US $187,995.00) 2010 ferrari california, black on chocolate, $232k msrp, 1-owner pristine car!!(US $159,888.00)

2010 ferrari california, black on chocolate, $232k msrp, 1-owner pristine car!!(US $159,888.00) Rosso corsa red convertible crema 10 tan 13 leather 11 best financing 458 used(US $214,888.00)

Rosso corsa red convertible crema 10 tan 13 leather 11 best financing 458 used(US $214,888.00) 2011 ferrari california 2dr conv(US $207,500.00)

2011 ferrari california 2dr conv(US $207,500.00)

Auto Services in Georgia

Youmans Chevrolet Co ★★★★★

Xtreme Window Tinting ★★★★★

Valvoline Instant Oil Change ★★★★★

Tribble`s Automotive Inc ★★★★★

Top Dollar for Junk Cars ★★★★★

Sun Shield Window Tinting ★★★★★

Auto blog

Fast and Furious 7 has resumed filming, and here's proof

Sat, Feb 8 2014It seems that Fast and Furious 7 is finally back in production. The UAE-based Speeed spotted crews from the movie filming in Abu Dhabi with help from the local police. According to Speeed, the production worked with the constabulary to shut down several roads in the metropolis and simulate a police chase with a Ferrari 458. This is the first real evidence that Fast and Furious 7 is still being made. After production of the flick was suspended in the wake of Paul Walker's death, the future of the film was put in doubt. Then it was announced that the film was being rewritten, and Vin Diesel said that the release date had been pushed back to April 10, 2015. Walker is rumored to still appear in the movie because several of his scenes were completed prior to his passing. Scroll down to watch the scene being filmed, and, if you're a fan of the series, get excited for next year when we can actually see it on the big screen. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Would you pay $2 million for a Ferrari F50? [w/video]

Wed, Jan 27 2016The F50 may not have been the finest of Ferrari's flagship supercars, but it remains a collector's commodity just the same – and its value keeps rising. F50s are already trading hands at upwards of $1 million apiece – and this year, at least one is expected to fetch upwards of $2.5 million. Ferrari launched the F50 in 1995 as the successor to the legendary F40 that came before. It eschewed the twin-turbo V8 that powered the 288 GTO and F40 for a naturally aspirated V12, setting the stage for the Enzo and LaFerrari that followed in the series. That high-revving 4.7-liter engine, according to Ferrari, was derived from the unit used in the actual F1 car from 1989 (known as the F1-89, naturally). This engine served as a stressed member of the chassis, mounted behind a carbon-fiber tub. With its removable hardtop, the F50 remains the only model in Maranello's flagship series (excluding the Enzo-based Maserati MC12) that offered an open cockpit. It was all very F1-like, but was barely any faster (if at all) than its iconic predecessor. Only 349 F50s were made, each carrying a half-million-dollar price tag. That would be a good $750k in today's money. Still, it is part of a highly collectible series. Only 349 were made, each carrying a half-million-dollar price tag that seemed astronomic at the time in the mid-'90s. That'd be about $750k in today's money, but it's still a far cry from what they're trading at these days. Last year alone, RM Sotheby's sold two F50s at auction: one in May at Villa d'Este for just under $1.4 million, and another at Pebble Beach (as part of the Pinnacle Portfolio) for nearly $2m. This compared to just a few years ago when they were selling for six figures, not seven, prior to 2013. At this early point in the year, two major auction houses have already announced consignments of F50s. RM has one (pictured above) on the docket that's estimated to sell for a good $1.5m. It's sure to be one of the top sellers in a couple of weeks at its sale in Paris during the Salon Retromobile (where Artcurial has another Ferrari for sale at over $30m). Gooding & Company has one lined up as part of the Tony Shooshani Collection. That example (depicted in the video below) was displayed at the 1995 Tokyo Motor Show and was owned by Jacques Swaters (of Ecurie Francorchamps fame). It has only 1,100 miles on the odometer and is expected to fetch between $2.5m and $2.9m, which would set a new record for the model.

Hennessey twin-turbo Ferrari 458 boasts 738 hp, 0-60 in 2.8 seconds

Wed, 14 Aug 2013Hennessey Performance Engineering, hot off the heels of its Bugatti Veyron-crushing Venom GT, set its sights on modifying one of the finer Ferrari models. The resulting HPE700 Twin Turbo 458 is a badder, faster 458 Italia with a twin-turbo upgrade that adds 168 horsepower to the already potent 4.5-liter V8. That's 738 hp, which, paired with the extra 134 pound-feet of torque, for a total of 532 lb-ft, is good for a 2.8-second 0-60 run.

Low-inertia ball-bearing turbochargers are used to boost the power, and an air-to-water intercooler makes sure the air surging into the combustion chambers is as cool and dense as possible. Twin wastegates and blow-off valves relieve extra boost pressure and, in addition to a new stainless-steel exhaust system, add some new noises to the 458's soundtrack. The V8 is boosted to a relatively mild 7 psi maximum and maintains 6 psi on its way up to redline. A reflash of the engine control unit brings the package together. HPE is confident enough about its wares that the $59,995 upgrade also comes with a one-year/12,000-mile warranty.

The HPE700 Twin Turbo 458 is set to be unveiled on Friday at the Concorso Italiano located at the Laguna Seca Golf Ranch, which is part of California's Monterey Car Week festivities. It also can be viewed on Saturday in the paddock at Mazda Raceway Laguna Seca for the Monterey Historics Rolex Monterey Motorsports Reunion vintage car races. Check out the press release below for the full details, as well as a video of the Ferrari in action.