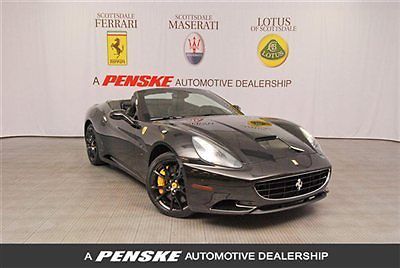

2010 Ferrari California Black Tan 5408 Miles Magneride 20 Camera Yellow Rev on 2040-cars

Rancho Mirage, California, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:4.3L 4308CC V8 GAS DOHC Naturally Aspirated

Body Type:Convertible

Fuel Type:GAS

Year: 2010

Make: Ferrari

Model: California

Trim: Base Convertible 2-Door

Disability Equipped: No

Doors: 2

Drive Type: RWD

Drivetrain: Rear Wheel Drive

Mileage: 5,408

Number of Doors: 2

Sub Model: 2+2

Exterior Color: Black

Number of Cylinders: 8

Interior Color: Tan

Ferrari California for Sale

2010 ferrari california~shields~afs system~yellow calipers~yellow stitching~(US $177,000.00)

2010 ferrari california~shields~afs system~yellow calipers~yellow stitching~(US $177,000.00) 2013 ferrari california 2+2 rosso maranello heavily optioned only 287 miles

2013 ferrari california 2+2 rosso maranello heavily optioned only 287 miles 2009 ferrari california 2+2 convertible red nav power daytona shields carbon

2009 ferrari california 2+2 convertible red nav power daytona shields carbon 2011 ferrari california 2+2 nav nero magneride 20 wheels ipod led carbon fiber

2011 ferrari california 2+2 nav nero magneride 20 wheels ipod led carbon fiber 2010 ferrari california 2+2 convertible rosso corsa nero 20 diamond magneride

2010 ferrari california 2+2 convertible rosso corsa nero 20 diamond magneride 2013 ferrari california/ silverstone over cuoio/ high option list/ sport pack(US $216,590.00)

2013 ferrari california/ silverstone over cuoio/ high option list/ sport pack(US $216,590.00)

Auto Services in California

Z Auto Sales & Leasing ★★★★★

X-treme Auto Care ★★★★★

Wrona`s Quality Auto Repair ★★★★★

Woody`s Truck & Auto Body ★★★★★

Winter Chevrolet - Honda ★★★★★

Western Towing ★★★★★

Auto blog

Ferrari IPO worth $1 billion to launch imminently

Fri, Oct 2 2015Or maybe not. Back in July, we reported that Ferrari's initial public offering could come any day, based on what FCA honcho Sergio Marchionne told reporters at an international economic forum. Marchionne himself ensured investors that the Maranello automaker was "days away" from filing the paperwork. That didn't happen. Now it's October, and the rumormill is churning about all things Ferrari IPO on the news that the company has filed amended IPO documents with the SEC on September 22. Like last time, the launch is apparently imminent – as early as today, reports CNBC – and sources are hearing an offer of $1 billion in stock, or roughly 10 percent of what FCA believes Ferrari to be worth. Back in July, Marchionne insisted that Ferrari was worth as much as $11 billion, despite experts at the time pointing out that this was much higher than even the company's internal assessment of the brand's value. Bloomberg is also reporting that demand for Ferrari stock may exceed supply by as much as 10 times, even before the IPO. Much of this value (as much as half) is derived from the brand as intellectual property, as opposed to its assets or profitability. Part of the brand value equation is Marchionne's attempt to reposition Ferrari as a "luxury" brand, as Business Insider notes – the word "luxury" is mentioned 151 times in the document. The broad universe of branded Ferrari goods, like luxury clothing and toys, are a strong illustration of Ferrari's power as a brand. For traditionalists and Ferrari fans jittery at the thought of their beloved manufacturer subject to the whims of shareholders, a few calming notes. Tech Times reports that the documents confirm that Ferrari will remain incorporated as an Italian company. More importantly, there's no indication at present that Ferrari's new emphasis on "luxury" will change their product plans, meaning ever-faster exotic cars will continue to roll out of Maranello for now.Related Video:

Ferrari's stock price falls off a cliff

Tue, Feb 2 2016The stock price skidded. The stock price stalled. Use whatever automotive analogy you want. It was a bad day for Ferrari on the New York Stock Exchange. Warning that sales growth would slow because of the economic slump in China, Ferrari NV watched its stock price slump accordingly. Shares of the company were down more than 13 percent in afternoon trading, falling to $34.64. Sprung from the Fiat Chrysler Automobiles less than four months ago, Ferrari's stock has lost a third of its value since its October initial public offering and is nearly half the price of its $62 high set days after the IPO. In a conference call with investors, chairman Sergio Marchionne said the company expected to ship approximately 7,900 vehicles this year. Marchionne said the company would be "fine" over the long term as long as it maintains a decades-long philosophy of maintaining strong demand. That means Ferrari won't follow some of its sports-car competitors who have broadened their vehicle portfolio's with the addition of SUVs. Marchionne bristled at such a suggestion. "You have to shoot me first," he told Bloomberg. But never say never? Previously, Ferrari had restricted its output to 7,000 vehicles per year. The company is already past that number, and Marchionne foresees the possibility that it could rise to approximately 9,000 by 2019. In a regulatory filing, Ferrari said, "we believe we can grow in a controlled manner while preserving the exclusivity of our brand by continuing to explore controlled growth in emerging markets to capitalize on the substantial wealth creation and the growing affluent populations in those markets." For now, those markets won't include China. Shipments there decreased 22 percent in 2015, even as worldwide output increased. Related Video:

Rebuilt Ferrari Enzo sells for $1.75 million at auction

Thu, Feb 4 2016See this Ferrari Enzo? See how it's in one piece? Well it wasn't always. It was involved in a horrendous crash a decade ago that split it clear in half. But it's long-since been rebuilt and sold for $1.75 million at the RM Sotheby's sale in Paris on Wednesday. The supercar in question belonged to Silicon Valley tech exec Stefan Eriksson, who crashed it into a pole along the Pacific Coast Highway in 2006. The Enzo was split in half, with the cockpit and nose on one side of the highway and the engine with its subframe on the other. If it were any less valuable a car, it might have been a complete write-off. But as yesterday's sale attested, the Enzo was worth fixing. So it was sent back to the factory where it was repaired, refurbished to as-new condition, repainted from red over black to black over red, and certified by the manufacturer. It was one of the top lots at RM Sotheby's autction, but even at that price, it wasn't the top earner of the day. That honor went to a rare 1962 Ferrari 400 Superamerica Aerodinamico, which sold for $3.3 million. Next up was a 1955 Porsche 550 Spyder that went for $3.07 million, followed by a '57 BMW 507 Roadster for $2.25 million. The Enzo came in fifth. Oh, and that Delta Integrale we were pining after? It went for $150 grand. Shame we weren't there with cash in hand. Related Video:

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.069 s, 7825 u