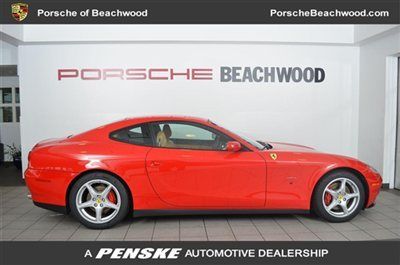

2008 Ferrari 612 Scaglietti / Heavily Optioned / Oto / Pano / Deaeler Serviced on 2040-cars

Richmond, Virginia, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:5.7L 5750CC V12 GAS DOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Dealer

Make: Ferrari

Model: 612 Scaglietti

Warranty: Vehicle does NOT have an existing warranty

Trim: Base Coupe 2-Door

Options: Leather Seats, CD Player

Drive Type: RWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Mileage: 12,462

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Sub Model: CARFAX CERTIFIED

Exterior Color: Black

Interior Color: Tan

Number of Doors: 2

Number of Cylinders: 12

Ferrari 612 for Sale

Ferrari scaglietti 5k miles! financing options available! low miles coupe(US $112,990.00)

Ferrari scaglietti 5k miles! financing options available! low miles coupe(US $112,990.00) 612 scaglietti*nav*backupcam*bluetooth*allservicerecords(US $103,777.00)

612 scaglietti*nav*backupcam*bluetooth*allservicerecords(US $103,777.00) 2008 ferrari 612 scaglietti 2dr cpe(US $149,998.00)

2008 ferrari 612 scaglietti 2dr cpe(US $149,998.00) 2006 ferrari 612 scaglietti rare 6 speed gated transmission gtc handling package(US $144,900.00)

2006 ferrari 612 scaglietti rare 6 speed gated transmission gtc handling package(US $144,900.00) 2005 ferrari 612 scaglietti silver 100% original & complete

2005 ferrari 612 scaglietti silver 100% original & complete 2006 ferrari 612 scaglietti, rare 6 speed manual, major service at 2385 miles(US $139,995.00)

2006 ferrari 612 scaglietti, rare 6 speed manual, major service at 2385 miles(US $139,995.00)

Auto Services in Virginia

Wright Motors ★★★★★

Warren James Auto Body & Towng ★★★★★

VITRO Glass and Window Repair ★★★★★

Valley Collision Repair Inc ★★★★★

Valley Collision Repair Inc ★★★★★

Tyson`s Ford ★★★★★

Auto blog

Ferrari celebrates its founder's birthday

Thu, Feb 18 2016Buon cumpleanno, Commendatore! That's what we'd be saying today to Enzo Ferrari if he were still alive. But the founder of the Prancing Horse marque passed away at the ripe old age of 90 way back in 1988. If he were still with us today, he'd be 118 years old. And we can't help but wonder what he'd think of his legacy if he were still around to see it. Enzo Anselmo Ferrari was born in Modena before the turn of the century – no, the previous century – way back in 1898. He started out as a racing driver, but soon found his real talents laid in preparing the racecars, not driving them. After achieving success running Alfa Romeo's factory team, Enzo struck out on his own - initially under the name Auto Avio Costruzioni (due to the terms of his previous contract) and then under the Scuderia Ferrari name. Under Enzo's leadership and those that followed, Ferrari emerged as one of the most successful teams in motor racing. The Scuderia has scored more championships, checkered flags, podiums, pole positions, and fastest laps than any other in the history of Formula One. And though it hasn't fielded a factory effort in the top tier decades, it's still among the winningest constructors at Le Mans, with nine outright wins between 1949 and 1965 – outscored only by Audi and Porsche. It also won the Targa Florio seven times, the Mille Miglia another eight, and Sebring 12 times. After famously rejecting a takeover bid from Ford, Enzo sold half his company to Fiat in 1969. He retained control until his passing in 1988 – upon which Fiat took over another 40 percent, leaving 10 to the Ferrari family. But now the company is independent again, having split off from the Fiat Chrysler Automobiles empire, and floated its IPO on the stock market. Though his son still serves as vice chairman, Enzo's prodigy and successor, Luca di Montezemolo, is gone. The road car division makes hybrids but no manual transmissions, the racing department hasn't won the Formula One World Championship since 2008, the theme park in Abu Dhabi welcomes more visitors than the factory museum, and the company makes a significant portion of its revenue these days from selling branded merchandise. It's a very different company, in short, from the one Enzo founded back in 1947, but it wouldn't be here without him. The factory is celebrating with a raft of social media posts. For our part down here, to il Commendatore at the big autodromo in the sky: happy birthday, Enzo.

Ferrari California replica from Ferris Bueller is so choice

Sat, 29 Jun 2013We like car auctions well enough, but often the high-end affairs are a bit too much like outdoor museums - very beautiful and very cold, and you're not allowed to touch anything. A perfect case in point is the upcoming Mecum auction during the 2013 Pebble Beach weekend, which will feature the legendary replica Ferrari 250 GT California Spyder used in none other than Ferris Bueller's Day Off. Only three were made. The current owner spent ten years restoring this car. It is his love, it is his passion. (Well, it was before he decided to auction it, anyway.)

Actually built by Modena Design and Development in El Cajon, CA, the official name of the stunning replica is Modena Spyder California. Built up on a tube frame, with a meticulously maintained interior and powered by a 500-horsepower small block V8 the car is so choice. If you have the means, we highly recommend picking one up.

Mecum hasn't suggested a predicted auction price for the Hollywood relic as of yet, but with the perfect pedigree to pull Gen X heartstrings, and the proliferation of stupid-wealthy fourtysomethings in and around northern California, we wouldn't be surprised to see a decent value. Just don't wait on it, life moves pretty fast around Pebble Beach. If you'd like to read a full description of the car with fewer script-quotes, look, it's real simple, scroll down.

Ferrari issues stop-sale order on 488 GTB for fire risk

Wed, Dec 30 2015The Basics: Ferrari North America has issued a stop-sale notice to its dealers regarding 2016 models of the new 488 GTB. The Problem: As with the earlier recall of the California T, the issue stems from low-pressure fuel line that may not connect properly to the feed pipe of the fuel pump. That could cause a fuel leak in the engine compartment, which could in turn start a fire. Injuries/Deaths: None reported. The fix: Dealers will need to replace the fuel line assembly. If you own one: All the problematic units of the 488 are in dealer hands. According to the statement below from the National Highway Traffic Safety Administration, "no un-remedied Ferrari 488 vehicles have been sold to the public." Ferrari S.p.A. informed Ferrari North America, Inc. (FNA) of the possible defect on the low pressure fuel line connection of the fuel pump provided by Ferrari's supplier Dytech – Dynamic Fluid Technologies S.p.A. on 11/17/15. Ferrari S.p.A. has informed FNA that during a routine pressure check for Assembly Line Testing on 11/04/15, they found a small air leak on the above described pipe connection. On 11/05/15 Ferrari S.p.A. extended their testing to evaluate vehicles that had been produced with the same batch of low pressure fuel lines. On 11/17/15 Ferrari S.p.A. concluded the investigatory testing and determined that the fuel vapor leak was a safety defect. With regard to the Ferrari 488 vehicles, on or about December 10, 2016 Ferrari determined that affected vehicles had left our control bound for various Ferrari dealers. We have notified our dealer network with a "Stop Sale" Notice informing them that this recall must be performed before the affected vehicles are sold to customers. It is important to note that no un-remedied Ferrari 488 vehicles have been sold to the public.