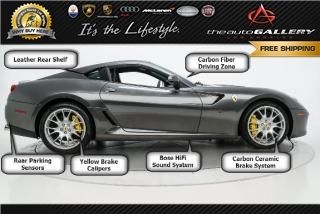

Carbon Fiber Lower Cabin Zone- Carbon Fiber Driving Zone- Carbon Ceramic Brakes on 2040-cars

Woodland Hills, California, United States

Transmission:Automatic

Body Type:Coupe

Vehicle Title:Clear

Fuel Type:GAS

Vehicle Inspection: Vehicle has been Inspected

Make: Ferrari

CapType: <NONE>

Model: 599 GTB

FuelType: Gasoline

Trim: Fiorano Coupe 2-Door

Listing Type: Pre-Owned

Certification: None

Drive Type: RWD

Mileage: 4,450

BodyType: Coupe

Sub Model: 2dr Cpe

Cylinders: 12 - Cyl.

Exterior Color: Gray

DriveTrain: REAR WHEEL DRIVE

Interior Color: Black

Number of Doors: 2

Warranty: Unspecified

Number of Cylinders: 12

Ferrari 599 for Sale

07 599 gtb fiorano only 5k custom asanti wheels black(US $199,999.00)

07 599 gtb fiorano only 5k custom asanti wheels black(US $199,999.00) 2007 ferrari 599 gtb fiorano f1 black daytona carbon fiber 20 wheels recaro

2007 ferrari 599 gtb fiorano f1 black daytona carbon fiber 20 wheels recaro 2008 f1a used cpo certified 6l v12 48v automatic rwd coupe premium(US $199,900.00)

2008 f1a used cpo certified 6l v12 48v automatic rwd coupe premium(US $199,900.00) 2008 f1a used cpo certified 6l v12 48v automatic rwd coupe premium(US $199,900.00)

2008 f1a used cpo certified 6l v12 48v automatic rwd coupe premium(US $199,900.00) 2010 f1a used cpo certified 6l v12 48v automatic rwd coupe premium(US $219,900.00)

2010 f1a used cpo certified 6l v12 48v automatic rwd coupe premium(US $219,900.00) 2008 f1a used cpo certified 6l v12 48v automatic rwd coupe premium(US $199,900.00)

2008 f1a used cpo certified 6l v12 48v automatic rwd coupe premium(US $199,900.00)

Auto Services in California

Zoll Inc ★★★★★

Zeller`s Auto Repair ★★★★★

Your Choice Car ★★★★★

Young`s Automotive ★★★★★

Xact Window Tinting ★★★★★

Whitaker Brake & Chassis Specialists ★★★★★

Auto blog

Haas F1 secures engine deal with Ferrari

Fri, 05 Sep 2014Plans are coming together for Gene Haas to launch his US-based Formula One team in 2016. The tooling magnate and NASCAR team owner has renamed his grand prix racing outfit from Haas Formula to Haas F1, he's setting up shop in North Carolina with a satellite location to be announced somewhere in Europe, and now he's penned an engine supply deal with Ferrari.

The deal doesn't come as such a surprise after Haas signed on as a sponsor with the Maranello squad a couple of months ago, but confirms the reinforcement of the partnership between the two teams. "The multi-year agreement," according to Ferrari in the statement below, "is for the supply of the entire power unit starting from 2016," including the engine, hybrid assist and presumably the gearbox as well. But that's not the extent of the deal.

Billed as a "technical collaboration agreement," the deal opens the door for Haas and Ferrari to cooperate even more closely than the latter does with existing powertrain customers Sauber and Marussia. "We believe this new partnership has the potential to evolve beyond the technical role of supplying our power unit and all related technical services," said Scuderia Ferrari team principal Marco Mattiacci.

Ferrari builds one-off hybrid F12 TRS roadster

Mon, 16 Jun 2014When Ferrari makes an open-top version of one of its V12 super-GTs, it typically comes in particularly low production numbers. Maranello only made 448 examples of the 550 Barchetta Pininfarina, 559 of the 575 Superamerica and 599 units of the 599 SA Aperta. What we have here, however, is not just the first F12 roadster we've seen yet, but also the most exclusive.

Called the F12 TRS, it's obviously based on the F12 Berlinetta, but with some key modifications. Not the least of which is the open-top body-style (which may or may not have a folding roof mechanism of some kind), coupled with some unique bodywork like a cowled rear deck and reshaped hood. But the TRS (which we can only assume is some tribute to the 250 Testa Rossa) is also said to pack an F1-derived KERS hybrid assist, presumably similar to the one in the LaFerrari - or more poignantly, in the 599 HY-KERS concept - to give the 6.3-liter V12 even more juice than the prodigious 730 horsepower it produces in stock Berlinetta form.

The vehicle, apparently spotted in the garage at the company's Fiorano test track, appears to be a one-off built by Ferrari's Special Projects division for one discerning and evidently very wealthy customer who is said to have paid $4.2 million for the privilege.

1962 Ferrari 250 GTO for sale in Germany at $64 million

Tue, 29 Jul 2014Prices keep climbing for the Ferrari 250 GTO with virtually no end in sight. In 1969 one sold for just $2,500, but by the 1980s they were trading for hundreds of thousands, then millions, then tens of millions to the point that the last last year, one was reported to have changed hands at $52 million. But now there's a GTO for sale in Germany that could eclipse even that gargantuan price tag.

Ferrari made 39 examples of the 250 GTO between 1962 and 1962, and the item listing on mobile.de doesn't give much in the way of specifics as to which exactly we're looking at. But last we checked, there were only two GTOs in Germany, and the other one was silver. That leaves chassis number 3809GT, which was delivered new in '62 to Switzerland and participated in numerous endurance races and hillclimb events throughout the early 60s. 3809GT has been owned until now by one Hartmut Ibing, who bought it in 1976 when values were in the tens of thousands, not tens of millions. Given how his asset has appreciated so dramatically, and with less than 10,000 miles on the odometers over 52 years, we could understand how Ibing would want to cash out.

Of course we could be mistaken and we could be looking at an entirely different example - the vast majority were, after all, painted red and fitted with blue upholstery just like this one - but either way, we're looking at a price tag of 47.6 million euros. That's nearly $64 million at today's rates, inclusive of Germany's 19 percent VAT rate that adds a staggering $10 million in taxes to the pre-tax price of 40 million euros, which comes in under $54 million but would still be the most ever paid for a GTO (or really, just about any car ever made).