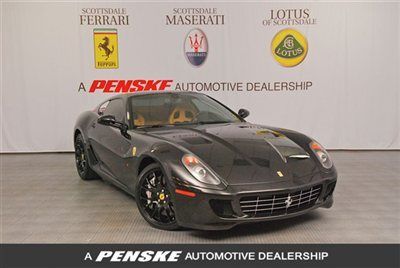

2008 Ferrari 599 Gtb~carbon Interior~shields~bose Sound~piping & Stitching~ 2009 on 2040-cars

Scottsdale, Arizona, United States

For Sale By:Dealer

Engine:6.0L 5999CC V12 GAS DOHC Naturally Aspirated

Body Type:Coupe

Fuel Type:GAS

Transmission:Automatic

Warranty: Vehicle does NOT have an existing warranty

Make: Ferrari

Model: 599 GTB

Options: Leather

Trim: Fiorano Coupe 2-Door

Number of Doors: 2

Drive Type: RWD

Doors: 2 doors

Mileage: 11,218

Engine Description: 6.0L V1 2 FI DOHC 48V

Sub Model: 2dr Cpe

Exterior Color: Nero Daytona

Number of Cylinders: 12

Interior Color: Beige

Ferrari 599 for Sale

2010 ferrari 599 gtb fiorano coupe v12 2dr nero scuderia(US $229,000.00)

2010 ferrari 599 gtb fiorano coupe v12 2dr nero scuderia(US $229,000.00) 08 599 gtb fiorano * only 3k mi * shields * calipers * wheels * daytona's(US $203,500.00)

08 599 gtb fiorano * only 3k mi * shields * calipers * wheels * daytona's(US $203,500.00) 2007 ferrari 599 f1 gtb v12(US $179,432.00)

2007 ferrari 599 f1 gtb v12(US $179,432.00) 599 gtb fiorano f1, handling hgte.

org. msrp $368,154.00(US $279,888.00)

599 gtb fiorano f1, handling hgte.

org. msrp $368,154.00(US $279,888.00) 2008 ferrari 599 gtb "stunning condition" black/black

2008 ferrari 599 gtb "stunning condition" black/black Carbon ceramics+carbon fibre zone+daytonas+shields+power seats+hifi+challenge ri(US $199,999.00)

Carbon ceramics+carbon fibre zone+daytonas+shields+power seats+hifi+challenge ri(US $199,999.00)

Auto Services in Arizona

Wright Cars ★★★★★

World Class Automotive Repair ★★★★★

Walt`s Body & Paint, LLC ★★★★★

Upark We Sell IT ★★★★★

Tristan Express Auto Sales ★★★★★

Superstition Springs Lexus ★★★★★

Auto blog

Ferrari IPO worth $1 billion to launch imminently

Fri, Oct 2 2015Or maybe not. Back in July, we reported that Ferrari's initial public offering could come any day, based on what FCA honcho Sergio Marchionne told reporters at an international economic forum. Marchionne himself ensured investors that the Maranello automaker was "days away" from filing the paperwork. That didn't happen. Now it's October, and the rumormill is churning about all things Ferrari IPO on the news that the company has filed amended IPO documents with the SEC on September 22. Like last time, the launch is apparently imminent – as early as today, reports CNBC – and sources are hearing an offer of $1 billion in stock, or roughly 10 percent of what FCA believes Ferrari to be worth. Back in July, Marchionne insisted that Ferrari was worth as much as $11 billion, despite experts at the time pointing out that this was much higher than even the company's internal assessment of the brand's value. Bloomberg is also reporting that demand for Ferrari stock may exceed supply by as much as 10 times, even before the IPO. Much of this value (as much as half) is derived from the brand as intellectual property, as opposed to its assets or profitability. Part of the brand value equation is Marchionne's attempt to reposition Ferrari as a "luxury" brand, as Business Insider notes – the word "luxury" is mentioned 151 times in the document. The broad universe of branded Ferrari goods, like luxury clothing and toys, are a strong illustration of Ferrari's power as a brand. For traditionalists and Ferrari fans jittery at the thought of their beloved manufacturer subject to the whims of shareholders, a few calming notes. Tech Times reports that the documents confirm that Ferrari will remain incorporated as an Italian company. More importantly, there's no indication at present that Ferrari's new emphasis on "luxury" will change their product plans, meaning ever-faster exotic cars will continue to roll out of Maranello for now.Related Video:

Ex-Ferrari chairman sounds off on IPO

Sat, Aug 1 2015Former Ferrari chairman Luca di Montezemolo preferred to put exclusivity over profits when he ran the company, and the lower volume still meant huge amounts of cash for the business. FCA CEO Sergio Marchionne has since taken over Ferrari, but that hasn't stopped di Montezemolo from voicing his opinions. "I hope that the clients will remain more important than the analyst or the investor or the financial markets," di Montezemolo said prior to his induction into the Automotive Hall of Fame in Detroit, the Detroit Free Press reported. The former chairman argued that once on the stock exchange, a company would need to maximize profits quarter after quarter to keep investors happy. Conversely, di Montezemolo said Ferrari's years of success came from an "exclusivity in terms of number of cars, exclusivity in terms of how you deal with the clients." When di Montezemolo left Ferrari last year, he and Marchionne were scuffling about the future of the brand, including the health of the Formula 1 program. With the change in leadership, the company has reversed course in some ways. Where volume was previously kept around 7,000 units annually, the carmaker has set a new goal of closer to 10,000. The paperwork was filed for the IPO, and Marchionne thinks the company could be worth over $11 billion. The actual shares are rumored to go on sale in October. Related Video:

First Ferrari LaFerrari hits the auction block

Thu, 02 Jan 2014If you haven't laid down your $1.4 million to be one of 499 people to own the new Ferrari LaFerrari by now, then you're already too late. Fortunately, Ferrari's new hybrid supercar has just been listed by German auction site SEMCO Gmbh, meaning that you still have a shot at owning one, but it'll cost you - dearly.

With just 124 miles on the odometer, this particular LaFerrari is being listed at 2.38 million euros - more than $3.2 million USD. But hey, at least that includes the Value Added Tax, eh? If the seller manages to command that asking price, it would be an incredible return on investment every bit as fast as the car itself, which in case your mind needs refreshing, is very fast indeed. Top Speed? Try 217 miles per hour and a 0-60 time of under three seconds.