2012 Spider on 2040-cars

Santa Barbara, California, United States

Body Type:convertible spider

Engine:V8

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Interior Color: Black

Make: Ferrari

Number of Cylinders: 8

Model: 458

Trim: SPIDER

Drive Type: rear wheel

Mileage: 1,721

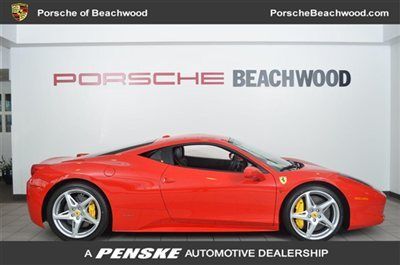

Exterior Color: Red

Warranty: remainder of factory

Ferrari 458 for Sale

2012 ferrari 458 italia, 2dr cpe, low miles, silver, fully loaded(US $269,500.00)

2012 ferrari 458 italia, 2dr cpe, low miles, silver, fully loaded(US $269,500.00) 2013 458 italia! low miles! 4.5l v8 rosso corsa

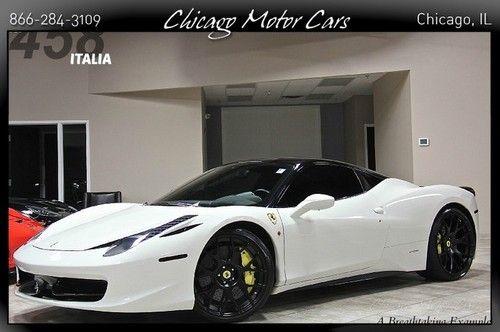

2013 458 italia! low miles! 4.5l v8 rosso corsa 2013 ferrari 458 italia coupe white over black low miles sport wheels(US $284,999.00)

2013 ferrari 458 italia coupe white over black low miles sport wheels(US $284,999.00) 2010 ferrari 458 italia base coupe 2-door 4.5l

2010 ferrari 458 italia base coupe 2-door 4.5l 7yr. main inc. ferrari approved cpo, low miles! showroom ready,daytona's(US $265,500.00)

7yr. main inc. ferrari approved cpo, low miles! showroom ready,daytona's(US $265,500.00) 2010 ferrari 458 italia $286 + msrp daytona seats scuderia shields white wow$$$$(US $257,800.00)

2010 ferrari 458 italia $286 + msrp daytona seats scuderia shields white wow$$$$(US $257,800.00)

Auto Services in California

ZD Autobody ★★★★★

Z Benz Company Inc ★★★★★

Www.Bumperking.Net ★★★★★

Working Class Auto ★★★★★

Whittier Collision Center #2 ★★★★★

West Tow & Roadside Servce ★★★★★

Auto blog

For his last act, Marchionne will outline an EV/hybrid roadmap this week

Wed, May 30 2018MILAN/LONDON — Fiat Chrysler (FCA) boss Sergio Marchionne is expected to outline new plans for electric and hybrid cars in a strategy presentation on Friday, aiming to ensure the world's seventh-largest carmaker remains in the race in the absence of a merger. The 65-year-old will present FCA's strategy to 2022, his final contribution to the company he turned around and multiplied in value through 14 years of canny dealmaking. After failing to secure a tie-up he said was necessary to manage the costs of producing cleaner vehicles, Marchionne needs to show the group can keep churning out profits on its own, even as emissions rules tighten, SUV competition intensifies and worries around his succession abound. Marchionne had long refused to jump on the electrification bandwagon, saying he would only do so if selling battery-powered cars could be done at a profit. He even urged customers not to buy FCA's Fiat 500e, its only battery-powered model, because he was losing money on each sold. But Tesla's success and the need to comply with tougher emissions rules have forced Marchionne to commit to what he calls "most painful" spending. "FCA is way behind rivals in terms of hybrid and electric vehicles and they need to hit the accelerator to convince investors they can close that gap," said Andrea Pastorelli, a fund manager at 8a+ Investimenti. Germany's Volkswagen, Daimler, BMW and U.S. rivals GM and Ford have committed to spending billions of euros each in coming years to try produce profitable cars powered by cleaner fuels. FCA needs to present a clear roadmap, just like Volvo Cars, which ditched diesel from its best-selling XC60 SUV, launched a new electric brand and pledged to shift all brands to hybrid by 2019, a banking source close to FCA said, noting: "The tech divide determines winners and losers in the industry." Marchionne has already said half of the wider FCA fleet will incorporate some elements of electrification by 2022, while luxury marque Maserati will spearhead FCA's electrification drive by making all new models due after 2019 electric. But its plans remain vaguer and less advanced than most big rivals and some investors wonder about the capital required to make vehicles compliant, and what share of spending can go to electrification given FCA's numerous demands.

The Prancing IPO

Fri, Feb 26 2016Owning a Ferrari is something that a lot of car nuts hope to achieve. If you cringe every time you see some celebrity put massive rims on a 458, or paint an F430 neon purple, then you are the kind of person that appreciates what a Ferrari is. It's not a status symbol that will somehow make everyone love you and think you the most amazing person. Rather it is a medium with which to connect yourself to the history and heritage that exists in Modena. The sights, sounds, and smells of the car are worth more than any "thumbs up" you might get driving down the street. The exclusivity of the brand is one of the mechanisms that helps preserve that absolute care it takes to create a Ferrari. Now I don't own a Ferrari, but I appreciate that the Mr. Enzo Ferrari had a very significant part in molding car culture and motorsports. That tradition was carried on by a lot of people after Enzo himself. During my formative years that person was Luca Di Montezemolo. Every time he stepped in front of the camera in his distinctively Italian suit and shoes, I knew Ferrari was in good hands. Just the attitude he had made me feel safe that this very significant part of car culture was in safe hands. He could be giving an interview in Italian and without understanding a single word (well maybe one word, Ferrari) knew he was going to keep the Ferrari in Ferrari. Enter Sergio Marchionne. Now I am a huge Sergio fan. This guy is not your typical auto exec. His office isn't in the highest part of the tallest tower in Auburn Hills, and he doesn't wear a hand-crafted suit made of million thread count cloth. Not dogging in the man's style (his wardrobe is for sure worth more than mine and most others), but basically he is normal guy that doesn't conform to what might be considered the norm. He is his own man. On top of all that, he is a financial wizard. I was skeptical when he took over the reins at Ferrari only because he seemed to have so much on his plate to begin with. In the end I knew a car-guy, albeit one with a CPA/MBA, was in charge. So now when I heard he wanted to spin off Ferrari, I started trying to guess how long it was going to be before the geniuses of Wall Street started pushing Ferrari to pump volume. I saw a horrible future where there was now some entry-level Ferrari with a turbo-six, and four doors...just so every 30 yr-old analyst could flash their Ferrari key at the bar. Then I started thinking about another thing, the value. What is it worth?

Ken Block's Gymkhana 8 to feature Dubai Police cars?

Tue, Feb 23 2016Yesterday we showed you the shiny Ford Fiesta that Ken Block will slide, spin, and hoon through the next Gymkhana video. In case the image above isn't clear, that video will drop at midnight EST on February 30th on the Ford Performance YouTube channel. We don't know all the entire premise of the video yet, but this Tweet from the man himself reveals that the video will be set in Dubai. Block is standing on the Fiesta we saw yesterday, and arrayed behind him are a handful of those famous Dubai Police cars you're probably familiar with. The force has a fleet of sportscars and supercars, and the purpose is outreach and goodwill among its citizenry, not necessarily the pursuit of criminals. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. From left to right, we can see a Maserati GranTurismo, Porsche 911, what looks to be a Nissan GT-R obscured by Block's Fiesta, a McLaren (likely a 650S), Ford Mustang, and a Ferrari 599 of some ilk. Will they take part? Maybe Block will try and run from what might be the most horsepower-intensive police fleet in the world. We'll have answers (and a few minutes of pure Block hooniganism) in a few days. Related Video: