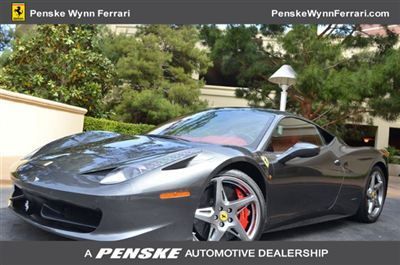

2010 Ferrari 458 Italia, 3,975 Miles,hre Performance Wheels!! Only $244,888.00!! on 2040-cars

Saint Louis, Missouri, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:4.5L 4499CC V8 GAS DOHC Naturally Aspirated

Body Type:Coupe

Fuel Type:GAS

Make: Ferrari

Warranty: No

Model: 458 Italia

Trim: Base Coupe 2-Door

Number of Doors: 2 Doors

Drive Type: RWD

Mileage: 3,975

Number of Cylinders: 8

Exterior Color: Red

Interior Color: Tan

Ferrari 458 for Sale

Cpo special paint afs yellow calipers daytona electric ipod shields camera 20(US $289,900.00)

Cpo special paint afs yellow calipers daytona electric ipod shields camera 20(US $289,900.00) 2011 ferrari 458 italia electrically operated seats 20" chrome rims afs system(US $279,900.00)

2011 ferrari 458 italia electrically operated seats 20" chrome rims afs system(US $279,900.00) 2013 ferrari 458 italia 20" chrome rims carbon fiber racing seats highpower hifi(US $389,900.00)

2013 ferrari 458 italia 20" chrome rims carbon fiber racing seats highpower hifi(US $389,900.00) 2010 ferrari 458 italia penske wynn ferrari las vegas nevada 702-770-2000(US $239,000.00)

2010 ferrari 458 italia penske wynn ferrari las vegas nevada 702-770-2000(US $239,000.00) 2010 ferrari 458 italia 2dr cpe

2010 ferrari 458 italia 2dr cpe Afs red calipers carbon fiber daytona led lifter ipod shields navigation tpms(US $284,900.00)

Afs red calipers carbon fiber daytona led lifter ipod shields navigation tpms(US $284,900.00)

Auto Services in Missouri

Wright Automotive ★★★★★

Wilson auto repair & 24-HR towing ★★★★★

Waggoner Motor Co ★★★★★

Vanzandt?ˆ™s Auto Repair ★★★★★

Valvoline Instant Oil Change ★★★★★

Todd`s & Mark`s Auto Repair ★★★★★

Auto blog

Marchionne: FCA, but not Ferrari, interested in Formula E

Sat, Aug 5 2017It seems like automakers have been clamoring to get on board with Formula E lately. In just the last few weeks a number of manufacturers have either become more directly involved, or otherwise announced entry into the series in coming years. That includes Audi, BMW, Mercedes-Benz and Porsche, with the latter two abandoning other series to join the electric one. Now, FCA CEO Sergio Marchionne says his company might join Formula E as well, according to Motorsport. Previously, Marchionne had toyed with the idea of bringing Ferrari into the Formula E field, but now says that would be unlikely. Instead, he thinks an FCA brand would be a better fit, perhaps Alfa Romeo or Maserati. At the moment, Maserati seems like the best fit, as Marchionne just announced that the brand would electrify its entire lineup after 2019, with each car it sells having either a hybrid or electric powertrain. Fans would probably be excited to see Maserati return to racing, and Formula E would be a good test laboratory for the development of electric propulsion technology. Still, another brand could represent FCA in Formula E, and apply the knowledge learned there to its vehicles, as Marchionne says half of the FCA fleet will be electrified by the end of the company's five-year plan ending in 2022. Marchionne said that while Ferrari won't be directly involved, he doesn't know which FCA brand – Alfa Romeo, Dodge, Chrysler, Fiat, or Maserati – would enter. As interesting as an electric Dodge race car would be, it seems unlikely, especially because of, well, Maserati. We're hoping it's Jeep, though. Related Video: News Source: MotorsportImage Credit: ALBERTO PIZZOLI/AFP/Getty Images Green Alfa Romeo Ferrari Maserati Green Culture Electric Racing Vehicles Sergio Marchionne FCA Formula E

Ferrari borrows $2.6 billion to finance FCA spinoff

Tue, Dec 1 2015Ferrari announced Monday that it is borrowing about $2.6 billion to finance its spinoff from Fiat Chrysler Automobiles. Here's how it breaks down: Ferrari NV, the automaker's parent company based in the Netherlands, is taking out loans totaling 2.5 billion euros. That's equivalent to $2.64 billion at current exchange rates, and is divided between a term loan of $2.12 billion and a revolving credit facility of $529 million. The larger term loan "will be used to refinance indebtedness owing to Fiat Chrysler Automobiles," among other purposes. That ought to constitute the lion's share of the $2.38 billion which the Prancing Horse marque was, according to reports last year, slated to pay its current parent company in order to help FCA fund its ambitious growth plans. The separate line of credit is earmarked "to be used from time to time for general corporate and working capital purposes of the Ferrari group." Though Ferrari is not expected to take any other Fiat Chrysler properties with it, the "group" in this case would include its various financial services and distribution arms around the world that may have been separately incorporated. As noted in the statement below, the financial arrangement "represents a further step towards the separation of Ferrari from the FCA Group," following the separate stock issues from both companies as independent from each other. FERRARI N.V. SIGNS ˆ2.5 BILLION SYNDICATED CREDIT FACILITY Ferrari N.V. (NYSE: RACE) ("Ferrari") announced today that it has entered into a ˆ2.5 billion syndicated loan facility with a group of ten bookrunner banks. The facility comprises a bridge loan (the "Bridge Loan") and a term loan (the "Term Loan") of ˆ2 billion in aggregate and a revolving credit facility of ˆ500 million (the "RCF"). Proceeds of the Bridge Loan and Term Loan will be used to refinance indebtedness owing to Fiat Chrysler AutomobilesN.V. (NYSE: FCAU) ("FCA") and other indebtedness and for other general corporate purposes. Proceeds of the RCF may be used from time to time for general corporate and working capital purposes of the Ferrari group. The Bridge Loan has a 12 month maturity with an option for Ferrari to extend once for a six-month period. Ferrari intends to refinance the Bridge Loan prior to its maturity with longer term debt, including through capital markets or other financing transactions. The Term Loan, which comprises a majority of the total facility, and the RCF each have a maturity of five years.

Ferrari to pay Fiat Chrysler $2.8B prior to spinoff

Sat, 15 Nov 2014Fiat Chrysler Automobiles is trying to get capital together in a hurry to finance the automaker's growth plans. Among its strategies to raise money, Ferrari will be spun off from the FCA mothership next year with an initial public offering. However, the Italian supercar maker will be a couple billion dollars poorer at the start of its new life.

According to a filing with US regulators obtained by Automotive News, FCA intends to "enter into certain other transactions including distributions and transfers of cash from Ferrari currently estimated at 2.25 billion euros ($2.8 billion)" before it spins the supercar maker off. Those funds might include paying a dividend to investors, and FCA possibly transferring some of its debt to the Prancing Horse.

The Ferrari IPO will likely be in the second or third quarter of 2015, according to Automotive News. Ten percent of the automaker will go onto the public market in the US and possibly Europe too, and 80 percent will be distributed among current FCA shareholders. The other 10 percent is held by co-chairman Piero Ferrari, according to AN.