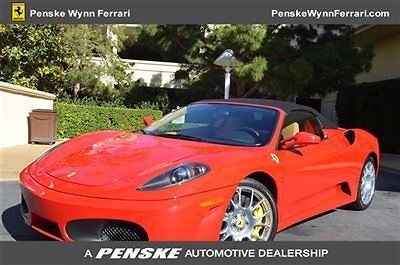

2009 Ferrari F430 F1 Spider Penske Wynn Ferrari Las Vegas 702-770-2000 on 2040-cars

Las Vegas, Nevada, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:4.3L 4308CC V8 GAS DOHC Naturally Aspirated

Body Type:Convertible

Fuel Type:GAS

Year: 2009

Make: Ferrari

Warranty: Vehicle does NOT have an existing warranty

Model: F430

Trim: Spider Convertible 2-Door

Doors: 2

Drive Type: RWD

Engine Description: 4.3L V8 FI DOHC 32V

Mileage: 1,282

Number of Doors: 2

Sub Model: 2dr Conv Spider

Exterior Color: Red

Number of Cylinders: 8

Interior Color: Tan

Ferrari 430 for Sale

Black on black scuderia with factory warranty!(US $179,900.00)

Black on black scuderia with factory warranty!(US $179,900.00) F430 f1 spider! wheels! carbon! bluetooth! scuderia! carfax certified! clean!(US $134,900.00)

F430 f1 spider! wheels! carbon! bluetooth! scuderia! carfax certified! clean!(US $134,900.00) F430, spyder, shields, daytona seats, carboceramics, yellow calipers, ipod, awes(US $172,500.00)

F430, spyder, shields, daytona seats, carboceramics, yellow calipers, ipod, awes(US $172,500.00) 2006 ferrari f430 spider convertible 2-door 4.3l(US $148,888.00)

2006 ferrari f430 spider convertible 2-door 4.3l(US $148,888.00) 2007 ferrari f430 spider convertible(US $158,888.00)

2007 ferrari f430 spider convertible(US $158,888.00) 2007 ferrari(US $139,988.00)

2007 ferrari(US $139,988.00)

Auto Services in Nevada

Vince`s Automotive ★★★★★

Unique RV & Auto Works ★★★★★

The Specialists Detail Studio ★★★★★

Texaco Xpress Lube ★★★★★

Summerlin Auto Body ★★★★★

Sin City Performance ★★★★★

Auto blog

Man orders LaFerrari for wife, dies before seeing gift delivered [w/video]

Fri, Jan 9 2015Ferrari has been profiling some of the 499 buyers of the LaFerrari in its official magazine, and the latest issue features Austrian-born Swiss artist Cornelia Hagmann. Her husband and Ferrari collector Walter Hagmann ordered a Rosso Corsa example of the supercar for Cornelia, but Walter passed away slightly more than a year ago, before it could be delivered. There's no reason to doubt that, as Ferrari says, her husband's gift is the car closest to her heart. The video above captures some behind-the-scenes moments during the photo shoot for the magazine, and there's a press release below with a few words about the article. We've also included a video below about another Swiss citizen, Ferrari collector, and LaFerrari buyer, Albert Obrist, whose love affair with the brand began when he went to the Grand Prix of Switzerland in 1951. An encounter with an artist and the car closest to her heart Maranello, 2th January 2015 – Cornelia Hagmann is an Austrian-born painter and sculptor that has made Switzerland her home for many years. Her wonderfully rich paintings are mostly of landscapes sumptuous with greenery and flowers. She does, however, have a second great passion: for Ferrari. This enduring fascination was sparked by her late husband, Walter Hagmann, a Swiss businessman and leading Ferrari collector, who unfortunately passed away a little over a year ago before the delivery of the magnificent Rosso Corsa LaFerrari he had ordered as a gift for his wife. In an interview with The Ferrari Official Magazine, Cornelia talks not just about her art but also her love of speed and the Prancing Horse. Plus, of course, her LaFerrari: "It's a real work of art: I could spend hours just staring at it...." This video features a few moments from the photo shoot that accompanies the interview.

Race Recap: Canadian F1 Grand Prix is one story with a thousand dramas

Tue, 11 Jun 2013There were rain and wind and sun, sometimes all at once. There was the Wall of Champions. There was nothing happening in first place and nothing happening back in sixth during the race, but everywhere else - from the time the weekend began - it was surprises, passes, spins, more passing, flying carbon fiber and finally a couple more last-minute surprises. The Canadian Formula One Grand Prix was a proper race for all the right reasons... well, except for the part where the crowd booed the winner.

2015 Malaysian F1 GP springs hot, humid surprises [spoilers]

Sun, Mar 29 2015In the two weeks since Australia both Mercedes and Ferrari spoke of the improved performance from their respective cars. In Malaysia, Ferrari showed it. Lewis Hamilton still put his Mercedes-AMG Petronas on pole position, but Sebastian Vettel got within two whiskers of the Brit, lining up second just 0.074 behind. Afterward, Vettel said Ferrari could win the race if everything went well. But in qualifying we didn't know how much of Ferrari's performance was truly down to the car and how much was down to the wet weather that struck near the beginning of Q2. The rain didn't hamper Nico Rosberg's run – the German said "I just didn't drive good enough" – and he took third spot in the second Mercedes-AMG Petronas. Showing what the Infiniti Red Bull Racing chassis can do when the power unit is working properly, teammates Daniel Ricciardo and Daniil Kvyat grabbed fourth and fifth. Whippersnapper Max Verstappen, in his second race, qualified in sixth with an excellent drive through the rain; just 0.030 behind Kvyat, he said he could have got fifth if he hadn't had a running problem with his brakes. Williams head of vehicle performance Rob Smedley said he wouldn't complain about Mercedes' advantage, but Felipe Massa has spent the whole season so far banging the alarm about Ferrari's pace. He says Williams has lost its straight-line advantage, part of the reason the first Grove car is back in seventh, while Valtteri Bottas is in eighth. Between them was Romain Grosjean in the Lotus, but he got dropped two positions for a pit-lane infraction in Q2, so he'll be tenth. Ahead of him is Marcus Ericsson in the Sauber, who would lead the charge to turn in another surprise for the Swiss team. But the real surprise came from the Scuderia Ferrari, who, on a bright, sunny day proved that they don't need to add water for race-winning pace. While Hamilton got made usual awesome start at the lights, Vettel channeled that other famous German Ferrari driver and immediately cut across the track to intimidate Rosberg, maintaining his second place position into the first turn. Arguably the race-winning move came three laps later at that same turn, when Ericsson plunged in too fast and swapped ends, beaching the rear of his Sauber in the gravel trap. The safety car came out when the recovery truck emerged to retrieve the Sauber, and nearly all of the front-runners took to the pits to swap out of the medium tires. Vettel, however, didn't.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.046 s, 7891 u