2007 Ferrari F430 Spyder on 2040-cars

Ferrari 430 for Sale

2008 ferrari f430 spider convertible 2-door 4.3l(US $165,000.00)

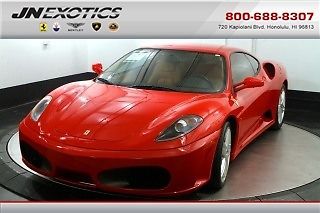

2008 ferrari f430 spider convertible 2-door 4.3l(US $165,000.00) Garage kept 1 owner f430 coupe red tan f1 loaded and serviced full history look!(US $149,900.00)

Garage kept 1 owner f430 coupe red tan f1 loaded and serviced full history look!(US $149,900.00) 2007 ferrari f430 coupe red/tan f1, daytonas, sport exhaust only 7100 miles(US $144,900.00)

2007 ferrari f430 coupe red/tan f1, daytonas, sport exhaust only 7100 miles(US $144,900.00) Novitec rosso ferrari f430 spider twin supercharged 680hp $250,000 built amazing(US $169,500.00)

Novitec rosso ferrari f430 spider twin supercharged 680hp $250,000 built amazing(US $169,500.00) Ferrari f430 f1 loaded leather 37 in stock. call today(US $119,995.00)

Ferrari f430 f1 loaded leather 37 in stock. call today(US $119,995.00) 2007 ferrari 430 berlinetta coupe

2007 ferrari 430 berlinetta coupe

Auto blog

2022 Villa d'Este Concours d'Elegance Mega Gallery | The show in pictures

Mon, May 23 2022COMO, Italy — Held annually, the Villa d'Este Concours d'Elegance is, in many ways, Europe's version of the Pebble Beach Concours d'Elegance. It takes place in a beautiful location, and it brings together an impressive selection of rare and valuable cars. It's a real treat for the eyes, the ears, and, if you're into champagne, the palate. The 2022 edition of the show was no exception: About 50 cars were shipped to Lake Como from over a dozen countries, and it wasn't just the usual suspects. Sure, there were a lot of pre-war cars (including a couple of one-off models), but some of the icons that younger enthusiasts grew up with (like the Lamborghini Countach) were present as well. This year's event was split into eight categories: The Art Deco Era of Motor Car Design, The Supercharged Mercedes-Benz, How Grand Entrances Were Once Made, Eight Decades of Ferrari Represented in Eight Icons, "Win on Sunday, Sell on Monday," BMW's M Cars and Their Ancestors, Pioneers That Chased the Magic 300 KPH, And a design award for concept and prototypes. The jury gave the coveted "best of show" award to a 1937 Bugatti 57 S owned by Andrew Picker of Monaco, while the aforementioned classes were won by, respectively: The Bugatti 57 S, shown below, A 1936 Mercedes-Benz 540K Cabriolet, A 1956 Chrysler Boano Coupe Speciale, A 1966 Ferrari 356 P Berlinetta Speciale Tre Posti, A 1961 Porsche 356 B Carrera Abarth GTL, A 1972 BMW 3.0 CSL, A 1989 Porsche 959 Sport, And the Bugatti Bolide concept unveiled in 2020. Winning at Villa d'Este is a big deal: The cars are judged by a panel of highly experienced judges. No one gave me a scoring sheet, presumably out of fear that I'd award points to the late-model Fiat 600 lurking in the parking lot, but several cars that didn't win an award caught my eye. One is a 1934 Bugatti Type 59 Sports, a grand-prix racer that was once owned by King Leopold III of Belgium and that has never been restored — its patina is inimitable. Another is a 1961 BMW 700 RS. One of two built (the other is in the BMW collection), it's a tiny, ultra-light roadster related to the 700 and powered by a 697-cubic-centimeter air-cooled flat-twin tuned to develop 70 horsepower. It won several hill-climb events during the 1960s, and it's one of the rarest cars ever to wear a BMW roundel. Aston Martin's freshly-restored 1979 Bulldog concept was cool to see as well; check out the cassette player integrated into the headliner!

Ferrari raises $893M, valued at $12B

Wed, Oct 21 2015Ferrari's stock is moving as quickly on the New York Stock Exchange as the brand's iconic sports cars do on the road. The company's incredibly popular initial public offering has already raised $893.1 million by virtue of 17.18 million shares sold for $52 apiece. If the deal's underwriters buy in as well, the figure would grow to $982.4 million. Plus, even after shouldering some of FCA's debt, the automaker carries an enterprise value of $12 billion, Bloomberg reports. Just as the company starts trading on the New York Stock Exchange, the share price is already racing upward, too. As of this writing, Ferrari stock, which is listed under the symbol RACE, is priced at $57.59. At its high so far today, the value reached as high as $60.95. While Ferrari is looking strong, the big winner in this success looks to be FCA because the company should raise $4 billion in the spin-off, according to Bloomberg. With nine percent of the sports car maker on the NYSE and one percent for the underwriters, another 80 percent will be distributed to FCA investors in 2016. When that's through, Exor, the holding company for the Agnelli/Elkann family, should have the largest stake at about 30 percent. Piero Ferrari holds the remaining 10 percent and has no intention to sell it. Related Video: FCA Announces Pricing of Initial Public Offering of Ferrari N.V. Common Shares Fiat Chrysler Automobiles N.V. (NYSE: FCAU/MI: FCA) ("FCA") and its subsidiary Ferrari N.V. ("Ferrari") announce today the pricing of Ferrari's initial public offering of 17,175,000 common shares at an offering price of $52 per share for a total offering size of $893.1 million ($982.4 million if the underwriters exercise the option described below in full). The shares are expected to begin trading on the New York Stock Exchange on Wednesday, October 21, 2015, under the symbol "RACE", and closing of the offering is expected to occur on October 26, 2015. In addition, the underwriters have a 30-day option to purchase an aggregate of up to 1,717,150 common shares of Ferrari from FCA. The offering is intended to be part of a series of transactions to separate Ferrari from FCA. Following completion of this offering, FCA expects to distribute its remaining ownership interest in Ferrari to FCA shareholders at the beginning of 2016. UBS Investment Bank is acting as Global Coordinator for the offering.

Ferrari to list stock on Italian exchange

Mon, Nov 23 2015Ferrari announced Monday it will list its stock on the Mercato Telematico Azionario – the main section of the Borsa Italia stock exchange in Milan. The news comes a little over a month after the exotic automaker launched its initial public offering on the New York Stock Exchange. The company's stock listings are the culmination of a long process that dates to the merger of Fiat and Chrysler, if not earlier. Once the two auto giants came together, they merged their brand portfolio under one umbrella, incorporating the Dodge, Ram, Jeep, Alfa Romeo, and Maserati brands, as well as Mopar, Lancia, Fiat Professional, and the Fiat and Chrysler brands themselves. Ferrari, however, was deemed a separate entity, even after FCA chief Sergio Marchionne wrested control of the Maranello-based outfit from longtime chairman Luca di Montezemolo. Almost exactly one year after FCA launched its IPO on the NYSE, Ferrari did the same. Nine percent of its common shares were listed under the symbol RACE. Another one percent was offered to the listing's underwriters. Ten percent remains in the hands of Enzo Ferrari's family, led by his son and company vice-chairman Piero Ferrari. And the remaining 80 percent will be distributed among FCA's shareholders. FERRARI APPLIES TO LIST SHARES ON MTA Ferrari N.V. (NYSE: RACE) and FE New N.V.1 announced today the filing of the application for the listing, in connection with the planned separation of Ferrari N.V. from Fiat Chrysler Automobiles N.V., of the common shares of Ferrari on the Mercato Telematico Azionario organized and managed by Borsa Italiana S.p.A. Maranello, 23 November 2015 1As part of the separation, Ferrari N.V. will be merged into FE New N.V. which immediately before the merger will hold the shares in Ferrari N.V. now held by Fiat Chrysler Automobiles N.V. FE New N.V. will then be renamed Ferrari N.V., and its common shares will be listed on the MTA and the New York Stock Exchange.