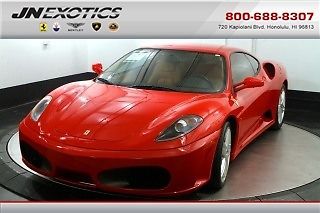

2007 Ferrari F430 Coupe Red/tan F1, Daytonas, Sport Exhaust Only 7100 Miles on 2040-cars

Cleveland, Ohio, United States

Ferrari 430 for Sale

Novitec rosso ferrari f430 spider twin supercharged 680hp $250,000 built amazing(US $169,500.00)

Novitec rosso ferrari f430 spider twin supercharged 680hp $250,000 built amazing(US $169,500.00) Ferrari f430 f1 loaded leather 37 in stock. call today(US $119,995.00)

Ferrari f430 f1 loaded leather 37 in stock. call today(US $119,995.00) 2007 ferrari 430 berlinetta coupe

2007 ferrari 430 berlinetta coupe 6-spd manual + shields + carbon fiber + daytonas + yellow tach + red calipers(US $134,999.00)

6-spd manual + shields + carbon fiber + daytonas + yellow tach + red calipers(US $134,999.00) F1 rwd convertible premium

F1 rwd convertible premium Yellow, 7,800 miles, f1, daytona seats, hi-firadio, 144 month financing, trades(US $129,750.00)

Yellow, 7,800 miles, f1, daytona seats, hi-firadio, 144 month financing, trades(US $129,750.00)

Auto Services in Ohio

Zink`s Body Shop ★★★★★

XTOWN PERFORMANCE ★★★★★

Wooster Auto Service ★★★★★

Walker Toyota Scion Mitsubishi Powersports ★★★★★

V&S Auto Service ★★★★★

True Quality Collision ★★★★★

Auto blog

Ferrari 412 picks up a teak cargo bed

Wed, 28 May 2014While marques like Porsche and Lamborghini having already branched out into SUVs, with Bentley and Maserati soon to follow, Ferrari remains one of the few high-end automakers that refuses, for better or worse, to follow suit. But the boys in Maranello never said anything about a pickup.

That's precisely what we have here, although as you might have guessed, this was not (unlike the similar treatment BMW applied to the previous M3) a factory-authorized conversion. Instead it was undertaken by the London Motor Group, parent company to the London Motor Museum and London Supercar Workshop. It's based on a late-80s Ferrari 412, the 2+2 coupe that preceded the 456 GT, which in turn was replaced by the 612 Scaglietti and then the FF, itself Ferrari's first hatchback. In other words, it comes from a line that was ripe to mark a first in terms of Ferrari body-styles.

The one-off retains the 4.9-liter V12 and just about everything forward of the cabin. But behind it's got a three-foot pickup bed lined in teak. The London outfit also gave it a twin-barrel hood scoop, variable exhaust and a custom Bang & Olufsen sound system to round it out. The vehicle is set to feature on the History Channel's Ultimate Wheels, alongside a VW camper, Ford Mustang, Group B-inspired Audi and a unique Bristol.

Ferrari F12 Berlinetta takes home 2014 Robb Report Car of the Year [w/video]

Tue, 25 Mar 2014In what is being called an "unprecedented landslide decision," those who have the right to cast votes have anointed the Ferrari F12 Berlinetta as the 2014 Robb Report Car of the Year. Standout features that have helped the Ferrari earn such a runaway victory include its 0-60 blast of 3.1 seconds, its 211-mile-per-hour top speed and the exhaust note of its 731-horsepower V12 engine.

After being driven by a team of journalists and 100 or so members of the private Robb Report Club, the grand tourer beat out a total of 13 contenders that included the Audi R8 V10 Plus, Lamborghini Aventador LP700-4 Roadster, Aston Martin Vanquish Volante, Bentley Continental Flying Spur, Jaguar F-Type V8 S, Chevrolet Corvette Stingray Coupe, Maserati Quattroporte GTS and Dodge SRT Viper GTS.

This is the 21st year that Robb Report has selected a Car of the Year. Scroll down below for the official announcement and video, and feel free to read more about the F12 Berlinetta and some of its worthwhile competitors over at Robb Report.

Ferrari 458 Speciale A is most powerful Prancing Horse convertible ever

Thu, 25 Sep 2014Let all of the speculation finally end because the convertible version of the Ferrari 458 Speciale is here. However, the Prancing Horse isn't calling it a spider; instead it's dubbed the 458 Speciale A, which stands for Aperta or "open" in English. It's also limited to a scant 499 cars, a few more than the 458 first rumored.

Regardless of its name or production numbers, what really matters is Ferrari's claim that this is its the most powerful droptop production model ever. That is thanks to the same 4.5-liter V8 from the hardtop Speciale, with 597 horsepower and 398 pound-feet of torque.

The aluminum-retracting top doesn't change performance much, while letting the wind blow through the owner's hair at ludicrous speeds. Ferrari claims the setup adds about 110 pounds (50 kilograms) to the overall weight and can open or close within 14 seconds. Acceleration to 62 miles per hour is reported at 3.0 seconds, about a tenth slower than the coupe, and the Aperta can hustle to 124 mph in 9.5 seconds.