2006 Ferrari F430 Coupe F1 Rosso Corsa / Beige on 2040-cars

Miami, Florida, United States

Engine:4.3L 4308CC V8 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Coupe

Transmission:Automatic

Fuel Type:GAS

Make: Ferrari

Options: Compact Disc

Model: F430

Safety Features: Anti-Lock Brakes, Driver Side Airbag

Trim: Base Coupe 2-Door

Power Options: Air Conditioning, Power Windows

Drive Type: RWD

Doors: 2 doors

Mileage: 16,709

Engine Description: 4.3L V8 FI DOHC 40V

Sub Model: F1

Number of Doors: 2

Exterior Color: Red

Interior Color: Beige

Number of Cylinders: 8

Warranty: Unspecified

Ferrari 430 for Sale

F1 rosso corsa w/ beige scuderia shields loaded(US $194,900.00)

F1 rosso corsa w/ beige scuderia shields loaded(US $194,900.00) 2008 ferrari 430 2dr cpe xenon headlights power tilt/telescopic steering wheel

2008 ferrari 430 2dr cpe xenon headlights power tilt/telescopic steering wheel 08 ferrari f430 scuderia collector quality 75 miles only $219,888.00!! must see!(US $199,888.00)

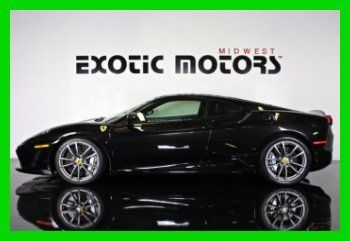

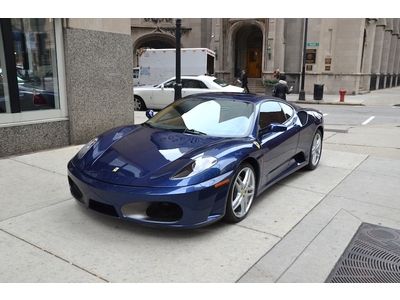

08 ferrari f430 scuderia collector quality 75 miles only $219,888.00!! must see!(US $199,888.00) Extra clean tubi passport radar clear bra call roland kantor 847-343-2721(US $139,995.00)

Extra clean tubi passport radar clear bra call roland kantor 847-343-2721(US $139,995.00) 2008 ferrari f430 scuderia 3k miles alcantara/bata upholstery only $189,888.00!!(US $189,888.00)

2008 ferrari f430 scuderia 3k miles alcantara/bata upholstery only $189,888.00!!(US $189,888.00) 2007 ferrari f430 spider 6 speed manual yellow with tan 1 owner car(US $129,800.00)

2007 ferrari f430 spider 6 speed manual yellow with tan 1 owner car(US $129,800.00)

Auto Services in Florida

Zeigler Transmissions ★★★★★

Youngs Auto Rep Air ★★★★★

Wright Doug ★★★★★

Whitestone Auto Sales ★★★★★

Wales Garage Corp. ★★★★★

Valvoline Instant Oil Change ★★★★★

Auto blog

Ex-Ferrari chairman sounds off on IPO

Sat, Aug 1 2015Former Ferrari chairman Luca di Montezemolo preferred to put exclusivity over profits when he ran the company, and the lower volume still meant huge amounts of cash for the business. FCA CEO Sergio Marchionne has since taken over Ferrari, but that hasn't stopped di Montezemolo from voicing his opinions. "I hope that the clients will remain more important than the analyst or the investor or the financial markets," di Montezemolo said prior to his induction into the Automotive Hall of Fame in Detroit, the Detroit Free Press reported. The former chairman argued that once on the stock exchange, a company would need to maximize profits quarter after quarter to keep investors happy. Conversely, di Montezemolo said Ferrari's years of success came from an "exclusivity in terms of number of cars, exclusivity in terms of how you deal with the clients." When di Montezemolo left Ferrari last year, he and Marchionne were scuffling about the future of the brand, including the health of the Formula 1 program. With the change in leadership, the company has reversed course in some ways. Where volume was previously kept around 7,000 units annually, the carmaker has set a new goal of closer to 10,000. The paperwork was filed for the IPO, and Marchionne thinks the company could be worth over $11 billion. The actual shares are rumored to go on sale in October. Related Video:

Ferrari borrows $2.6 billion to finance FCA spinoff

Tue, Dec 1 2015Ferrari announced Monday that it is borrowing about $2.6 billion to finance its spinoff from Fiat Chrysler Automobiles. Here's how it breaks down: Ferrari NV, the automaker's parent company based in the Netherlands, is taking out loans totaling 2.5 billion euros. That's equivalent to $2.64 billion at current exchange rates, and is divided between a term loan of $2.12 billion and a revolving credit facility of $529 million. The larger term loan "will be used to refinance indebtedness owing to Fiat Chrysler Automobiles," among other purposes. That ought to constitute the lion's share of the $2.38 billion which the Prancing Horse marque was, according to reports last year, slated to pay its current parent company in order to help FCA fund its ambitious growth plans. The separate line of credit is earmarked "to be used from time to time for general corporate and working capital purposes of the Ferrari group." Though Ferrari is not expected to take any other Fiat Chrysler properties with it, the "group" in this case would include its various financial services and distribution arms around the world that may have been separately incorporated. As noted in the statement below, the financial arrangement "represents a further step towards the separation of Ferrari from the FCA Group," following the separate stock issues from both companies as independent from each other. FERRARI N.V. SIGNS ˆ2.5 BILLION SYNDICATED CREDIT FACILITY Ferrari N.V. (NYSE: RACE) ("Ferrari") announced today that it has entered into a ˆ2.5 billion syndicated loan facility with a group of ten bookrunner banks. The facility comprises a bridge loan (the "Bridge Loan") and a term loan (the "Term Loan") of ˆ2 billion in aggregate and a revolving credit facility of ˆ500 million (the "RCF"). Proceeds of the Bridge Loan and Term Loan will be used to refinance indebtedness owing to Fiat Chrysler AutomobilesN.V. (NYSE: FCAU) ("FCA") and other indebtedness and for other general corporate purposes. Proceeds of the RCF may be used from time to time for general corporate and working capital purposes of the Ferrari group. The Bridge Loan has a 12 month maturity with an option for Ferrari to extend once for a six-month period. Ferrari intends to refinance the Bridge Loan prior to its maturity with longer term debt, including through capital markets or other financing transactions. The Term Loan, which comprises a majority of the total facility, and the RCF each have a maturity of five years.

Is the $1.4M LaFerrari sold out?

Mon, 09 Dec 2013If you look at the stratospheric sticker prices on the latest generation of hypercars and wonder how an automaker could possibly justify it, bear in mind a few factoids. For one thing, even when the sticker prices start lower, they quickly balloon past the million-dollar mark. For another, automakers charge that much because they can, and don't seem to have much trouble selling them all.

Case in point: the new LaFerrari. While presenting the state-of-the-art supercar on CNBC, Ferrari North America CEO Marco Mattiacci revealed that all 499 examples that will be made of the hybrid hypercar - including those 120 earmarked for North America - have already been spoken for. This despite the $1.4 million asking price that makes it the most expensive Ferrari ever made.

Or the most expensive new Ferrari, we should say, because prices for the most collectable machines ever to roll out the gates at Maranello continue to rise. Figure you'll save a little and get LaFerrari's predecessor? Trading hands these days at prices approaching $2 million (around three times its original $660k MSRP), the Enzo is even more expensive. And that's just the scarlet tip of the iceberg.