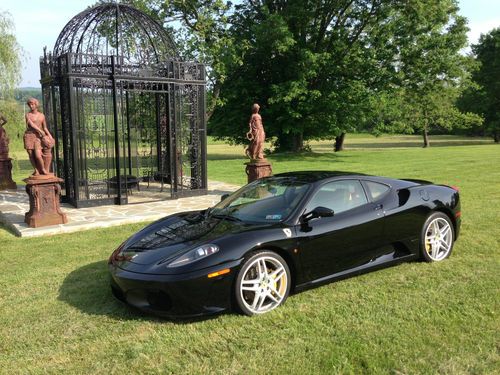

2005 Ferrari 430 Coupe! F1 Transmission! Clean Car! Carbon Fiber! Super Clean! on 2040-cars

El Paso, Texas, United States

Engine:8

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Make: Ferrari

Cab Type (For Trucks Only): Other

Model: 430

Warranty: Vehicle does NOT have an existing warranty

Mileage: 13,952

Sub Model: Berlinetta

Exterior Color: Red

Disability Equipped: No

Interior Color: Tan

Doors: 2

Drive Train: Rear Wheel Drive

Ferrari 430 for Sale

2007 f430 spider f1, powercube warranty til 12/2013, highly optioned, pristine!!(US $152,888.00)

2007 f430 spider f1, powercube warranty til 12/2013, highly optioned, pristine!!(US $152,888.00) $1149 mo./w.a.c. f-1,carbon brakes,shields,pwr. daytona,carbon interior!!!(US $174,900.00)

$1149 mo./w.a.c. f-1,carbon brakes,shields,pwr. daytona,carbon interior!!!(US $174,900.00) 2006 ferrari f430 coupe for $998 dollars a month with $25,000 dollars down

2006 ferrari f430 coupe for $998 dollars a month with $25,000 dollars down 2007 ferrari f430 f1 coupe for $1139 a month with $28,000 down

2007 ferrari f430 f1 coupe for $1139 a month with $28,000 down 2005 ferrari 430 spider, f1 blk/red(US $124,988.00)

2005 ferrari 430 spider, f1 blk/red(US $124,988.00) 2007 ferrari f430(US $139,950.00)

2007 ferrari f430(US $139,950.00)

Auto Services in Texas

Zoil Lube ★★★★★

Young Chevrolet ★★★★★

Yhs Automotive Service Center ★★★★★

Woodlake Motors ★★★★★

Winwood Motor Co ★★★★★

Wayne`s Car Care Inc ★★★★★

Auto blog

FCA likely won't sell more than 10% of Ferrari stake

Fri, Apr 17 2015The initial public offering of Ferrari on the stock market is likely coming in the second or third quarter of this year, but apparently the exact stake of the Prancing Horse set to hit the exchange isn't final. When FCA first announced the plan to spin off Ferrari, the idea was for 10 percent of the stock to go on the open market in the US and maybe also in Europe. Another 10 percent would go to company vice chairman and Enzo's son Piero Ferrari, and the remaining 80 percent would be divided among current shareholders, including a large portion for the Agnelli family. FCA CEO Sergio Marchionne hasn't finished tweaking those numbers, though. Last month, he indicated the automaker might put more than 10 percent of Ferrari on the market to boost liquidity. However, the original proposal has now returned to the table. "I don't believe we will go above 10 percent," Marchionne said, according to Automotive News, but also noted things weren't final. By increasing the Ferrari stock on the open market for the IPO, FCA decreases the amount going to current shareholders, according to Automotive News. With that being the case, don't expect too much of the Prancing Horse to be offered up to investors when the stock hits the market. Related Video:

What's the smarter investment, Ferrari stock or a Ferrari?

Sun, Jul 26 2015Fiat Chrysler Automobiles is gearing up to spin Ferrari off into its own company, and float some of its shares on the stock market. But buying and trading in Ferrari stock could face a rather unlikely competitor from within. As Bloomberg points out, the values held by classic Ferraris keeps going up, and by no small margin. Even something as relatively humble as the 80s-era Testarossa, for example, has nearly doubled in value over the past year alone. Meanwhile the value of some models – particularly those built in the 1950s, 60s, and 70s – have skyrocketed nearly seven-fold since 2006. Just look at the 250 GTO, one of the most coveted of classic Ferraris among collectors: not taking inflation into account, they were worth thousands in the late 60s, were already selling for hundreds of thousands in the 1980s, and by now are trading hands – on the rare occasion when they do trade hands – for tens of millions. One sold in 2004 for $10 million, and another in 2013 for over $50 million. Those kinds of increases can make a vintage Ferrari seem like a sound investment. That might make it difficult for Ferrari's stock to compete. The company hopes investors will view it as a luxury goods manufacturer along the likes of Prada, Hermes, or Louis Vuitton Moet Hennessy, the stocks of which tend to increase in value at a greater rate than those of most automakers. But even the best of those luxury stocks have merely doubled in value since 2006, compared to the aforementioned seven-fold increase enjoyed by some classic Ferraris over the same period. Add to that the prospect of actually getting to enjoy owning a classic Ferrari – albeit at the risk of damaging it and hindering its value – and the idea of investing in Maranello's products instead of its stock can seem like a much more enticing prospect. Related Video:

Ferrari borrows $2.6 billion to finance FCA spinoff

Tue, Dec 1 2015Ferrari announced Monday that it is borrowing about $2.6 billion to finance its spinoff from Fiat Chrysler Automobiles. Here's how it breaks down: Ferrari NV, the automaker's parent company based in the Netherlands, is taking out loans totaling 2.5 billion euros. That's equivalent to $2.64 billion at current exchange rates, and is divided between a term loan of $2.12 billion and a revolving credit facility of $529 million. The larger term loan "will be used to refinance indebtedness owing to Fiat Chrysler Automobiles," among other purposes. That ought to constitute the lion's share of the $2.38 billion which the Prancing Horse marque was, according to reports last year, slated to pay its current parent company in order to help FCA fund its ambitious growth plans. The separate line of credit is earmarked "to be used from time to time for general corporate and working capital purposes of the Ferrari group." Though Ferrari is not expected to take any other Fiat Chrysler properties with it, the "group" in this case would include its various financial services and distribution arms around the world that may have been separately incorporated. As noted in the statement below, the financial arrangement "represents a further step towards the separation of Ferrari from the FCA Group," following the separate stock issues from both companies as independent from each other. FERRARI N.V. SIGNS ˆ2.5 BILLION SYNDICATED CREDIT FACILITY Ferrari N.V. (NYSE: RACE) ("Ferrari") announced today that it has entered into a ˆ2.5 billion syndicated loan facility with a group of ten bookrunner banks. The facility comprises a bridge loan (the "Bridge Loan") and a term loan (the "Term Loan") of ˆ2 billion in aggregate and a revolving credit facility of ˆ500 million (the "RCF"). Proceeds of the Bridge Loan and Term Loan will be used to refinance indebtedness owing to Fiat Chrysler AutomobilesN.V. (NYSE: FCAU) ("FCA") and other indebtedness and for other general corporate purposes. Proceeds of the RCF may be used from time to time for general corporate and working capital purposes of the Ferrari group. The Bridge Loan has a 12 month maturity with an option for Ferrari to extend once for a six-month period. Ferrari intends to refinance the Bridge Loan prior to its maturity with longer term debt, including through capital markets or other financing transactions. The Term Loan, which comprises a majority of the total facility, and the RCF each have a maturity of five years.