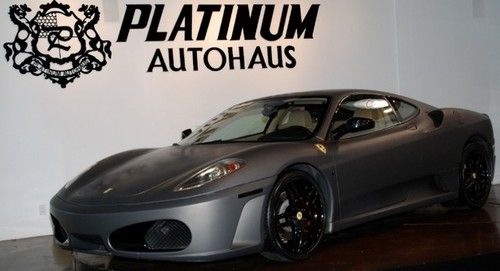

2005 Ferrari 430 Berlinetta Navigation Clean Carfax on 2040-cars

Beverly Hills, California, United States

Engine:4.3 l dohc mpf 40 valve v 8 engine

Body Type:Coupe

Vehicle Title:Clear

Exterior Color: Matte Grey

Make: Ferrari

Interior Color: Beige

Model: 430

Number of Cylinders: 8

Trim: coupe 2

Drive Type: RWD

Mileage: 26,995

Warranty: Vehicle does NOT have an existing warranty

Ferrari 430 for Sale

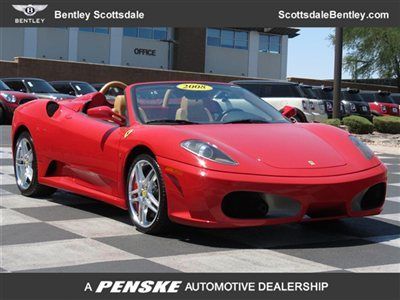

08 ferrari f430 dr cpe red(US $167,000.00)

08 ferrari f430 dr cpe red(US $167,000.00) 06 nero (black) 4.3l v8 manual:6-speed coupe *carbon fiber steering wheel*low mi(US $139,997.00)

06 nero (black) 4.3l v8 manual:6-speed coupe *carbon fiber steering wheel*low mi(US $139,997.00) F430 spider 6 speed f1 trans nero daytona leather carboceramic yellow calipers(US $160,000.00)

F430 spider 6 speed f1 trans nero daytona leather carboceramic yellow calipers(US $160,000.00) 2008 ferrari f430 daytona style seats high power hifi with subwoofer(US $179,900.00)

2008 ferrari f430 daytona style seats high power hifi with subwoofer(US $179,900.00) 2006 ferrari f430 spider convertible(US $119,995.00)

2006 ferrari f430 spider convertible(US $119,995.00) 2006 ferrari f430 berlinetta 4.3 - f1 transmission, navigation, ipod ready(US $119,995.00)

2006 ferrari f430 berlinetta 4.3 - f1 transmission, navigation, ipod ready(US $119,995.00)

Auto Services in California

Z Best Auto Sales ★★★★★

Woodland Hills Imports ★★★★★

Woodcrest Auto Service ★★★★★

Western Tire Co ★★★★★

Western Muffler ★★★★★

Western Motors ★★★★★

Auto blog

Top Gear brings together LaFerrari, McLaren P1 and Porsche 918

Mon, Jan 26 2015Earlier this month, Top Gear released a brief video of the comparison test between three hybrid hypercars we'd all been waiting for: the Ferrari LaFerrari, McLaren P1 and Porsche 918 Spyder. The story was done by the print magazine and not by the television show, and the video they released was barely over half a minute long, reserving the full version for subscribers of the iPad edition. Now the British mag has put the full video on YouTube, and while it's still only a minute and a half long – three times the length of the previous teaser – it's packed with electrified exotic goodness. The test surely took some serious wrangling to put together, and though the metal (or carbon fiber, as the case may be) was apparently furnished mostly by private owners, to hear Top Gear tell it, the manufacturers – Ferrari, McLaren and Porsche – were eager and helpful in putting the showdown together. For the final conclusions, we're afraid you'll still have to buy the magazine, but for a rare chance to watch all these three world-beaters on the same road at the same time, you'll want to scope out this latest video clip. Related Video: News Source: Top Gear via YouTube Ferrari McLaren Porsche Hybrid Supercars Videos porsche 918 spyder mclaren p1 ferrari laferrari

Top Gear names BMW i8 Car of the Year, Corvette, Ferrari, Mercedes also win big

Fri, Dec 5 2014The lads at Top Gear have released their listing of the finest cars of the past year, handing the ultimate honor to BMW's revolutionary i8 plug-in-hybrid supercar. "The i8 is a milestone in the annals of automotive history and a glorious statement for an exciting and positive future. The i8 delivers - and then some," the British mag wrote. The i8, though, was far from the only hybridized car to take victories. James May and Richard Hammond both highlighted hybrids as their personal cars of the year, with May saluting the Ferrari LaFerrari and the Hamster, unsurprisingly, heaping praise on the Porsche 918 Spyder. Jeremy Clarkson, meanwhile, opted to shock many by selecting not only an American car as his best of 2014, but giving the honor to of all things, a Corvette. Clarkson wasn't the only person to honor the USA's iconic sports car, with the new, 650-horsepower Z06 variant being named TG's Muscle Car of the Year. Other big winners include Mercedes-Benz, which TG honored for S-Class Coupe (Luxury Car of the Year), the new AMG GT (Sports Car of the Year) and the not-for-US C-Class Estate (Family Car of the Year). The 458 Italia Speciale A snagged a second win for Ferrari. The best of the rest include the Citroen C4 Cactus, Renault Twingo, Volkswagen Golf R, Lamborghini Huracan and Audi TT. Take a look below for the celebratory press blast from BMW. The BMW i8 wins Top Gear Car of the Year The BMW i8 has been named as Top Gear magazine's global Car of the Year 2014. The plug-in hybrid performance vehicle beat off some stiff competition from a host of other premium and luxury manufacturers to win the overall award. The editorial team of Top Gear commended the BMW i8 for its breadth of abilities. Its 1.5-litre three-cylinder turbocharged petrol engine combined with an electric motor gives searing acceleration and driver enjoyment but all wrapped in a package that takes BMW's EfficientDynamics philosophy to the extreme courtesy of CO2 emissions less than 49g/km and a 135mpg combined cycle figure. Charlie Turner, Editor in Chief at Top Gear magazine, said: "The BMW is a milestone in the annals of automotive history and a glorious statement for an exciting and positive future. The i8 delivers – and then some. It's the kind of car we should celebrate, a beautiful vision of the future, delivered now.

FCA Partners With Goolge, Marchionne Is New CEO Of Ferrari And We Spy The 2018 Jeep Wrangler | Autoblog Minute

Sat, May 7 2016Greg Migliore recaps the week in automotive news, including a look at the FCA, Google partnership, Ferrair's new CEO, and the 2018 Jeep Wrangler. Ferrari Jeep Autoblog Minute Videos Original Video FCA