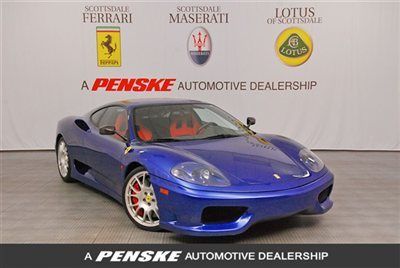

2004 Ferrari 360 Stradale - Fresh Major Service - Rare Color - Like 2003 on 2040-cars

Scottsdale, Arizona, United States

Body Type:Coupe

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Make: FERRARI

Model: 360

Warranty: Vehicle does NOT have an existing warranty

Mileage: 9,336

Sub Model: Challenge Stradale

Exterior Color: Blu Mediterraneo

Interior Color: Rosso/Nero

Doors: 2 doors

Number of Cylinders: 8

Engine Description: 3.6L V8 FI DOHC 40V

Ferrari 360 for Sale

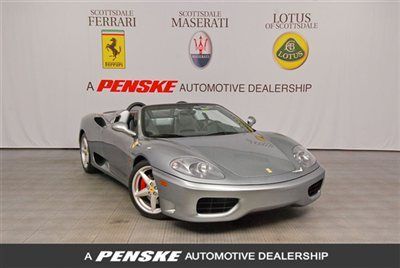

2002 ferrari 360 spider~recent major service & clutch~shields~calipers~like 2003(US $98,000.00)

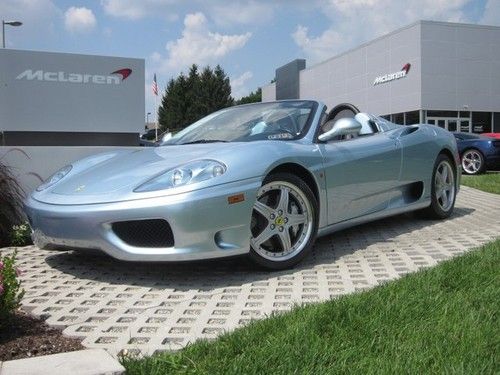

2002 ferrari 360 spider~recent major service & clutch~shields~calipers~like 2003(US $98,000.00) 2004 ferrari 360 spyder f1(US $97,900.00)

2004 ferrari 360 spyder f1(US $97,900.00) Ferrari 01 luxury sport 6-speed convertible xenon premium soft performance(US $99,900.00)

Ferrari 01 luxury sport 6-speed convertible xenon premium soft performance(US $99,900.00) F1..very low miles..colored seat piping..very clean!!(US $88,995.00)

F1..very low miles..colored seat piping..very clean!!(US $88,995.00) 2002 ferrari 360 spider 6spd 12k miles serviced tubi!!!

2002 ferrari 360 spider 6spd 12k miles serviced tubi!!! 2000 ferrari 360 with many extras(US $71,000.00)

2000 ferrari 360 with many extras(US $71,000.00)

Auto Services in Arizona

Windshield Replacement Phoenix ★★★★★

Valley Express Auto Repair ★★★★★

Tj`s Speedometer Repair ★★★★★

Super Discount Transmissions ★★★★★

Sun Devil Auto ★★★★★

Storm Auto Glass ★★★★★

Auto blog

Ferrari families have 'agreement' to prevent takeover

Thu, Oct 22 2015With its initial public offering already a massive success, Ferrari is now officially a publicly traded company on the New York Stock Exchange. While anyone can buy those shares, don't expect investors to take control away from some of the top owners of the Prancing Horse anytime soon. To maintain their power, Enzo Ferrari's son, Piero, and Exor chairman John Elkann will sign a deal guaranteeing themselves nearly half of the automaker's voting rights, Bloomberg reports. As part of this arrangement, shareholders that agree to hang onto Ferrari stock for at least three years would receive additional voting rights in the company, and that would give Piero and Elkann a combined 48.7 percent of the automaker by banding together. While not quite complete control, the move should be enough to prevent a takeover of the business. "We have an agreement among the families to protect our interests in Ferrari," Piero said to Bloomberg. This agreement won't really become a concern until next year because only 10 percent of Ferrari will be traded for now. FCA will distribute another 80 percent to its shareholders in early 2016, and Elkann's Exor will be getting the largest portion of the Prancing Horse in the spin-off. Meanwhile, Piero holds the remaining 10 percent but has absolutely no intention to sell his stake in his father's business. The newly public Ferrari will push to grow volume with a goal of moving 9,000 vehicles annually by 2019. To reach that 30-percent boost, expect to see a new model every year, and some of them might use a new, modular platform that's reportedly under development. Related Video:

1989 Ferrari F40 review had one Italian cyclist seeing rosso

Thu, 14 Aug 2014We've got to say: we're really enjoying the MotorWeek incarnation of this Throwback Thursday trend that seems to be enveloping everyone's social media feeds. MW has an almost impossibly deep library of historical tape to draw from, meaning each recent Thursday has met with another gem dropped on YouTube.

The last old-timer that drew our interest (and yours, based on all the comments) was a sports car showdown of epic, 1990s proportions. Today though, we've got one of the most legendary supercars of all time, the Ferrari F40, presented with the wholesome goodness that is John Davis' signature style. Any classic road test of the the F40 would probably earn our clicks, but this particular video comes with some added drama around the 5:10 mark.

Don't rush there, it's fun to listen to the period-correct praise along the way, but prepare yourself for a near-miss that's almost as breathtaking as the Ferrari itself.

Stellantis not looking for further mergers, including with Renault

Mon, Feb 5 2024MILAN — Stellantis Chairman John Elkann on Monday denied the carmaker was hatching merger plans, responding to press speculation about a possible French-led tie-up with rival Renault. Elkann said that the Peugeot owner, the world's third largest carmaker by sales, was focused on the execution of its long-term business plan. "There is no plan under consideration regarding merger operations with other manufacturers," said Elkann, who also heads Exor, the Agnelli family holding company that is the largest single shareholder in Stellantis. After abandoning the Russian market, at the time its second largest after France, and reducing the scope of its global cooperation with Nissan, Renault has been seen as a potential M&A target. Speculation intensified after an electric vehicle market slowdown forced it last week to cancel IPO plans for its EV and software unit Ampere. Its market cap remains stubbornly low at little over 10 billion euros ($10.8 billion) despite a financial recovery over the past few years. Stellantis, the product of a 2021 merger between France's PSA and Fiat Chrysler and one of the most profitable groups in the industry, has a market cap of more than 85 billion euros when unlisted shares are factored in. It has a 14 brand portfolio also including Citroen, Jeep, Opel and Alfa Romeo. NEWSPAPER REPORT Italian daily Il Messaggero had said on Sunday that the French government, which is Renault's largest shareholder and also has a stake in Stellantis, was studying plans for a merger between the two groups. A spokeswoman for Renault said on Monday the group did not comment on rumors. France's Finance Ministry had declined to comment on Sunday. Stellantis has crossed swords with the Italian government, which has accused it of acting against the national interest on occasions. Industry Minister Adolfo Urso last week raised the prospect of the Italian government taking a stake in Stellantis to help to balance the French influence. Renault shares pared gains after Elkann's comments to stand 1.2% higher by 1220 GMT, having initially risen more than 4%. Stellantis CEO Carlos Tavares, a Portuguese-national, last week said in an interview with Bloomberg that the group was "ready for any kind of consolidation" and that its job was to make sure that it would be "one of the winners". Analysts, however, question the rationale of a Stellantis-Renault merger, which would also expand the group's excess capacity in Europe.