2001 Ferrari 360 Modena Spider on 2040-cars

Sicklerville, New Jersey, United States

|

|

Ferrari 360 for Sale

1999 ferrari 360 coupe for $749 a month with $18,000 dollars down(US $94,900.00)

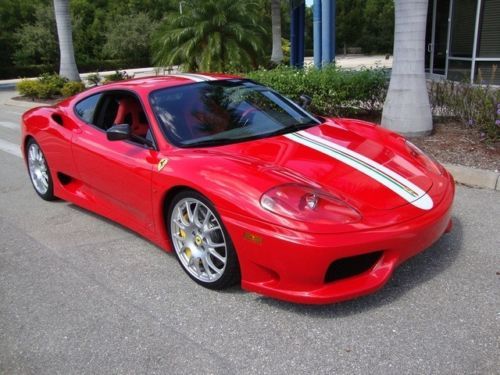

1999 ferrari 360 coupe for $749 a month with $18,000 dollars down(US $94,900.00) Challenge stradale real factory stripe alacantera new clutch cambelts done(US $164,900.00)

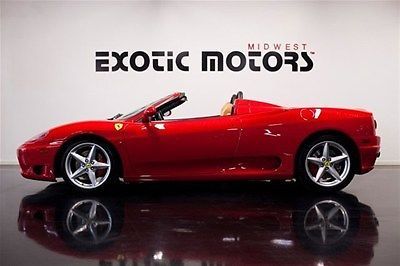

Challenge stradale real factory stripe alacantera new clutch cambelts done(US $164,900.00) 2003 ferrari 360 spider 8k 6 speed manual daytonas convertible(US $99,900.00)

2003 ferrari 360 spider 8k 6 speed manual daytonas convertible(US $99,900.00) 2001 ferrari 360 modena(US $76,000.00)

2001 ferrari 360 modena(US $76,000.00) 2001 ferrari 360 spider immaculate condition with only 24k miles

2001 ferrari 360 spider immaculate condition with only 24k miles 2001 360 spider red/beige, fresh service 19k mi $82,888(US $82,888.00)

2001 360 spider red/beige, fresh service 19k mi $82,888(US $82,888.00)

Auto Services in New Jersey

World Class Collision ★★★★★

Warren Wylie & Sons ★★★★★

W & W Auto Body ★★★★★

Union Volkswagen ★★★★★

T`s & Son Auto Repair ★★★★★

South Shore Towing ★★★★★

Auto blog

Ferrari 250 GTO may have set new sale record at $52M

Thu, 03 Oct 2013Records are made to be broken, and it seems that one may have just been snapped again. An Italian website is reporting that a Ferrari 250 GTO, owned by American collector Paul Pappalardo, recently sold for $52 million.

Now, this is far from confirmed - Pappalardo responded to questions about the sale saying, "I do not confirm these things, I have no comment about!" - and if it's a private sale, it's unlikely that we'll ever know the exact amount of the transaction. If that figure is correct, though, it easily eclipses the $35 million made in a 250 GTO sale in April of 2012, as well as the $27.5-million sale of a 1967 Ferrari 275 GTB/4 NART Spider sold at RM's Monterey auctions in August.

What makes a car that had 39 examples built more valuable than one that had only 10 units produced? Racing pedigree. The 250 GTO is a racing legend, with each car having a unique provenance that is more than enough to add some serious value. According to 0-100.it, the GTO in question, 5111GT, found its first owner in French racer and winner of the 1964 24 Hours of Le Mans, Jean Guichet, back in 1963. The Frenchman used the V12-powered racer to win the GT category of the Tour de France Automobile in that same year.

Ferrari boss Montezemolo expects big changes from FIA

Mon, 02 Dec 2013You'd think that with former Ferrari principal Jean Todt running the FIA, the relationship between the motorsport governing body and the team he once called home would be a solid one. But his former boss expects more from the organization that overseas Formula One.

In a recent interview (excerpts from which you can read below), Ferrari chairman Luca di Montezemolo pointed to some perceived inconsistencies in rulings made by FIA officials this season and called for "strong changes." Among those controversies was a drive-through penalty handed to Felipe Massa at the season-closing Brazilian Grand Prix last weekend, his last for the Scuderia. Massa was reprimanded for cutting across the white line that marks the exit from the pit lane, the penalty for which dropped him from fourth place in the race to seventh, and cost Ferrari its second place in the final standings for the constructors' championship - and with it a good $10 million in prize money. Montezemolo characterized the penalty as "disproportionate and unjust".

The Ferrari chief also pointed to penalties handed to Mercedes as either too harsh or not harsh enough, calling for greater consistency in FIA rulings and implying that more permanent race stewards be appointed instead of alternating race to race.

Ferrari stock demand exceeding supply

Sun, Oct 18 2015As with the Ferrari cars, so it is with shares in the company's initial public offering: When Ferrari has a limited quantity of something to sell, demand far outstrips supply. Investors told banks weeks ago that bids for the $1 billion in stock – up to 18.89 million shares – would exceed the number of shares available over the entire expected range of $48 to $52. Ten percent of the company is going on the block' Bloomberg reports that the books close on the IPO on Monday at 4:00 pm. The final price will be set on Tuesday, and trading will begin Wednesday under the ticker symbol RACE on the New York Stock Exchange. Piero Ferrari, the son of Enzo Ferrari, will hold onto the ten-percent stake he currently has in the company. Fiat Chrysler will disburse the final 80 percent to its investors sometime in 2016. In combination with spinning Ferrari off from its parent company next year, the share sale is expected to put $4 billion into Fiat Chrysler coffers, which will be used to help fuel the growth of Alfa Romeo, Jeep, and Maserati. Assuming all goes to plan, Bloomberg says Ferrari will be valued at roughly $12 billion, a number $1 billion greater than the valuation Fiat Chrysler CEO Sergio Marchionne put on Ferrari earlier this year and higher than the brand's own internal assessment. Related Video: