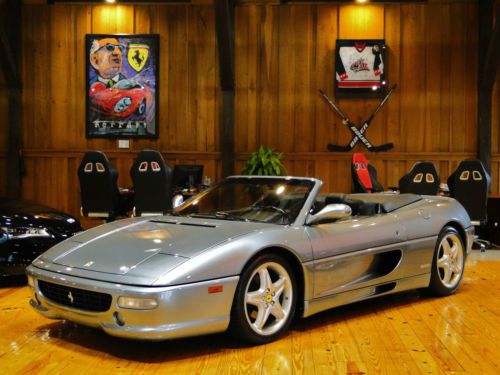

1999 Ferrari 355 F1 Spyder -recent Service, New Leather, Shedoni Luggage - Mint on 2040-cars

Westbank, British Columbia, Canada

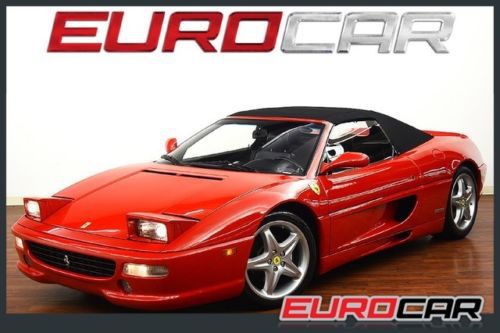

Ferrari 355 for Sale

F355 spider, 6 speed manual, full service history and records, beautiful(US $63,879.00)

F355 spider, 6 speed manual, full service history and records, beautiful(US $63,879.00) Berlinetta(US $69,000.00)

Berlinetta(US $69,000.00) 1997 ferrari gtb

1997 ferrari gtb 1995 ferrari f355 spider 17k miles serviced / 6 speed manual transmission / 355(US $64,999.00)

1995 ferrari f355 spider 17k miles serviced / 6 speed manual transmission / 355(US $64,999.00) Ferrari 355 f1 spider, fresh 30k service, 82% clutch, pristine(US $69,888.00)

Ferrari 355 f1 spider, fresh 30k service, 82% clutch, pristine(US $69,888.00) 6 speed manual stick 355 360 430 458 550 575 spider convertible(US $79,900.00)

6 speed manual stick 355 360 430 458 550 575 spider convertible(US $79,900.00)

Auto blog

Ferrari borrows $2.6 billion to finance FCA spinoff

Tue, Dec 1 2015Ferrari announced Monday that it is borrowing about $2.6 billion to finance its spinoff from Fiat Chrysler Automobiles. Here's how it breaks down: Ferrari NV, the automaker's parent company based in the Netherlands, is taking out loans totaling 2.5 billion euros. That's equivalent to $2.64 billion at current exchange rates, and is divided between a term loan of $2.12 billion and a revolving credit facility of $529 million. The larger term loan "will be used to refinance indebtedness owing to Fiat Chrysler Automobiles," among other purposes. That ought to constitute the lion's share of the $2.38 billion which the Prancing Horse marque was, according to reports last year, slated to pay its current parent company in order to help FCA fund its ambitious growth plans. The separate line of credit is earmarked "to be used from time to time for general corporate and working capital purposes of the Ferrari group." Though Ferrari is not expected to take any other Fiat Chrysler properties with it, the "group" in this case would include its various financial services and distribution arms around the world that may have been separately incorporated. As noted in the statement below, the financial arrangement "represents a further step towards the separation of Ferrari from the FCA Group," following the separate stock issues from both companies as independent from each other. FERRARI N.V. SIGNS ˆ2.5 BILLION SYNDICATED CREDIT FACILITY Ferrari N.V. (NYSE: RACE) ("Ferrari") announced today that it has entered into a ˆ2.5 billion syndicated loan facility with a group of ten bookrunner banks. The facility comprises a bridge loan (the "Bridge Loan") and a term loan (the "Term Loan") of ˆ2 billion in aggregate and a revolving credit facility of ˆ500 million (the "RCF"). Proceeds of the Bridge Loan and Term Loan will be used to refinance indebtedness owing to Fiat Chrysler AutomobilesN.V. (NYSE: FCAU) ("FCA") and other indebtedness and for other general corporate purposes. Proceeds of the RCF may be used from time to time for general corporate and working capital purposes of the Ferrari group. The Bridge Loan has a 12 month maturity with an option for Ferrari to extend once for a six-month period. Ferrari intends to refinance the Bridge Loan prior to its maturity with longer term debt, including through capital markets or other financing transactions. The Term Loan, which comprises a majority of the total facility, and the RCF each have a maturity of five years.

Ferrari to launch new model every year, keep production limited

Tue, 06 May 2014You've no doubt perused the big news coming out of Fiat-Chrysler's headquarters in Auburn Hills, MI today. But at the end of the brand discussions, Sergio Marchionne spoke briefly about an incredibly important, low-volume part of the Fiat-Chrysler empire: Ferrari.

"You do need one of these cars in your driveway," Marchionne joked. And while other brand heads today lined out detailed plans for future product, Sergio's words about Ferrari's next five years were very simple, and very vague.

Marchionne confirmed that Ferrari will launch a new car every year between now and 2018. The cars will have a four-year lifecycle, after which, "M" versions will be produced, with a separate four-year cadence. No specific models were mentioned during Marchionne's presentation.

McLaren, Red Bull and Ferrari call for unfreezing F1 engines

Mon, Dec 29 2014Formula One is a hugely expensive sport. Not only do you have enormous salaries and logistical expenses, as you would in any other sport, but each team also spends huge sums developing their own chassis from the ground up – and so too do the participating automakers in developing the engines. One of the ways the series organizers mitigate those costs is by freezing development. So once the new crop of V6 turbo hybrid powertrains were developed, that was it. But now three of the of the sport's leading teams are calling on the FIA to unfreeze engine development. Their reason? Unfair advantage. There's little question that Mercedes did the best job of developing its "power unit" to meet the new regulations that took effect at the beginning of this past season. That's how the Mercedes team won all but three of the grands prix this season and finished with at least one car on the podium at every single race. It's also a big part of how the teams that bought their engines from Mercedes this season managed to consistently outperform the other non-works-supported teams. That clear advantage is why Red Bull, Ferrari and now McLaren are calling for engine development to be unfrozen. Their argument is that, under the current locked-down status quo, their engine suppliers (Renault, Ferrari and Honda, respectively) cannot possibly catch up. So unless the FIA and Formula One Management want the next few seasons to be the kind of absolute blow-outs that this past season was, these leading teams argue, the powers that be are going to have to make some changes. For its part, Mercedes naturally counters that unfreezing engine development would send costs spiraling out of control. But then of course it stands to lose the most by re-opening engine development. If those three teams, however, closely intertwined as they are with the three other engine suppliers participating in next year's championship, manage to solicit enough support from the other customer teams and bring the matter to a vote, Mercedes may very well find itself out-numbered. News Source: ESPNImage Credit: Patrick Baz/AFP/Getty Motorsports Ferrari McLaren Mercedes-Benz F1 engine