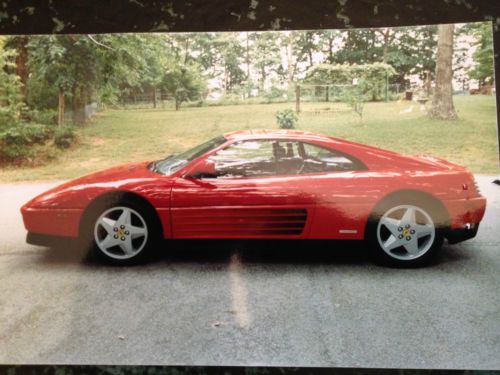

One Owner Estate Car All Books & Records Rare Hard/fixed Top Ferrari 348tb Red on 2040-cars

Buford, Georgia, United States

|

I bought this car from the original (deceased) owner's estate (he passed in 2006) in Augusta, Georgia -

I bought it as part of a four car package (the other cars being early Ford Mustangs which is my forte) - The car was bought, brand new, in 1989 at FAF Motorcars (Ferrari of Atlanta) a factory-authorized Ferrari dealership- It is a US model car (see pix of window sticker). MSRP was $ 95,850.00 but because of the wait times on these (then) brand new introduced cars I have an original bill of sale that shows the original owner paying FAF Motorcars $ 160,000.00 PLUS SALES TAX for this car - The car comes with every book, record, receipt, leather books, leather tool kit, original factory brochures & posters & more. The original owners son-in-law (estate executor) had the 40,000 major service done about 6 years ago and when that was done he also had the upgrades done to the factory A/C (blows ice cold) and the Bosch computers (got the bugs out) - The car runs and drives fantastic - It has the original paint that is a solid 8 on a scale of 1 to 10 - The original Connolly leather interior still smells new - Non-smoking owner - The car was custom-ordered for the original owner so every factory letter, dealer & factory correspondence etc. is in this cars very thick file - Really great stuff that you just do not see with a 26-year-old-car, let alone a one owner Ferrari Fly in and drive home - Original owner ordered the car factory-radio DELETE because he said that the only music allowed in a Ferrari is the one V8 going on behind his head - He also ordered a fix-top/roof because he did not want the targa top to leak on him and he did not want the body flex of a targa top while driving the car - I have ordered a set of 4 brand new high dollar Goodyear Supercar tires, for the car, and they will be installed prior to new owner taking possession of this car - The tires that are on the car are fine (tread-wise) but they are 12 years old and I would not feel comfortable allowing anyone to buy a car from me with 12 year old tires on it - This car is very well sorted out and needs nothing to drive and enjoy - Car has never been out of the state of georgia The tItle is clear and ready to be signed over to the new owner - I have researched price/value on these cars and I have seen them selling for as low as $ 35,000.00 (high mileage, multi owner,- junk) to $ 85,000.00 (one owner, low mileage, trailer queen car) - I have priced the car realistically - It is priced below NADA retail - This car is meant to be driven. According to the executor, it was well enjoyed by the original owner till the time of his passing. Enzo would be proud! Stephen Becker (770) 900 5532 |

Ferrari 348 for Sale

1991 ferrari 348tb black/black 27kmiles

1991 ferrari 348tb black/black 27kmiles Fully serviced, 26k, none nicer, tubi, 360 wheels, challenge grille, cold a/c!!(US $46,995.00)

Fully serviced, 26k, none nicer, tubi, 360 wheels, challenge grille, cold a/c!!(US $46,995.00) 1995 ferrari 348 spider,red,sharp,look low rerserve

1995 ferrari 348 spider,red,sharp,look low rerserve 1994 ferrari 348 spider with 10838 original miles.(US $49,000.00)

1994 ferrari 348 spider with 10838 original miles.(US $49,000.00) 1990 ferrari 348tb in blue medio with grey leather interior

1990 ferrari 348tb in blue medio with grey leather interior 1994 ferrari 348 spider - private sale(US $45,500.00)

1994 ferrari 348 spider - private sale(US $45,500.00)

Auto Services in Georgia

Young`s Upholstery & Seat Covers ★★★★★

Vic Williams Tire & Auto ★★★★★

United Auto Care ★★★★★

Unique Auto App ★★★★★

Ultimate Benz Service Center ★★★★★

Transmission For Less.Com ★★★★★

Auto blog

Ferrari F60 America is a powerful, exclusive US special

Fri, 10 Oct 2014Ferrari is observing its 60th anniversary in North America this year, and to celebrate, it's given us this: the F60 America, an incredibly exclusive supercar based on the already outrageous F12 Berlinetta. Want one? Too bad. Production has been limited to just 10 examples, and according to Ferrari, "the wonderfully elegant and unique F60 America has entranced US collectors and all 10 examples are already spoken for."

Entranced, indeed. It's a slick-looking machine, with clear revisions over the F12's already svelte bodywork. The F60 America takes the form of a roadster, with carbon fiber-trimmed flying buttresses that stretch from behind the cabin to the rear of the car. There's no power soft- or hardtop available - instead, Ferrari says the car can be closed off with a light fabric top that's usable at speeds of up to about 75 miles per hour.

The F60 is painted in the classic North American Racing Team livery, with a unique 60th anniversary Prancing Horse on the wheel arches and transmission tunnel inside the cabin. That NART tribute explains the car's seriously limited production run, as well. The 1967 Ferrari 275 GTS4 NART Spider - a car importer Luigi Chinetti specifically requested from Enzo Ferrari for US customers - was also capped at just 10 units.

The Ferrari Enzo's designer isn't worried about the future of supercars

Thu, Aug 25 2016Ken Okuyama is a talented designer with a prestigious portfolio. He spent 12 years at the famed Italian design house Pininfarina after a stint with GM's Advanced Design Studio, where he worked on the C5 Corvette. He also styled the Boxster and 996-generation 911 at Porsche. His first Ferrari design was the Rossa concept car, though his most famous creation is the Enzo. Now Okuyama runs a design studio that not only is responsible for the new Kode57 supercar that debuted in Monterey this past weekend, but also eye glasses, civic planning, and even Japanese bullet trains. We caught up with Okuyama at the Concorso Italiano car show, plopped down on a couple of plush leather chairs right in front of his brand new Kode57, and chatted about what the future holds for car design. Alex Kierstein: Lately there's been a lot of talk about autonomy and future mobility. What sort of challenges and opportunities do you think this autonomous future is going to provide for you as a car designer? Ken Okuyama: It is a really fantastic time for designers because of two reasons. One is that the public and private transport have been two separate, completely different industries up until now. Now, when you think about the future of autonomy, that really brings the automobiles into something more of a public transportation. You really have to think about the total experience of the customers from buying the ticket to the paying mechanism. That's just hardware, actually. It is a huge challenge for engineers and designers, and I really love that. That's one reason. Another reason is that just like horses were a means of transport 100 or so years ago, up until Henry Ford mass-produced the Model T. Now, maybe sports cars are becoming like horses. Now, horses are a great object for hobby, sports, and part of the Olympics and everything. Cars are going to be like that also. Dr. Porsche [was asked what type of] automobile is going to last for the longest time. He said, "the sports car." I really believe in that, because with sports cars, you never lose a sense of ownership. Autonomous vehicles are things you don't have to own. You have to design a total experience and the whole operation. A car, you want to own it. It's part of you. Your mechanical watches, do you borrow them from somebody? You want to own it. Your suits, your favorite shirts, you want to borrow them from somebody for your experience? No, you want to own it. Ownership is a core part of human beings.

Dubai police add Ferrari FF to keep Lambo company

Thu, 18 Apr 2013Supercars are a sulky lot by nature. Leave them to their own devices and they'll quickly grow despondent. That's why so many owners have more than one exotic in the stable. The Dubai Police seem to have caught on to that fact, having just added a Ferrari FF to help keep the force's new Lamborghini Aventador company. The duo will patrol the city's more affluent regions to promote the area's image as a mecca for money.

Mission: accomplished.

Of course, the Dubai PD certainly isn't the first law enforcement agency to adopt flashy cruisers, and car gods willing, it won't be the last. There was the Nissan GT-R gussied up for police duty, as well as the Lamborghini Gallardo LP560-4 and the Mitsubishi Evo X, but we have to say the DPD certainly has the most lust-worthy stable at the moment.