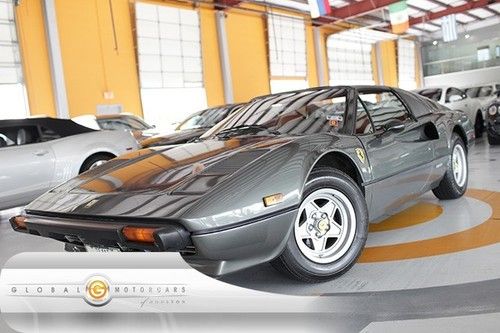

79 Ferrari 308 Gts Manual Leather-seats Am/fm-stereo Alloys 58k-miles on 2040-cars

Stafford, Texas, United States

Engine:8

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Manual

Body Type:Convertible

Cab Type (For Trucks Only): Other

Make: FERRARI

Warranty: Unspecified

Model: 308

Mileage: 58,895

Sub Model: GTS

Disability Equipped: No

Exterior Color: Gray

Doors: 2

Interior Color: Tan

Drive Train: Rear Wheel Drive

Inspection: Vehicle has been inspected

Ferrari 308 for Sale

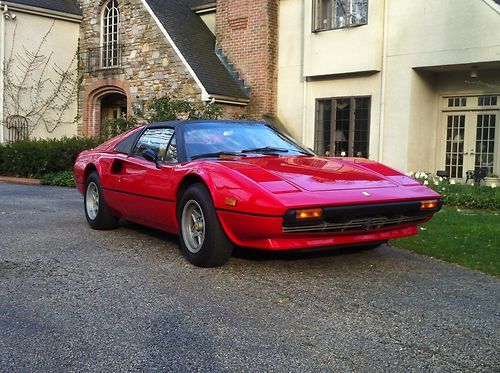

1979 ferrari 308 gts - 20.5k miles! concours winner. same owner last 25 years.

1979 ferrari 308 gts - 20.5k miles! concours winner. same owner last 25 years. 1983 ferrari 308 gtsi coupe only 24,000 original miles

1983 ferrari 308 gtsi coupe only 24,000 original miles 1982 ferrari 308 gtsi - rosso corsa with tan leather - everything done - wow!

1982 ferrari 308 gtsi - rosso corsa with tan leather - everything done - wow! 1982 ferrari 308 gtsi base coupe 2-door 3.0l

1982 ferrari 308 gtsi base coupe 2-door 3.0l

1982 ferrari 308 gtsi rare black/black with 348 rims and momo steering wheel(US $28,000.00)

1982 ferrari 308 gtsi rare black/black with 348 rims and momo steering wheel(US $28,000.00)

Auto Services in Texas

XL Parts ★★★★★

XL Parts ★★★★★

Wyatt`s Towing ★★★★★

vehiclebrakework ★★★★★

V G Motors ★★★★★

Twin City Honda-Nissan ★★★★★

Auto blog

Ferrari raises $893M, valued at $12B

Wed, Oct 21 2015Ferrari's stock is moving as quickly on the New York Stock Exchange as the brand's iconic sports cars do on the road. The company's incredibly popular initial public offering has already raised $893.1 million by virtue of 17.18 million shares sold for $52 apiece. If the deal's underwriters buy in as well, the figure would grow to $982.4 million. Plus, even after shouldering some of FCA's debt, the automaker carries an enterprise value of $12 billion, Bloomberg reports. Just as the company starts trading on the New York Stock Exchange, the share price is already racing upward, too. As of this writing, Ferrari stock, which is listed under the symbol RACE, is priced at $57.59. At its high so far today, the value reached as high as $60.95. While Ferrari is looking strong, the big winner in this success looks to be FCA because the company should raise $4 billion in the spin-off, according to Bloomberg. With nine percent of the sports car maker on the NYSE and one percent for the underwriters, another 80 percent will be distributed to FCA investors in 2016. When that's through, Exor, the holding company for the Agnelli/Elkann family, should have the largest stake at about 30 percent. Piero Ferrari holds the remaining 10 percent and has no intention to sell it. Related Video: FCA Announces Pricing of Initial Public Offering of Ferrari N.V. Common Shares Fiat Chrysler Automobiles N.V. (NYSE: FCAU/MI: FCA) ("FCA") and its subsidiary Ferrari N.V. ("Ferrari") announce today the pricing of Ferrari's initial public offering of 17,175,000 common shares at an offering price of $52 per share for a total offering size of $893.1 million ($982.4 million if the underwriters exercise the option described below in full). The shares are expected to begin trading on the New York Stock Exchange on Wednesday, October 21, 2015, under the symbol "RACE", and closing of the offering is expected to occur on October 26, 2015. In addition, the underwriters have a 30-day option to purchase an aggregate of up to 1,717,150 common shares of Ferrari from FCA. The offering is intended to be part of a series of transactions to separate Ferrari from FCA. Following completion of this offering, FCA expects to distribute its remaining ownership interest in Ferrari to FCA shareholders at the beginning of 2016. UBS Investment Bank is acting as Global Coordinator for the offering.

Ferrari 458 Speciale is our Frankfurt fantasy [w/video]

Tue, 10 Sep 2013This is the Ferrari 458 Speciale, and while its name might underwhelm, its performance and lineage more than make up for it. The successor to the proud line of hot, higher-performance, mid-engined Ferraris like the 360 Challenge Stradale and 430 Scuderia, the 458 Speciale is blessed with a 596-horsepower, 4.5-liter V8 and the ability to skip to 62 miles per hour in three seconds. It also comes with a not-so-subtle racing stripe, which we like.

Thanks to a scarcely believable curb weight of 2,844 pounds, special Michelin Pilot Sport cup 2 tires, and a few tweaks to the electronic diff, the Speciale is quite a dancer as well. Naturally, Ferrari is showing off the newest member of the scuderia at Frankfurt, and we made it a priority to see it in person. We've got a full gallery of live images above, a video and stock photography from Ferrari down below, and our original coverage of the car, from August, right here.

Stellantis and LG launch joint venture for North American battery plant

Mon, Oct 18 2021Stellantis has struck a preliminary deal with battery maker LG Energy Solution (LGES) to produce battery cells and modules for North America, as the world's No. 4 automaker rolls out its 30 billion euro ($35 billion) electrification plan. Global automakers are investing billions of euros to accelerate a transition to low-emission mobility and prepare for a progressive phase-out of internal combustion engines. Stellantis and LGES's joint venture will produce battery cells and modules at a new facility with an annual capacity of 40 gigawatt hours (GWh), the two firms said on Monday. No financial details of the deal were provided. The plant is scheduled to start production by the first quarter of 2024, with groundbreaking expected in the second quarter of 2022, the companies said in their statement. Its location is under review and will be announced later. Stellantis, formed in January from the merger of Italian-American automaker Fiat Chrysler and France's PSA, has said it wants to secure more than 130 GWh of global battery capacity by 2025 and more than 260 GWh by 2030. The batteries produced under the deal will supply Stellantis' U.S., Canadian and Mexican assembly plants for installation in hybrid and fully electric vehicles, supporting its goal of e-vehicles making up more than 40% of its U.S. sales by 2030. The company, whose brands include Peugeot, Fiat, Opel and U.S. best-sellers Jeep and Ram, earlier this year announced it would invest more than 30 billion euros through 2025 on electrifying its vehicle lineup. Stellantis has said it would build three battery plants in Europe and two in North America, including at least one in the United States. Intesa Sanpaolo analyst Monica Bosio said the deal was positive, and a further step ahead in Stellantis' electrification process. It comes weeks after Stellantis and its partner TotalEnergies agreed to open up their battery cell joint venture ACC to Daimler, to expand their European sourcing of battery cells. Stellantis is also targeting more than 70% of sales in Europe to be of low-emission vehicles by 2030, and aims to make the total cost of owning an EV equal to that of a gasoline-powered model by 2026. Related video: Green Plants/Manufacturing Alfa Romeo Chrysler Dodge Ferrari Fiat Jeep Maserati RAM Citroen Lancia Opel Peugeot Vauxhall Electric Hybrid EV batteries LG