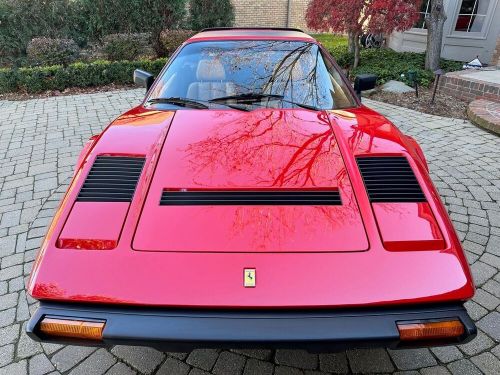

1982 308 Gtsi Targa on 2040-cars

Vehicle Title:Clear

Body Type:Sedan

Transmission:Automatic

VIN (Vehicle Identification Number): 00000000000000000

Mileage: 30012

Warranty: No

Model: 308

Fuel: Gasoline

Drivetrain: RWD

Sub Model: GTSI Targa

Trim: GTSI Targa

Doors: 2

Exterior Color: Burgundy

Interior Color: Other

Make: Ferrari

Ferrari 308 for Sale

1979 ferrari 308 gorgeous car built by mr norwood here locally(US $349,991.00)

1979 ferrari 308 gorgeous car built by mr norwood here locally(US $349,991.00) 1984 ferrari 308(US $133,700.00)

1984 ferrari 308(US $133,700.00) 1982 ferrari 308 gtsi targa(US $5,200.00)

1982 ferrari 308 gtsi targa(US $5,200.00) 1974 ferrari 308(US $76,500.00)

1974 ferrari 308(US $76,500.00) 1984 ferrari 308(US $84,500.00)

1984 ferrari 308(US $84,500.00) 1980 ferrari 308(US $67,500.00)

1980 ferrari 308(US $67,500.00)

Auto blog

Weekly Recap: Ferrari pens a provocative F1 car of the future

Sat, Feb 21 2015Scuderia Ferrari unveiled its vision of the future for Formula One this week, revealing sketches of a sleek, muscular racecar. Called the Concept F1, Ferrari is showcasing the design to start a conversation about the next generation of Formula One cars and spur interest in the sport, which has been maligned for its unattractive racecars in recent years. The Concept F1 was penned by the company's in-house studio, Centro Stile Ferrari, with input from its aerodynamics department. Though the sketches look futuristic, the company says the design could be executed without changing F1 regulations. From its beginning, Ferrari's racecars have had both form and function, winning on the track and turning heads with everything from the 250 Testa Rossa, 330 P3, Michael Schumacher's single-seaters from the early 2000s and many others. That lineage led the Scuderia's leaders to survey the paddock, wring their hands and come up with the Concept F1. As Ferrari said on its website: "Our challenge was to create something that was – to put it short – better looking." It's a philosophy that was implemented for this season's car, the SF15-T. While not groundbreaking in appearance, Ferrari cleaned up the design, particularly up front, and the racecar now has a more attractive nose that delivers better aerodynamics. It's more of the same in back, where a tighter design creates more downforce. "This year's car is certainly an awful lot better looking than last year's car," Ferrari technical director James Allison said in a video on the Scuderia's website. The updates come as Ferrari, and all F1 teams, get a better handle on the extensive 2014 rule changes that brought back turbocharged engines and altered the aerodynamic regulations for the series. Less dramatic changes also are going into effect this year. Ferrari, which is coming off a disappointing fourth-place finish in the World Championship, is obviously looking to the future. Appearances have always mattered for the red cars. We'll see if they bring the Scuderia success this season and beyond. Other News and Notes Next-generation Chrysler Town & Country spied Fiat Chrysler Automobiles is hard at work on the next-gen Town & Country minivan, and our spy shooters have captured heavily covered prototypes during testing on the road. We can't tell anything about the exterior design, though we see glimpses of an instrument panel (which looks vaguely Dodge Charger-esque) and infotainment screen inside.

2015 Chinese Grand Prix shines bright sun on the dark days of racing

Sun, Apr 12 2015Yes, we tuned into the Formula One Grand Prix in Shanghai China to see a race. But we all know we really tuned in to see if Ferrari, or any other team, could make it a competitive race with Mercedes-AMG Petronas. Based on qualifying, things didn't get off the best of starts: Lewis Hamilton made it four-out-of-four at the front, leading all three Free Practice sessions and then taking pole position in his Mercedes. Nico Rosberg is making the most of his time in the simulator, getting closer to Hamilton as the months go by. This time he lined up in second, just 0.042 in arrears. Ferrari did its best to temper expectations after Malaysia. Even though Sebastian Vettel qualified in third, almost a second behind Hamilton, the Scuderia's race pace is still considered a danger. Kimi Raikkonen's final hot lap went sour in Turn 3 and dropped the Finn to sixth place on the grid. In between the Ferraris, Williams is another team desperately working to maintain its advantage, and both of its drivers capitalized on Raikkonen's misfortune. Felipe Massa took fourth, Valtteri Bottas was in fifth. Daniel Ricciardo led the Infiniti Red Bull Racing charge in seventh, ahead of Romain Grosjean in the Lotus earning a spirits-lifting eighth. The two Saubers continue to show how good the Ferrari engine is, with Felipe Nasr taking ninth position and teammate Marcus Ericsson in tenth. Yet when the lights went out, so did the racing, for the most part. At the end of the first lap, because of some excellent moves by Raikkonen on both Williams' and a terrible start by Ricciardo that dropped him to seventeenth, the order was Hamilton, Rosberg, Vettel, Raikkonen, Massa, Bottas, Grosjean, Nasr, Ericsson, and Pastor Maldonado in the Lotus rounding out the top ten. At the end of the race, the only positions that had changed were the final two: Ricciardo had a laps-long battle with Ericsson, passing, getting repassed, then passing again to take ninth for good, with Ericsson finishing tenth. Maldonado suffered the worst in a battle with Jenson Button in the McLaren, when Button misjudged the entry into Turn 1 for a pass and clouted the back of the Lotus. Button was able to finish but Maldonado had to retire. Yes, there were some decent moments in between, like Bottas getting by Massa at the start, then Raikkonen getting past Massa in the first few corners and the Finn's move on Bottas also letting Massa through.

The Ferrari FF is now the GTC4 Lusso

Mon, Feb 8 2016As groundbreaking as it might have been when it debuted in 2011, the FF was never the best-looking Ferrari in the fleet. And at five years old, it's now the oldest as well. But Maranello is out to correct that with the new model you see here. Dubbed the GTC4 Lusso, the updated version of the FF is not only better-looking than the model it replaces, but packs some innovations under its slightly sharper coachwork as well. It debuts next month at the Geneva Motor Show. The 6.3-liter V12 carries over in naturally aspirated guise, but now produces 680 hp and 514 lb-ft. That's a marked improvement over the existing ratings of 651 horsepower and 504 pound-feet of torque. It still stops short of threatening the more focused F12 Berlinetta with its 730 hp and 509 lb-ft. The muscle still meets the road through the only all-wheel drive system that Ferrari has ever made, but now integrates four-wheel steering as well, like we saw on the F12 TdF. The 4RM-S system works in tandem with Slip Side Control 4.0, integrating the electronic differential and adaptive dampers to keep this horse prancing on no matter the conditions. No mention was made of the transmission, but we're likely dealing with the same seven-speed DCT as its predecessor. Regardless, the sum total is a 0-62 time quoted at 3.4 seconds and a top speed of 208 miles per hour. The revised mechanical bits, as you can see, are wrapped in new sheetmetal. It all looks tauter, more sculpted, and more aggressive than some of the rounded forms of the FF, and the interior has been updated as well. The key change is at the back of the greenhouse. Often derided as somewhat awkward and ungainly, the fastback roofline is lowered with the kink at the back of the side glass flipped, a spoiler added at the trailing edge of the roof, and the twin taillights replaced by four. THE FERRARI GTC4LUSSO DEBUTS AT THE GENEVA SHOW - The Ferrari GTC4Lusso debuts at the Geneva Show: class-leading performance, versatility in all driving conditions, sublime elegance. - A unique car, a whole new world Maranello, 8 February 2016 – Ferrari announces the addition to its range of the Ferrari GTC4Lusso, the new four-seater which hails a major evolution of the sporting Grand Tourer concept by integrating rear-wheel steering with four-wheel drive for the first time.