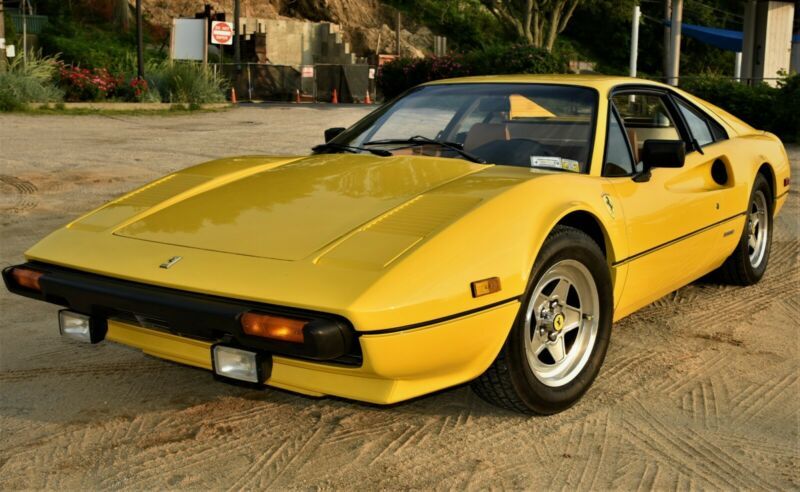

1981 Ferrari 308 Gtbi on 2040-cars

Malibu, California, United States

1981 Ferrari 308 GTBi. Excellent straight rare color closed-roof example. Starts, runs, drives, shifts and stops

great. Does not leak one drop of oil. Original books, tools and service records. Original colors. The car resided in California and passed emissions while there. Additional photos available.

Ferrari 308 for Sale

1979 ferrari 308 2 door(US $24,000.00)

1979 ferrari 308 2 door(US $24,000.00) 1981 ferrari 308 gtsi(US $23,360.00)

1981 ferrari 308 gtsi(US $23,360.00) 1985 ferrari 308 gtsi qv(US $20,800.00)

1985 ferrari 308 gtsi qv(US $20,800.00) 1985 ferrari 308 gtsi qv(US $20,800.00)

1985 ferrari 308 gtsi qv(US $20,800.00) 1975 ferrari 308(US $20,640.00)

1975 ferrari 308(US $20,640.00) 1981 ferrari 308 targa(US $21,490.00)

1981 ferrari 308 targa(US $21,490.00)

Auto Services in California

Yoshi Car Specialist Inc ★★★★★

WReX Performance - Subaru Service & Repair ★★★★★

Windshield Pros ★★★★★

Western Collision Works ★★★★★

West Coast Tint and Screens ★★★★★

West Coast Auto Glass ★★★★★

Auto blog

Ferrari profits rise 46 percent in 2018

Thu, Jan 31 2019MILAN — Italian luxury sports car maker Ferrari says profits last year rose 46 percent, driven by a surge in V12 sales and vehicle personalization. Ferrari on Thursday reported 2018 net profit of 787 million euros ($904 million), up from 537 million euros the previous year. Shipments rose 10 percent to 9,251 vehicles, while net revenues were flat at 3.4 billion euros. Ferrari set a forecast for 3-percent revenue growth to over 3.5 billion euros. It did not provide a shipment forecast. Sales of 12-cylinder models surged 20 percent, led by the 812 Superfast, while sales of 8-cylinder models rose 8 percent. Sales rose across the globe, with double-digit increases posted in Europe and greater China. The carmaker said fourth-quarter profits rose 40 percent to 191 million euros.Related Video:

Chris Harris does road and track work in the LaFerrari

Sun, Nov 30 2014Yes, we know, we just saw Chris Harris smoking it up around Anglesey Circuit in a Porsche 911 GT3 and a Ferrari 458 Speciale, and here he is again. But this is Harris in one of the (three!) era-defining supercars, and we simply can't miss that. Harris celebrates every aspect of the Ferrari LaFerrari but one - its name - praising it for "immediate" thrust, a "very pointy" front end, and the sound at 9,000 revs. Even if you watched without words, his face tells tales, sometimes intense, sometimes agog, and at least once, with mouth agape at 9:44, looking like he's doing something other than driving a car. His final verdict is that the LaFerrari "is in a class of two," but beats all. Take 15 minutes of your day to enjoy the video and discover the LaFerrari's only competitor, as well as "a little oversteer." In slow motion, naturally.

How to polish car paint | Autoblog Details

Fri, May 6 2016Here's how to quickly and properly polish your car's paint to increase the depth and shine of your clear coat with a dual action polisher. Watch all our Autoblog Details videos for more quick car care tips from professional detailer Larry Kosilla. Show full video transcript text [00:00:00] Polishing paint properly is not only a skill, but it's what I consider an art especially on this 1964 Ferrari GTE. And like any art form, it takes years of practice to perfect. Today we're gonna discuss how to quickly and safely polish or paint to increase the depth and shine of your clear coat with dual action polishers. Coming up on this episode of Details. My name is Larry Kosilla and I'm a professional detailer. Together with Autoblog, we're creating [00:00:30] the ultimate collection of quick car care videos. This is Autoblog Details. Here are the items you'll need for this task. If your car has clear coat, and in most cases, any car manufactured after the mid 1980s, or repainted like this one here, will come standard with clear coat, and you'll need to use a machine. Polishing clear coat by hand is not recommended due to the hardness of the paint. [00:01:00] Polishing paint is typically done for two main purposes. First is to remove any remaining swirls left over from a previous compounding step, or to simply increase the gloss of the paint that has no scratches that lacks a deep rich shine like this one here. First, attach a foam polishing pad to a machine. In this case, I'm using a Meguiars foam yellow pad on a Rupes LHR 21ES polisher. Spread your polish of choice around the pad, covering all pores evenly by massaging the product in [00:01:30] by hand and of course, wearing gloves. Make sure to add a bit more in some areas that remain uncoated. Now that the pad is primed, add three small dots of polish and place the pad directly on the paint prior to engaging the machine. Speed settings will vary by machine and the type of pad used but a setting of three to four is a good place to start. Take note on small orbit polishing machines if the polishing pad is not rotating, little to no polishing work is being done to the paint. Adjustments to speed, pressure, [00:02:00] and machine angle may be needed. Apply light to medium pressure to the machine so that the foam pad compresses slightly. Arm speed is moderate to slow. But keep in mind, the slower your arm speed, the more work is being done to the paint.