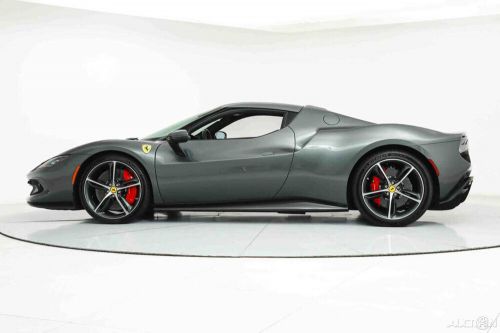

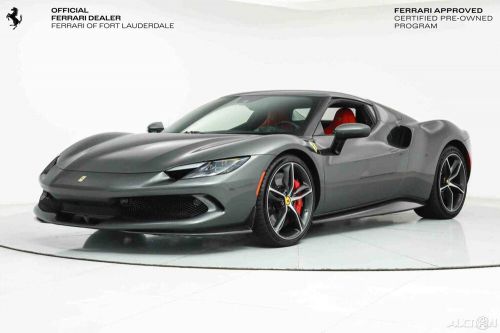

2022 Ferrari 296 Gtb on 2040-cars

Fort Lauderdale, Florida, United States

Engine:3.0L V6

For Sale By:Dealer

Transmission:Automatic

Vehicle Title:Clean

VIN (Vehicle Identification Number): ZFF99SLA8N0285066

Mileage: 2171

Drive Type: RWD

Exterior Color: Gray

Interior Color: Red

Make: Ferrari

Manufacturer Exterior Color: Gray

Manufacturer Interior Color: Red

Model: 296 GTB

Number of Cylinders: 6

Number of Doors: 2 Doors

Sub Model: 2dr Coupe

Warranty: Vehicle does NOT have an existing warranty

Ferrari 296 GTB for Sale

2024 ferrari 296 gtb(US $535,000.00)

2024 ferrari 296 gtb(US $535,000.00) 2023 ferrari 296 gtb(US $549,900.00)

2023 ferrari 296 gtb(US $549,900.00) 2022 ferrari 296 gtb(US $459,900.00)

2022 ferrari 296 gtb(US $459,900.00) 2022 ferrari 296 gtb .(US $459,990.00)

2022 ferrari 296 gtb .(US $459,990.00) 2023 ferrari 296 gtb(US $436,900.00)

2023 ferrari 296 gtb(US $436,900.00) 2023 ferrari 296 gtb(US $419,000.00)

2023 ferrari 296 gtb(US $419,000.00)

Auto Services in Florida

Your Personal Mechanic ★★★★★

Xotic Dream Cars ★★★★★

Wilke`s General Automotive ★★★★★

Whitehead`s Automotive And Radiator Repairs ★★★★★

US Auto Body Shop ★★★★★

United Imports ★★★★★

Auto blog

Race Recap: Abu Dhabi GP is reversals, luck, leanness and last dances

Mon, Nov 24 2014We weren't sure if Alter Ego Nico Rosberg, the one who flew into Brazil and showed Mercedes AMG Petronas teammate Lewis Hamilton that he knew also knew how to grab an entire race weekend by the scruff of the neck, arrived in Abu Dhabi. In both Friday practice sessions Hamilton showed Rosberg the way. Then on Saturday, Alter Ego Rosberg took over, taking the last Free Practice session and then pole position by a whopping four-tenths of a second over Hamilton. Thanks to the gimmicky and soon-to-be-obliterated spectre of double points, if Rosberg won the race and Hamilton finished lower than second, the World Championship would remain in German hands. Behind Hamilton came the Williams duo, again, with Valtteri Bottas ahead of Felipe Massa. Daniil Kvyat did swell to put his Toro Rosso in fifth, Jenson Button was just as swell getting his McLaren into sixth. Kimi Raikkonen outqualified his Ferrari teammate Fernando Alonso for the third time this year, the pair taking seventh and eighth on the grid. Kevin Magnussen lined the second McLaren up in ninth, Jean-Eric Vergne making the top ten for Toro Rosso in his last race for the team. To be clear, that was the final grid for race: Daniel Ricciardo and Sebastian Vettel had both qualified in the top ten but were sent to the back of the grid when their Infiniti Red Bull Racing front wings were deemed illegal. They'd start from the pit lane, which was still ahead of Romain Grosjean in the Lotus, who took so many penalties for new engine components that he started the race in Turkey. At lights-out on Sunday, well, it was pretty much lights out. That's when Hamilton got the start of the year, bolting off the line so quickly it didn't take him 100 meters to get in front of Rosberg. The Brit took Turn 1 in the lead, then laid more than a second into the German on the first lap. Rosberg kept close, about 2.5 seconds back, but it was Hamilton's race to lose and everyone knew it; barring a reliability issue or the kind of driving mistake Hamilton hasn't made all year, Britain would have its fourth double world champion. Rosberg was left asking his engineer what kind of strategy they might use to claim first place. That reliability issue did come, but it struck Rosberg on Lap 26 when his entire Energy Recovery System failed, robbing him of 160 horsepower and taxing his brakes.

Ferrari Lusso ownership will add some time to your morning commute

Fri, 19 Apr 2013If you've ever driven a vintage vehicle on a regular basis, you know the process from getting from point A to point B is a bit more convoluted than simply hopping in and going. There are rituals to observe, checklists to run through and processes to address before ever touching the ignition. Neglect any one of a number of small tasks and you're likely to find yourself on the side of the road. James Chen, the owner of Axis Wheels, knows all about that. You see, he owns a gorgeous Ferrari Lusso, and coaxing the V12 under the hood to life requires a certain amount of procedure.

Once it's rolling, of course, all that premeditation seems entirely worth the effort. Chen does his best to keep the machine out of traffic, but refuses to keep the coupe sealed away in a museum, so he gets up early and takes to the canyon roads around LA before anyone else is awake. Atta boy.

Check out the latest video from Petrolicious below.

Ferrari FXX K could get even more extreme Evoluzione version

Tue, Jan 6 2015Whenever a new Ferrari comes out – a mid-engined one especially – speculation begins to ramp up over how the boys in Maranello could make it even faster. When the 458 Italia was revealed, for example, focus immediately turned to what would become the 458 Speciale – just as the F430 begat the 430 Scuderia before it. Ditto LaFerrari, which was instantly projected to breed a new track variant, and that's exactly what we got with the debut of the FXX K in Abu Dhabi last month. And now that it's here, speculation is beginning to mount for an even more hardcore Evoluzione version. Look over the history of Ferrari's Corse Cliente version and you'll see the original Enzo-based FXX was followed by an FXX Evoluzione, and the subsequent 599XX bred a similarly enhanced 599XX Evoluzione. It would stand to reason, then, that an FXX K Evoluzione could be in the cards, but it won't come anytime soon. Speaking with Autocar, Ferrari test driver, former grand prix pilot and Le Mans winner Marc Gene said, "Right now, I think we cannot improve" on the FXX K, "but no doubt something will come up. I wouldn't be surprised if it happens, but it won't be in two years." Approximately three years separated the debut of the FXX and FXX Evo, but the 599XX was only out for a year or two before the 599XX Evoluzione came around. If and when a FXX K Evo does arrive, Gene figures it will focus more on weight reduction, efficiency and handling than on power. As it is, the FXX K already produces 1,035 horsepower, after all. Given the nature of the XX development program, however, owners of the FXX K can expect their track machine to get incrementally more advanced as the Prancing Horse marque uses the program to test new components.