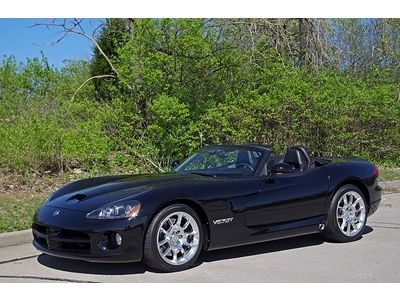

500 Horse 2003 Viper Srt-10 Polished Razor Wheels on 2040-cars

Saint Charles, Missouri, United States

Engine:8.3L 8275CC 505Cu. In. V10 GAS OHV Naturally Aspirated

For Sale By:Dealer

Body Type:Convertible

Fuel Type:GAS

Transmission:Manual

Warranty: Unspecified

Make: Dodge

Model: Viper

Options: CD Player

Trim: SRT-10 Convertible 2-Door

Power Options: Power Locks

Drive Type: RWD

Number of Doors: 2 Generic Unit (Plural)

Mileage: 11,647

Sub Model: 2dr SRT-10 C

Number of Cylinders: 10

Exterior Color: Other

Dodge Viper for Sale

1997 dodge viper gts - blue/white stripes(US $34,900.00)

1997 dodge viper gts - blue/white stripes(US $34,900.00) 2004 dodge viper srt-10 2dr convertible

2004 dodge viper srt-10 2dr convertible Only 1200 miles!!! ultra-rare color, 600 hp, absolutely stunning, v10 6 speed(US $74,882.00)

Only 1200 miles!!! ultra-rare color, 600 hp, absolutely stunning, v10 6 speed(US $74,882.00) 2008 dodge viper srt-10 coupe! navigation! belanger upgrades! stripes! 3k mi!(US $69,900.00)

2008 dodge viper srt-10 coupe! navigation! belanger upgrades! stripes! 3k mi!(US $69,900.00) 2006 dodge viper srt-10 coupe 2-door 8.3l(US $38,500.00)

2006 dodge viper srt-10 coupe 2-door 8.3l(US $38,500.00) Rt/10 viper v10 fast low miles showroom 1-owner garage kept like new

Rt/10 viper v10 fast low miles showroom 1-owner garage kept like new

Auto Services in Missouri

Wrench Tech ★★★★★

Valvoline Instant Oil Change ★★★★★

Tint Crafters Central ★★★★★

Riteway Foreign Car Repair ★★★★★

Pevely Plaza Auto Parts Inc ★★★★★

Performance By Joe ★★★★★

Auto blog

Stellantis wants to outfit cars with AI software to drive revenue

Tue, Dec 7 2021MILAN — Carmaker Stellantis announced a strategy Tuesday to embed AI-enabled software in 34 million vehicles across its 14 brands, hoping the tech upgrade will help it bring in 20 billion euros ($22.6 billion) in annual revenue by 2030. CEO Carlos Tavares heralded the move as part of a strategy that would transform the car company into a “sustainable mobility tech company,” with business growth coming from features and services tied to the internet. That includes using voice commands to activate navigation, make payments and order products online. The company is expanding existing partnerships with BMW on partially automated driving, iPhone manufacturer Foxconn on customized cockpits and Waymo to push their autonomous driving work into light commercial vehicle delivery fleets. StellantisÂ’ embrace of artificial intelligence and expansion of software-enabled vehicles is part of a broad transformation in the auto industry, with a race toward more fully electric and hybrid propulsion systems, more autonomous driving features and increased connectivity in automobiles. Ford and General Motors also are banking on dramatically increased revenue from similar online subscription services. But the automakers face immense competition for monthly consumer spending from movie and music streaming services, news outlets, Amazon Prime and others. Stellantis, which was formed from the combination of PSA Peugeot and FCA Fiat Chrysler, said the software would seamlessly integrate into customers' lives, with the capability of live updates providing upgraded services over time. New products will include the possibility to subscribe to automated driving features, purchase usage-based car insurance or even increase the power of the vehicle with a tune-up to add horsepower. As a baseline, Stellantis generates 400 million euros in revenue on software-generated services installed in 12 million vehicles. To meet the targets, Stellantis will expand its software engineering team of 1,000 to 4,500 in North America, Asia and Europe. More than 1,000 of the expanded team will be retrained in house. Stellantis also announced a new partnership with Foxconn to develop semiconductors to cover 80% of the companyÂ’s needs and simplify the supply chain. The first microchips from the partnership are targeted to be installed in vehicles in 2024.

Buyer says Dodge dealer gave him wrong Charger, failed to notice for 2 months

Wed, Dec 31 2014Mistakes happen, and they happen all the time. But when that mistake means a customer doesn't get what he or she paid for, something's gotta give. That's what one Dodge Charger buyer claims he is trying to sort out with his local dealership. Two months after taking delivery, the owner (going by the user name Dakrbouncer4689 on Reddit) says he got a call from his local Dodge dealership reporting a little problem. He had ordered and paid for the Charger SXT (pictured above on the dealer lot), but was given a Charger SE instead. The SE being the lower trim level, this presented one set of problems – namely a $2,000 discrepancy in equipment, like a five-speed automatic versus an eight-speed, a 4.3-inch infotainment display instead of 8.4, heated seats, leather steering wheel, premium audio, remote starter and so on. The second set of issues is that the VIN number on the paperwork (including the registration and insurance papers) of course doesn't match that of the car itself. The dealer, having obviously made a rather large mistake, apparently called the owner in to sort out the mess, but according to the customer's account, things didn't go as smoothly. Instead of immediately working to address the problem, the salesman kept the owner waiting, acted like it was no big deal, and offered only to swap the cars with no compensation for the trouble. Fortunately, the manager proved more sympathetic and apologetic, and offered the customer three options: he could swap the cars (re-doing the tinted windows on the SXT that the customer had done on the SE and throwing in leather seats for free), he could keep the SE (with the dealership handling the paperwork, throwing in the leather seats, adjusting the price and refunding an extra $400), or they could cancel everything, return the car and part company. As we go to press, the Charger owner had yet to make (or at least share) his decision. But while the principle of caveat emptor makes us wonder how he managed to take home a different car from the one he paid for, clearly the salesman and the dealership made a pretty large mistake by presenting him with the wrong set of keys and letting him off the lot without double checking it all. News Source: Darkbouncer4689 via Reddit, World Car Fans Dodge Car Buying Car Dealers Economy Cars Sedan

China's Great Wall confirms its interest — in Jeep, or all of FCA

Tue, Aug 22 2017HONG KONG/SHANGHAI — Chinese automaker Great Wall Motor reiterated its interest in Fiat Chrysler Automobiles NV on Tuesday, but said it had not held talks or signed a deal with executives at the Italian-American automaker. China's largest sport utility vehicle manufacturer made a direct overture to Fiat Chrysler on Monday, with an official saying the company was interested in all or part of FCA, owner of the Jeep and Ram truck brands. Automotive News first reported the news, quoting Great Wall Motor President Wang Fengying as saying she planned to contact FCA to discuss acquiring the Jeep brand specifically. Those comments sent FCA shares higher but also raised questions over the ability of China's seventh-largest automaker by sales to buy larger Western rival FCA, or even Jeep, which some analysts value at as much as one-and-a-half times FCA. Great Wall sought to dampen speculation on Tuesday. It confirmed it had studied Fiat Chrysler, but said there was "no concrete progress so far" and "substantial uncertainty" over whether it would eventually bid. "The company has not built any relationship with the directors of FCA nor has the company entered into any discussion or signed any agreements with any officer of FCA so far," the company said in an English-language stock exchange filing. It did not give further detail. Fiat Chrysler stock dipped on the statement on Tuesday. Great Wall said trading in its Shanghai-listed shares would resume on Wednesday after having been suspended. Fiat Chrysler declined to comment on Great Wall's statement. On Monday, it said it had not been approached and was fully committed to implementing its current business plan. FLUSHING OUT RIVALS? Great Wall Motor, which was early to spot China's love of SUVs, had revenue of $14.8 billion last year and sold 1.07 million vehicles - but that compares with FCA's 2016 revenue of 111 billion euros ($130.6 billion). Analysts said Great Wall would need to raise both debt and equity to complete any deal, meaning its chairman Wei Jianjun could lose majority control. One possible scenario, according to analysts at Jefferies, would see Wei keeping a roughly 30 percent stake, while Great Wall would raise $10-$14 billion in debt and $10 billion in equity - hefty for a group currently worth just $16 billion. Ultimately, politics could be the clincher.