2014 Dodge Journey Se on 2040-cars

2385 US-501, Conway, South Carolina, United States

Engine:2.4L I4 16V MPFI DOHC

Transmission:4-Speed Automatic

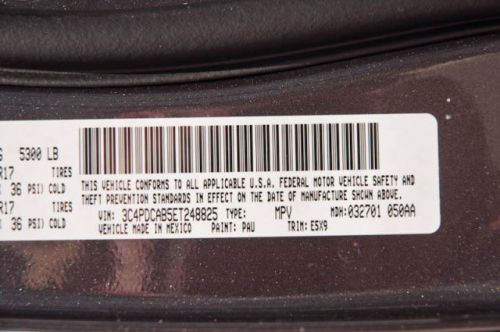

VIN (Vehicle Identification Number): 3C4PDCAB5ET248825

Stock Num: 5293

Make: Dodge

Model: Journey SE

Year: 2014

Exterior Color: Granite Crystal

Interior Color: Black

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 11

Take command of the road in the 2014 Dodge Journey! This SUV is purpose-built for the most treacherous terrain! Top features include remote keyless entry, adjustable headrests in all seating positions, front dual-zone air conditioning, and more. Under the hood you'll find a 4 cylinder engine with more than 170 horsepower, and for added security, dynamic Stability Control supplements the drivetrain. Our knowledgeable sales staff is available to answer any questions that you might have. They'll work with you to find the right vehicle at a price you can afford. We are here to help you.

Dodge Journey for Sale

2014 dodge journey se(US $22,490.00)

2014 dodge journey se(US $22,490.00) 2014 dodge journey se(US $22,885.00)

2014 dodge journey se(US $22,885.00) 2013 dodge journey sxt(US $22,995.00)

2013 dodge journey sxt(US $22,995.00) 2014 dodge journey se(US $25,080.00)

2014 dodge journey se(US $25,080.00) 2014 dodge journey sxt(US $29,280.00)

2014 dodge journey sxt(US $29,280.00) 2014 dodge journey se(US $20,990.00)

2014 dodge journey se(US $20,990.00)

Auto Services in South Carolina

Village Motors Inc ★★★★★

Shell Rapid Lube & Service Center ★★★★★

Santee Lake Service Center Inc ★★★★★

S & S Tire Inc ★★★★★

Richbourg`s Auto Electric Service ★★★★★

Randy`s Automotive ★★★★★

Auto blog

Stellantis wants to outfit cars with AI software to drive revenue

Tue, Dec 7 2021MILAN — Carmaker Stellantis announced a strategy Tuesday to embed AI-enabled software in 34 million vehicles across its 14 brands, hoping the tech upgrade will help it bring in 20 billion euros ($22.6 billion) in annual revenue by 2030. CEO Carlos Tavares heralded the move as part of a strategy that would transform the car company into a “sustainable mobility tech company,” with business growth coming from features and services tied to the internet. That includes using voice commands to activate navigation, make payments and order products online. The company is expanding existing partnerships with BMW on partially automated driving, iPhone manufacturer Foxconn on customized cockpits and Waymo to push their autonomous driving work into light commercial vehicle delivery fleets. StellantisÂ’ embrace of artificial intelligence and expansion of software-enabled vehicles is part of a broad transformation in the auto industry, with a race toward more fully electric and hybrid propulsion systems, more autonomous driving features and increased connectivity in automobiles. Ford and General Motors also are banking on dramatically increased revenue from similar online subscription services. But the automakers face immense competition for monthly consumer spending from movie and music streaming services, news outlets, Amazon Prime and others. Stellantis, which was formed from the combination of PSA Peugeot and FCA Fiat Chrysler, said the software would seamlessly integrate into customers' lives, with the capability of live updates providing upgraded services over time. New products will include the possibility to subscribe to automated driving features, purchase usage-based car insurance or even increase the power of the vehicle with a tune-up to add horsepower. As a baseline, Stellantis generates 400 million euros in revenue on software-generated services installed in 12 million vehicles. To meet the targets, Stellantis will expand its software engineering team of 1,000 to 4,500 in North America, Asia and Europe. More than 1,000 of the expanded team will be retrained in house. Stellantis also announced a new partnership with Foxconn to develop semiconductors to cover 80% of the companyÂ’s needs and simplify the supply chain. The first microchips from the partnership are targeted to be installed in vehicles in 2024.

Legacy Classic Power Wagon First Drive

Wed, Oct 7 2015Shortly before the US entered World War II, Dodge supplied the military with a line of pickups internally codenamed WC, those letters designating the year 1941 and the half-ton payload rating. From 1941 to 1945 Dodge built more than a quarter million of them, and even though "WC" came to refer to the Weapons Carrier body style, the WC range served in 38 different configurations from pickup trucks to ambulances to six-wheeled personnel and weapons haulers. The story is that soldiers returning from active duty badgered Dodge for a civilian version of that indefatigable warhorse, so Dodge responded with the Power Wagon in 1946. Even for those no-nonsense times the truck was so austere that the first three names Dodge gave it were "Farm Utility Truck," "WDX General Purpose Truck," and "General Purpose, One Ton Truck." "Power Wagon" was the fourth choice, not finalized until just before it went on sale. Nothing like today's Power Wagon, the original could be seen as either a glorified tractor or a slightly less uncouth military vehicle – hell-for-leather meant going 50 miles per hour. But it would go nearly anywhere. The civilian version was still built like it had to survive, well, a world war; power take-offs (PTOs) ran all manner of ancillaries; multiplicative gear ratios helped it produce enough torque to make an earthquake envious. Said to be the first civilian 4x4 truck made in America, any organization that needed a simple, sturdy mechanized draught animal knew it needed a Power Wagon. If history, the aura of war, and ruthless functionality attract you but mean comforts and 70-year-old manners don't, then you need to get in touch with Legacy Classic Trucks. If that history, the aura of war, and the ruthless functionality attract you but the mean comforts and 70-year-old manners don't, then you need to get in touch with Legacy Classic Trucks. The Jackson Hole, WY, restorer retains every ounce of the Power Wagon's orchard-work aptitude, decorated with present-day amenities and the best components. Each job starts with having to find a usable donor. The city of Breckenridge, CO, bought the red truck in our gallery in 1947 and used it as a snowplow for the next 30 years. In 1977 a log-home builder bought it from the city and used it for another decade as a company hauler. That's the kind of grueling longevity that lets Ram put a five-figure premium on the 2500 Power Wagon pickup it sells today. Legacy Classics founder Winslow S.

NHTSA, IIHS, and 20 automakers to make auto braking standard by 2022

Thu, Mar 17 2016The National Highway Traffic Safety Administration, the Insurance Institute for Highway Safety and virtually every automaker in the US domestic market have announced a pact to make automatic emergency braking standard by 2022. Here's the full rundown of companies involved: BMW, Fiat Chrysler Automobiles, Ford, General Motors, Honda, Hyundai, Jaguar Land Rover, Kia, Mazda, Mercedes-Benz, Mitsubishi, Nissan, Subaru, Tesla, Toyota, Volkswagen, and Volvo (not to mention the brands that fall under each automaker's respective umbrella). Like we reported yesterday, AEB will be as ubiquitous in the future as traction and stability control are today. But the thing to note here is that this is not a governmental mandate. It's truly an agreement between automakers and the government, a fact that NHTSA claims will lead to widespread adoption three years sooner than a formal rule. That fact in itself should prevent up to 28,000 crashes and 12,000 injuries. The agreement will come into effect in two waves. For the majority of vehicles on the road – those with gross vehicle weights below 8,500 pounds – AEB will need to be standard equipment by September 1, 2022. Vehicles between 8,501 and 10,000 pounds will have an extra three years to offer AEB. "It's an exciting time for vehicle safety. By proactively making emergency braking systems standard equipment on their vehicles, these 20 automakers will help prevent thousands of crashes and save lives," said Secretary of Transportation Anthony Foxx said in an official statement. "It's a win for safety and a win for consumers." Read on for the official press release from NHTSA. Related Video: U.S. DOT and IIHS announce historic commitment of 20 automakers to make automatic emergency braking standard on new vehicles McLEAN, Va. – The U.S. Department of Transportation's National Highway Traffic Safety Administration and the Insurance Institute for Highway Safety announced today a historic commitment by 20 automakers representing more than 99 percent of the U.S. auto market to make automatic emergency braking a standard feature on virtually all new cars no later than NHTSA's 2022 reporting year, which begins Sept 1, 2022. Automakers making the commitment are Audi, BMW, FCA US LLC, Ford, General Motors, Honda, Hyundai, Jaguar Land Rover, Kia, Maserati, Mazda, Mercedes-Benz, Mitsubishi Motors, Nissan, Porsche, Subaru, Tesla Motors Inc., Toyota, Volkswagen and Volvo Car USA.