***city Surplus*** 2005 Dodge Dakota Ext-cab ***no Reserve*** on 2040-cars

Hot Springs National Park, Arkansas, United States

Body Type:Pickup Truck

Vehicle Title:Clear

Engine:3.7L 226Cu. In. V6 GAS SOHC Naturally Aspirated

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Dodge

Model: Dakota

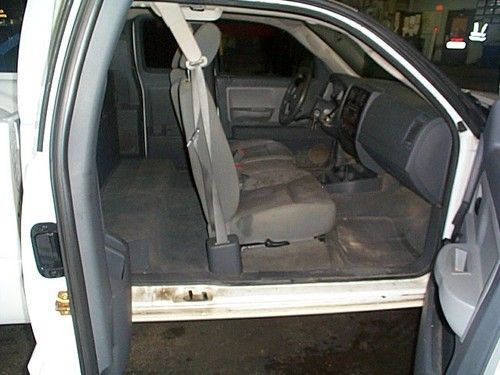

Trim: ST Extended Cab Pickup 4-Door

Options: CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Drive Type: 2WD

Power Options: Air Conditioning

Mileage: 203,111

Exterior Color: White

Interior Color: Gray

Disability Equipped: No

Number of Cylinders: 6

Warranty: Vehicle does NOT have an existing warranty

Dodge Dakota for Sale

2003 dodge dakota r/t-preformance & exterior modifications(US $6,500.00)

2003 dodge dakota r/t-preformance & exterior modifications(US $6,500.00) 2000 custom painted dodge dakota

2000 custom painted dodge dakota 2004 dodge dakota food delivery truck refrigeration and oven unit(US $6,500.00)

2004 dodge dakota food delivery truck refrigeration and oven unit(US $6,500.00) 2000 dodge dakota slt crew cab pickup 4-door 4.7l

2000 dodge dakota slt crew cab pickup 4-door 4.7l 1996 dodge dakota slt extended cab pickup 2-door 3.9l

1996 dodge dakota slt extended cab pickup 2-door 3.9l Dodge dakota slt 4dr quad cab

Dodge dakota slt 4dr quad cab

Auto Services in Arkansas

Young Tire & Auto ★★★★★

Walker Engine Service ★★★★★

Turner`s Muffler Oil & Lube ★★★★★

Snappy Windshield Repair ★★★★★

Ralph`s Glass Shop ★★★★★

Posey`s Service Center ★★★★★

Auto blog

Diesel Power finds the ultimate modified oil-burner

Sat, 24 Aug 2013For nine years, Diesel Power magazine has run the Diesel Power Challenge, this year's grindfest being "a week-long torture test that features seven events, nine trucks, 8,000 horsepower, and nearly 15,000 pound-feet of torque." The road to being crowned "the most powerful truck" starts with a dyno run, and then continues through the completion of a CDL-style obstacle course, an eighth-of-a-mile drag race while towing a 10,000-pound trailer, a quarter-mile drag race without a trailer, a fuel economy test in the mountains and finally a sled-pulling test through a 300-foot-long packed-mud pit.

What kind of trucks get into such a fight? Last year's winner, for instance - who upgraded his truck this year to prove he didn't "luck into the win" - drives a 2008 Ford F-250 Super Duty with a 6.4-liter Power Stroke V8 upgraded with a custom intake, Elite Diesel triple turbos and a two-stage nitrous system. Another competitor has a 2005 Dodge Ram 2500 powered by a 5.9-liter Cummins inline-six, upgraded with Garrett turbos, dual-stage nitrous, a seven-inch exhaust stack and twin fans built into the bed to cool the Sun Coast Omega transmission. The numbers on that truck: 1,255 horsepower, and 2,063 pound-feet of torque at the wheels. Naturally, as the image above might suggest, things don't always end well.

You'll find all five videos covering this years challenge below. A scene in the dyno video sums it all up perfectly: a competitor leaves his nitrous on too long and the crew is treated to some ominous poppings, he leans out the window, throws both hands up and shouts, "Amer'ca!"

Junkyard Gem: 1988 Dodge Diplomat Salon

Sun, Jan 29 2017Except for the Viper, Prowler, and some Mitsubishi-derived AWD machines, all Chrysler cars went front-wheel-drive starting in the 1990 model year and continued that way until our current century. The last holdout was the Dodge Diplomat (and its Plymouth Gran Fury and Chrysler Fifth Avenue siblings), and these cars were the most common police cruisers in America throughout most of the 1980s and well into the 1990s. You won't see many Diplomats today, but I found this high-luxe civilian Salon version in my local Denver self-service yard. This one was purchased new in Cheyenne, which is just up I-25 from Denver. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. A Diplomat was one of the automotive protagonists in the classic car-chase scene from the 1990 film, Short Time. Diplomats have figured heavily in many films over the years. I got my first driver's license in 1982, in a Navy town with ruthless Diplomat-equipped traffic-law enforcement, and so my right foot still twitches in the direction of a brake pedal when I see this grille. This one was full of Denver-centric ephemera from the early-to-middle 1990s, layered with the shredded paper and rodent poop that indicates long-term outdoor storage, so I'm guessing that the car's elderly owner stopped driving it 20 years ago and it sat until finally evicted by an angry landlord. These cars weren't known for being particularly quick in stock form. This one has the carbureted 318-cubic-inch V8 (yes, some cars still had carburetors as late as 1988), good for 140 horsepower. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Fiendishly seductive! Related Video:

Mopar '13 Dart is a bruiser of a compact

Fri, 08 Feb 2013For the fourth year in a row, Mopar is offering a limited-production car decked with a plenty of add-ons and a unique look. This year's black-and-blue car is the Mopar '13 Dart, which was unveiled at the Chicago Auto Show with the now-signature paint scheme. Like previous Mopar models, only 500 of the '13 Darts will be built. Past models include the Mopar '10 Challenger, Mopar '11 Charger and the Mopar '12 300.

The all-black Dart gets a brightly contrasting, offset blue stripe running the full length of the car, and other styling mods like the aero-tuned body kit, gloss black grille, wheels and mirror caps. Curiously, Mopar chose to stick with the Dart's standard headlights rather than the darker, smoked lights. The interior gets a similar black-and-blue treatment, but this unique cabin features a blue leather driver's seat to go along with the black leather seating for the rest of the passengers.

More than just a styling package, the Mopar '13 Dart also gets some performance and handling goodies to complement the Dart's turbocharged 1.4-liter engine, such as upgraded brakes with slotted rotors, a lowered suspension, retuned electric power steering and a "sport-tuned" exhaust system.