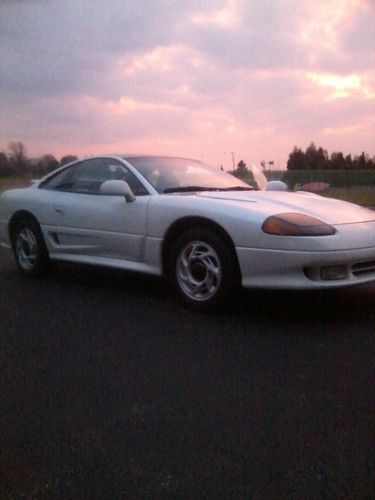

1993 Dodge Stealth Es Hatchback 2-door 3.0l on 2040-cars

Downers Grove, Illinois, United States

Body Type:Hatchback

Vehicle Title:Clear

Engine:3.0L 2972CC 181Cu. In. V6 GAS DOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Private Seller

Model: Stealth

Trim: ES Hatchback 2-Door

Options: 4-Wheel Drive, Leather Seats, CD Player

Drive Type: FWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 105,561

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Exterior Color: Black

Interior Color: Black

Number of Cylinders: 6

Warranty: Vehicle does NOT have an existing warranty

The car is in great shape for the year, there are A few very minor scratchs (not noticable) For A 20 year old sweet car its really in good shape and drives really good to. Its fast and ready to drive home today.

Dodge Stealth for Sale

We finance 93 stealth r/t 5 speed leather seats low miles sunroof aux input v6(US $7,000.00)

We finance 93 stealth r/t 5 speed leather seats low miles sunroof aux input v6(US $7,000.00) 1992 dodge stealth rt/tt twin turbo vr4(US $3,900.00)

1992 dodge stealth rt/tt twin turbo vr4(US $3,900.00) 1995 dodge stealth hatchback 5-speed one owner 39k original miles!!(US $6,995.00)

1995 dodge stealth hatchback 5-speed one owner 39k original miles!!(US $6,995.00) 1994 dodge stealth r/t hatchback 2-door 3.0l(US $3,100.00)

1994 dodge stealth r/t hatchback 2-door 3.0l(US $3,100.00) Dodge stealth twin turbo r/t,rare very fast! classic(US $9,500.00)

Dodge stealth twin turbo r/t,rare very fast! classic(US $9,500.00) '91' dodge stealth/ twin turbo; pearl white - one owner

'91' dodge stealth/ twin turbo; pearl white - one owner

Auto Services in Illinois

Wolf and Cermak Auto ★★★★★

Wheels Of Chicagoland ★★★★★

Urban Tanks Custom Vehicle Out ★★★★★

Towing Solutions ★★★★★

Top Coverage Ltd ★★★★★

Supreme Automotive & Trans ★★★★★

Auto blog

Dodge Journey gets new $24,895* SE V6 AWD model

Wed, 12 Mar 2014While the Dodge Journey crossover remains largely unchanged for the 2014 model year, there are two new flavors of the seven-passenger CUV on offer: the butch-looking Crossroad, and the SE V6 AWD, pictured right, which makes its debut today. As its name suggests, this new Journey model features the automaker's 3.6-liter Pentastar V6, and offers all-wheel drive, which, with a starting price of $24,895 (*excluding $995 for destination), reduces the cost-of-entry for an AWD-equipped Journey by $1,800 versus the SXT AWD model. Scroll down for the official press blast.

Stellantis is official: FCA and PSA merger finally sealed

Sat, Jan 16 2021MILAN — Fiat Chrysler and PSA sealed their long-awaited merger on Saturday to create Stellantis, the world's fourth-largest auto group with deep enough pockets to fund the shift to electric driving and take on bigger rivals Toyota and Volkswagen. It took over a year for the Italian-American and French automakers to finalize the $52 billion deal, during which the global economy was upended by the COVID-19 pandemic. They first announced plans to merge in October 2019, to create a group with annual sales of around 8.1 million vehicles. "The merger between Peugeot S.A. and Fiat Chrysler Automobiles N.V. that will lead the path to the creation of Stellantis N.V. became effective today," the two automakers said in a statement. Shares in Stellantis, which will be headed by current PSA Chief Executive Carlos Tavares, will start trading in Milan and Paris on Monday, and in New York on Tuesday. Now analysts and investors are turning their focus to how Tavares plans to address the huge challenges facing the group – from excess production capacity to a woeful performance in China. Tavares will hold his first press conference as Stellantis CEO on Tuesday, after ringing NYSE's bell with Chairman John Elkann. FCA and PSA have said Stellantis can cut annual costs by over 5 billion euros ($6.1 billion) without plant closures, and investors will be keen for more details on how it will do this. Marco Santino, a partner at consultants Oliver Wyman, said he expected Tavares to disclose the outlines of his action plan soon, but without divulging too many details at first. "He has proven to be the kind of person who prefers action to words, so I don't think he will make loud statements or try to over-sell targets," he said. Like all global automakers, Stellantis needs to invest billions in the years ahead to transform its vehicle range for the electric era. But other pressing tasks loom, including reviving the group's lagging fortunes in China, rationalizing its huge global empire and addressing massive overcapacity. "It will be a step by step process, also to allow the market to better appreciate every single move. I don't think we will have all the details before one year," Santino said.

FCA and Peugeot reportedly agree on merger

Wed, Oct 30 2019Citing a Wall Street Journal report, the Detroit Free Press says "Fiat Chrysler and PSA Groupe have agreed to merge." The Journal reported on talks between the two car companies only yesterday. It's said that Peugeot's board met yesterday to approve the deal, FCA's board met today, and an announcement could come as soon as tomorrow, Thursday. Both automakers have released statements, but neither company has released any information beyond admitting to ongoing talks. If the merger happens, the combined entity would become the world's fourth-largest carmaker with a $50 billion valuation, slotting in behind Toyota, the Volkswagen Group, and the Renault Nissan Mitsubishi alliance. Among the merger options possible, "an all-stock merger of equals" is the one analysts and Moody's seem to give the best grade. The reported merger would come about four months after FCA walked away from merger talks with Renault. FCA said the French government scuppered those talks over the role of Nissan in a reformed entity, but there were also brewing issues with French unions, and ongoing turmoil among Renault and Nissan leadership thanks to continuing fallout from ex-CEO Carlos Ghosn's arrest last year. FCA makes most of its revenue in the U.S. and rules Italy, while Peugeot is the second-best-selling automaker in Europe with its own brand in France and Opel in Germany. The two companies already have a partnership in Europe making vans, one that FCA CEO Mike Manley has spoken highly of. Among the list of obvious benefits in a potential merger, FCA would get access to Peugeot's small, modern platforms, $10.2 billion in cash, and electrified and hybrid architecture developments, the latter especially important to FCA as those are fields where it lags. Peugeot would get much easier access to the U.S. market, and the money-printing brands Jeep and Ram. A merged carmaker would have combined sales of nearly 9 million a year, based on 2018 results. By comparison, both Volkswagen and Toyota sell over 10 million cars a year, while the Renault-Nissan-Mitsubishi alliance almost 11 million. Peugeot CEO Carlos Tavares has proved he knows how to do turnarounds and mergers. After leaving a position as Carlos Ghosn's right-hand man in 2012, Tavares took over Peugeot in 2014, navigated a bailout from the French government and China's Dongfeng Motors in 2015, and turned PSA into a regional powerhouse.