Ram 4500 Diesel Slt Hyperteh Chip Aisin Hiab Highlift Crane Cm Bed Palfinger on 2040-cars

East Liverpool, Ohio, United States

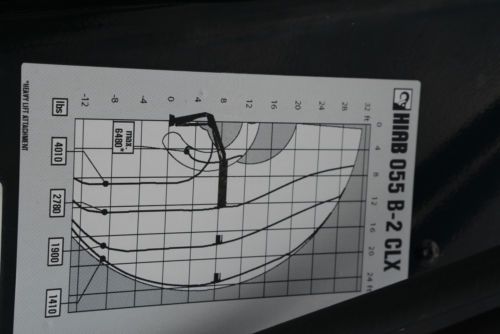

2011 Ram 4500 SLT6.7L Engine, Automatic Transmission, Dually Chassis, Crew Cab, 197 inch Wheel Base, 84 inch cab to axle, Cloth Upholstery, Power Windows, Power Mirrors, Power Locks, A/C, Cruise Control, Tilt Wheel, CD/MP3 Player, AUX Input, Trailer Brake, Rear Defrost, Tow Package. This truck has a Hyperteh XRT PRO with Cat and Urea Deleted. It really runs great! It is set up with a CM 10 foot Steel Bed Truck was used to Set Headstones for a Monument Company. Also has a 2006 HIAB 055 Boom Crane With LOW Hours Extends over 29 feet Lifting capacity 6000 lbs max |

Dodge Ram 4500 for Sale

2011 dodge ram 4500 diesel crew cab 4x4 auto truck with hauler bed(US $39,000.00)

2011 dodge ram 4500 diesel crew cab 4x4 auto truck with hauler bed(US $39,000.00) 2013 dodge ram 4500 reg cab/chassis diesel drw 4x4 37k texas direct auto(US $33,780.00)

2013 dodge ram 4500 reg cab/chassis diesel drw 4x4 37k texas direct auto(US $33,780.00) 2011 dodge ram 4500 drw diesel 4x4 6-speed flat bed hauler crew 1 texas owner(US $40,585.00)

2011 dodge ram 4500 drw diesel 4x4 6-speed flat bed hauler crew 1 texas owner(US $40,585.00) 2009 dodge ram 4500 4x4

2009 dodge ram 4500 4x4 2008 dodge ram 4500-5500 - 2008 sterling bullet cummins 6.7- car hauler hot shot(US $10,900.00)

2008 dodge ram 4500-5500 - 2008 sterling bullet cummins 6.7- car hauler hot shot(US $10,900.00) 2011 dodge ram 4500 4x4 heavy duty utility body crew cab diesel 131k(US $32,000.00)

2011 dodge ram 4500 4x4 heavy duty utility body crew cab diesel 131k(US $32,000.00)

Auto Services in Ohio

Xenia Radiator & Auto Service ★★★★★

West Main Auto Repair ★★★★★

Top Knotch Automotive ★★★★★

Tom Hatem Automotive ★★★★★

Stanford Allen Chevrolet Cadillac ★★★★★

Soft Touch Car Wash Systems ★★★★★

Auto blog

Consumer Reports says these are the worst new cars of 2014

Thu, 27 Feb 2014Consumer Reports has announced its annual list of worst vehicles, a cringe-inducing contrast to its list of top vehicles. Ignominiously leading the way in 2014 is Chrysler, which has a staggering seven models listed.

Jeep nearly sweeps the small SUV segment by itself, with its Compass, Patriot and 2.4-liter version of the new Cherokee, while the only midsize sedans listed by CR were the Chrysler 200 and Dodge Avenger. The new Dodge Dart and the Dodge Journey round out CR's condemnation of Chrysler.

Ford is taking heat as well, with the Taurus, Edge and their counterparts from Lincoln all listed as the worst vehicles in their respective segments. Toyota doesn't fare much better, with its Lexus IS, Scion iQ and tC also making the list.

2015 Dodge Challenger SRT Hellcat revving is sonic bacon

Fri, 23 May 2014This is the Dodge Challenger SRT Hellcat, and we're sure that by now, you know its stats, including over 600 horsepower from its 6.2-liter, supercharged V8. What, pray tell, does that blown engine sound like, though?

At least judging on the sonic strength of this video, it's very, very dirty. Honestly, it sounds unlike anything that's come out of the Chrysler Group in a long time, if ever. It's loud, almost brutally so, with a bark that few road-going V8s can match.

Of course, you should be the final judge here. Take a look and a listen at the two videos below, one of which comes from our friends at Cars.com that provides a nice look under the hood, and then let us know what you think of the Hellcat's singing voice in Comments.

Dodge Hellcat orders on hold due to 'unprecedented demand'

Sun, Mar 15 2015Want to get your hands on a 707-horsepower Dodge Challenger or Charger Hellcat to call your very own? We don't blame you, and you're not alone. According to Motor Authority and confirmed by a spokesperson from Chrysler, Dodge has gotten so many orders for its stable of Hellcats that it simply cannot keep up with demand: "Due to unprecedented demand for the 2015 Dodge Charger and Challenger SRT Hellcats, we are temporarily restricting orders while we validate current orders that are in the system." Put another way, if you're waiting for a Hellcat, your wait is likely to be a lot longer than you'd like. We've reached out to Chrysler to find out how long it might take for a new customer to get a new Hellcat, and we'll update if and when we hear back. Related Video: Featured Gallery 2015 Dodge Challenger SRT Hellcat View 88 Photos News Source: Motor Authority Chrysler Dodge Car Buying Ownership Coupe Performance Sedan dodge hellcat dodge challenger hellcat dodge charger hellcat autoblog black