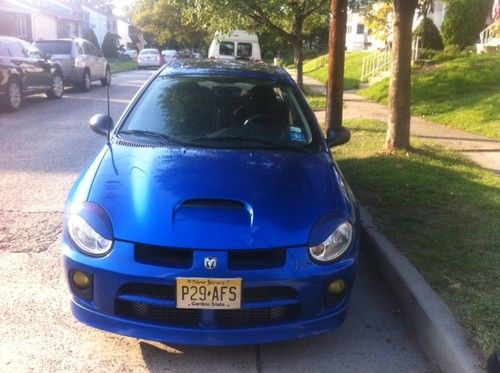

1998 Dodge Neon Sport Sedan 4-door 2.0l, No Reserve on 2040-cars

Orange, California, United States

Engine:2.0L 1996CC 122Cu. In. l4 GAS DOHC Naturally Aspirated

Transmission:Automatic

Vehicle Title:Clear

Body Type:Sedan

Make: Dodge

Mileage: 93,634

Model: Neon

Exterior Color: White

Trim: Sport Sedan 4-Door

Interior Color: Gray

Drive Type: FWD

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 4

Dodge Neon for Sale

2002 dodge neon base sedan 4-door 2.0l(US $1,995.00)

2002 dodge neon base sedan 4-door 2.0l(US $1,995.00) 2005 dodge neon srt-4 turbo sedan 5 speed low miles clean hurst shifter warranty(US $11,900.00)

2005 dodge neon srt-4 turbo sedan 5 speed low miles clean hurst shifter warranty(US $11,900.00) 1995 dodge neon base sedan 4-door 2.0l

1995 dodge neon base sedan 4-door 2.0l 1998 dodge neon sport sedan 4-door 2.0l(US $1,000.00)

1998 dodge neon sport sedan 4-door 2.0l(US $1,000.00) 2004 dodge neon srt-4 sedan 4-door 2.4l(US $7,000.00)

2004 dodge neon srt-4 sedan 4-door 2.4l(US $7,000.00) 2003 dodge srt-4

2003 dodge srt-4

Auto Services in California

Z & H Autobody And Paint ★★★★★

Yanez RV ★★★★★

Yamaha Golf Cars Of Palm Spring ★★★★★

Wilma`s Collision Repair ★★★★★

Will`s Automotive ★★★★★

Will`s Auto Body Shop ★★★★★

Auto blog

2016 Dodge Challenger and Charger Hellcats see doubled production

Mon, Jul 27 2015The launch of the Hellcat supercharged V8 in the Dodge Challenger and Charger for the 2015 model year was a massive success. The one-two punch of muscle cars probably grabbed the brand more headlines than it had seen in ages by offering a world-beating 707 horsepower from the growling engine under the hood. The only real wrench in the works was keeping up with all of the orders. For 2016, Dodge might have fixed that little problem with plans to make more than twice as many of these mean machines Despite production seeing a massive boost, a few customers with orders for 2015 examples will need to wait just a little longer to experience those 707 ponies. The automaker will cancel any unscheduled, sold orders for the current model, but those buyers will receive a discount on the 2016. Similar to last year, dealers will earn their allocation of the muscle cars based on Dodge sales and how long the Hellcats stay on their lots. There are some very tiny changes for any buyers who are holding out for the 2016 Hellcats, too. Mechanically, they are identical to the 2015s with a 6.2-liter supercharged V8 and eight-speed automatic. The interiors see some improvements, though. Both the Challenger and Charger now receive standard Laguna Leather upholstery and an improved 8.4-inch Uconnect system with navigation, an HD radio, and five years of SiriusXM Travel Link and Traffic. Orders for both open in the second week of August, and production actually begins in September in Brampton, Ontario, Canada.

Watch this Dodge Viper get clawed to death

Tue, 07 Jan 2014There's a scene in the James Bond movie, Casino Royale, where Daniel Craig's Agent 007 is captured by villain Le Chiffre, played by Mads Mikkelsen. Le Chiffre tortures Bond in a scene that is rather difficult to watch (especially for blokes) and impossible to describe on these digital pages (Google at your own risk). This video is the automotive equivalent of the Casino Royale torture scene.

It shows a Dodge Viper - a late, first-generation GTS judging by the center-exit exhausts - getting assaulted by a giant piece of heavy equipment. The large claw shows no mercy on the V10-powered sports car, rending its muscular curves into pieces and then running it over, just for good measure. It's a painful video to watch (and hear!), made worse because we don't know what the Viper did to deserve such a fate. About a third of the way through the video, the cameraman indicates that the man with the claw is a new operator from Chrysler, and it appears there may be some fire damage, but beyond that, we don't have much to go on.

Scroll down for the video but be warned, it isn't for the faint of heart.

Dodge Durango to stay classy with Ron Burgundy as spokesperson [w/video]

Sat, 05 Oct 2013The upcoming 2014 Dodge Durango has a lot of things going for it, including its 290-horsepower V6 and 360-hp Hemi V8 engine options, an eight-speed automatic and aggressive looks. And now it will have Ron Burgundy, the fictional television news anchor played by comedian Will Ferrell, as a spokesperson, Adweek reports. He follows in the footsteps of other non-fictional Chrysler brand spokespeople such as Eminem, Clint Eastwood and the late Paul Harvey.

Though the star of 2004's Anchorman and the upcoming Anchorman 2 is wildly popular, we're not sure we see a Dodge spokesperson in Burgundy. (Please, no womanizing or scotchy, scotch, scotch before test test drives). But at this point there's no turning back: Chrysler's chief marketing officer Olivier Francois previewed three ad spots at the Association of National Advertisers (ANA) Masters of Marketing conference in Phoenix on Friday, and says Chrysler has already filmed 68(!) Durango ads with the fictional newsman.

According to Adweek, one of the ads previewed had Burgundy highlighting the SUV's glovebox size, and in another he compared its horsepower to a white horse standing next to him. Will this help Dodge Durango sales improve? We can only wait and see. In the meantime, feel free to share your thoughts in Comments, and check out the trailer for Anchorman 2 below.