1973 dodge dart swinger 5.6l

1973 dodge dart swinger 5.6l Dodge dart swinger 1973 california car built 318 all original panels clean car

Dodge dart swinger 1973 california car built 318 all original panels clean car Vintage 1969 dodge dart , mr. norms 440 converison, auto. posi 391, nice car !!!

Vintage 1969 dodge dart , mr. norms 440 converison, auto. posi 391, nice car !!! True gts,factory console 4speed,a/c,ps,pb,build sheet,high show condition,sweet(US $31,995.00)

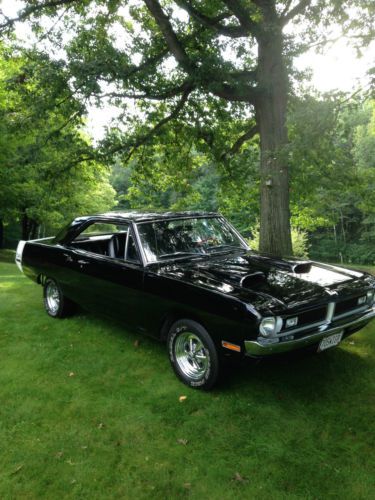

True gts,factory console 4speed,a/c,ps,pb,build sheet,high show condition,sweet(US $31,995.00) 1972 dodge dart swinger black vinyl top 2-door(US $6,500.00)

1972 dodge dart swinger black vinyl top 2-door(US $6,500.00) 1970 dart 340, 4 speed h code 73,000 original miles(US $14,500.00)

1970 dart 340, 4 speed h code 73,000 original miles(US $14,500.00) 1972 dodge dart swinger 64k mopar-see video 360 engine-cruise nights-working ac-(US $15,500.00)

1972 dodge dart swinger 64k mopar-see video 360 engine-cruise nights-working ac-(US $15,500.00) Original 1969 dodge dart swinger 340 4-speed now 440 automatic(US $16,900.00)

Original 1969 dodge dart swinger 340 4-speed now 440 automatic(US $16,900.00) Limited 2.0l cd front wheel drive traction control power steering abs fog lamps(US $17,995.00)

Limited 2.0l cd front wheel drive traction control power steering abs fog lamps(US $17,995.00) Blue , navigation, leather, chrome wheels, sunroof(US $16,498.00)

Blue , navigation, leather, chrome wheels, sunroof(US $16,498.00) Gray, rally(US $13,988.00)

Gray, rally(US $13,988.00) 1971 dodge dart swinger no reserve

1971 dodge dart swinger no reserve 2013 dart wrecked damaged salvage title rebuilder(US $4,995.00)

2013 dart wrecked damaged salvage title rebuilder(US $4,995.00) 1965 dodge dart gt 4.5l

1965 dodge dart gt 4.5l 1963 dodge dart station wagon(US $4,500.00)

1963 dodge dart station wagon(US $4,500.00) 1971 dodge dart swinger hardtop 2-door 440 cu inch(US $7,995.00)

1971 dodge dart swinger hardtop 2-door 440 cu inch(US $7,995.00) 1967 dodge dart gt convertible 2-door 5.2l

1967 dodge dart gt convertible 2-door 5.2l 1964 dodge dart 4 speed

1964 dodge dart 4 speed 13 back up camera navigation remote start sunroof tint cd player heated leather

13 back up camera navigation remote start sunroof tint cd player heated leather 1968 dodge dart 270(US $6,000.00)

1968 dodge dart 270(US $6,000.00) Documented 1 of 5 dart gts convertible 383 4 speed(US $109,900.00)

Documented 1 of 5 dart gts convertible 383 4 speed(US $109,900.00) 4dr sedan sxt low miles automatic gasoline 4 cyl engine tungsten metallic clear

4dr sedan sxt low miles automatic gasoline 4 cyl engine tungsten metallic clear 1967 dodge dart pro street drag car street legal roller hemi(US $17,750.00)

1967 dodge dart pro street drag car street legal roller hemi(US $17,750.00) 2013 dodge dart sxt perfect carfax like new loaded we ship low miles ga car bid!(US $14,990.00)

2013 dodge dart sxt perfect carfax like new loaded we ship low miles ga car bid!(US $14,990.00) 1967 dodge dart gts 383..#'s match..radio delete..galen doc..

1967 dodge dart gts 383..#'s match..radio delete..galen doc.. 2013 sedan used 2.0l 4 cyls automatic fwd bright white clearcoat(US $15,100.00)

2013 sedan used 2.0l 4 cyls automatic fwd bright white clearcoat(US $15,100.00) 1969 dodge dart gt convertible(US $12,500.00)

1969 dodge dart gt convertible(US $12,500.00) 1970 dodge dart swinger hardtop 2-door, 340, 4-speed, rare color combination!(US $36,000.00)

1970 dodge dart swinger hardtop 2-door, 340, 4-speed, rare color combination!(US $36,000.00) 1964 dodge dart gt convertible 50th. anniversary edition

1964 dodge dart gt convertible 50th. anniversary edition Sxt cd mp3 2.0l black premium cloth front bucket seats front wheel drive abs(US $18,988.00)

Sxt cd mp3 2.0l black premium cloth front bucket seats front wheel drive abs(US $18,988.00) 37k original miles - one owner for 40 years(US $15,000.00)

37k original miles - one owner for 40 years(US $15,000.00) 1969 dodge dart

1969 dodge dart 2014 dodge dart gt sedan 4-door 2.4l(US $14,900.00)

2014 dodge dart gt sedan 4-door 2.4l(US $14,900.00) 1971 dodge dart 2 door hardtop swinger!!!(US $1,800.00)

1971 dodge dart 2 door hardtop swinger!!!(US $1,800.00) Very clean low budget muscle car, fresh motor, lots of new parts, cool swinger!(US $19,995.00)

Very clean low budget muscle car, fresh motor, lots of new parts, cool swinger!(US $19,995.00) 2013 dodge dart rallye turbo 1.4l(US $14,300.00)

2013 dodge dart rallye turbo 1.4l(US $14,300.00) Dodge dart custom 4-dr 1972(US $7,000.00)

Dodge dart custom 4-dr 1972(US $7,000.00) 1969 dodge dart custom sedan 2-door 5.2l(US $11,000.00)

1969 dodge dart custom sedan 2-door 5.2l(US $11,000.00) 2013 sxt/rallye used 2l i4 16v automatic fwd sedan premium

2013 sxt/rallye used 2l i4 16v automatic fwd sedan premium 72 dart swinger, original paint, loaded with options

72 dart swinger, original paint, loaded with options 2013 other sxt/rallye!(US $15,991.00)

2013 other sxt/rallye!(US $15,991.00) 1964 dodge dart 270 convertible with a 273 motor , . push button trans ,

1964 dodge dart 270 convertible with a 273 motor , . push button trans , 1969 dodge dart drag car(US $13,000.00)

1969 dodge dart drag car(US $13,000.00) 1966 green runsdrivesstops bodyinter fair project car!

1966 green runsdrivesstops bodyinter fair project car! 1968 dodge dart gts 5.6l

1968 dodge dart gts 5.6l 1967 dodge dart gt 5.2l classic

1967 dodge dart gt 5.2l classic Very cool dodge dart gt, original 273ci motor, restored in 2006, small upgrades(US $15,995.00)

Very cool dodge dart gt, original 273ci motor, restored in 2006, small upgrades(US $15,995.00) 1969 dodge dart 383 big block 6.3l mopar classic msd 6al hedman

1969 dodge dart 383 big block 6.3l mopar classic msd 6al hedman 1972 dodge dart swinger plymouth valiant duster swinger demon scamp 3 speed stik(US $3,450.00)

1972 dodge dart swinger plymouth valiant duster swinger demon scamp 3 speed stik(US $3,450.00) 1970 dodge dart base hardtop 2-door 5.6l

1970 dodge dart base hardtop 2-door 5.6l 1969 dodge dart 440ci blower mopar duster charger challenger cuda gtx prostreet

1969 dodge dart 440ci blower mopar duster charger challenger cuda gtx prostreet 1967 dodge dart 270 coupe 2-door 4.5l

1967 dodge dart 270 coupe 2-door 4.5l 1972 dodge demon project car with 340 and lots of new parts(US $3,500.00)

1972 dodge demon project car with 340 and lots of new parts(US $3,500.00) 1961 dodge dart seneca. slant 6 pushbutton auto. rat rod low rider lead sled.(US $3,850.00)

1961 dodge dart seneca. slant 6 pushbutton auto. rat rod low rider lead sled.(US $3,850.00) 1970 dodge dart swinger 340 hugger orange(no reserve)(US $23,900.00)

1970 dodge dart swinger 340 hugger orange(no reserve)(US $23,900.00) 1974 dodge dart valiant swinger coupe all original 6 cylinder auto $3499 or bst(US $3,499.00)

1974 dodge dart valiant swinger coupe all original 6 cylinder auto $3499 or bst(US $3,499.00) Dodge dart 4dr sedan gt manual gasoline 2.4l 4 cyl blue streak pearl coat

Dodge dart 4dr sedan gt manual gasoline 2.4l 4 cyl blue streak pearl coat 1973 dodge dart swinger, very clean

1973 dodge dart swinger, very clean 1968 dodge dart trade for shovelhead panhead(US $2,500.00)

1968 dodge dart trade for shovelhead panhead(US $2,500.00) 1968 dodge dart 2 door post car california car(US $3,500.00)

1968 dodge dart 2 door post car california car(US $3,500.00)

Dodge Dart Price Analytics

About Dodge Dart

Auto blog

Fiat/PSA's dominance in small vans hangs up EU's merger approval

Mon, Jun 8 2020BRUSSELS — EU antitrust regulators are concerned about Fiat Chrysler and Peugeot / PSA's combined high market share in small vans and may require concessions to clear their $50 billion merger, people familiar with the matter said. The companies, which are seeking to create the world's fourth biggest carmaker, were told of the European Commission's concerns last week. If Fiat and PSA fail to dispel the European Commission's doubts in the next two days and subsequently decline to offer concessions by Wednesday, the deadline for doing so, the deal would face a four-month-long investigation. The EU competition enforcer, which has set a June 17 deadline for its preliminary review, declined to comment. Fiat was not immediately available for comment while PSA had no immediate comment. Hiving off overlapping businesses, usually a regulatory demand to ensure more competition, could prove tricky for the carmakers because of the technicalities. Fiat and PSA are looking to merge to help offset slowing demand and shoulder the cost of making cleaner vehicles to meet tougher emissions regulations. The deal puts under one roof the Italian carmaker's brands such as Fiat, Jeep, Dodge, Ram, Maserati and the French company's Peugeot, Opel and DS. Related Video: Government/Legal Chrysler Dodge Fiat Jeep Maserati RAM Citroen Opel Peugeot

Fiat Chrysler's next-generation Uconnect is faster, built on Android

Mon, Jan 27 2020If you're a regular reader of Autoblog, you know that for a long time we've liked Fiat Chrysler's Uconnect infotainment system for its bright, clear, responsive touchscreen interface. Now, according to the company, it will be better than ever with Uconnect 5, the latest iteration of the system. It has upgraded hardware and a revamped graphic user interface (the stuff on the screen). Looking at sample screens shown above, there are characteristics shared with the old system, such as the time, status and shortcuts at the top and the menu icons at the bottom. In the middle, the major change is the addition of home screens that can be customized with favorite menus and readouts that are always available. Each of these home screens can have up to four functions and you can have five pages to flip through. The graphics themselves feature more legible fonts and updated icons. Each car brand will get its own set of icons, colors and textures to help create unique experiences. And while each Fiat Chrysler product will be able to have Uconnect, including Alfa Romeo that has until now lacked Uconnect, each brand has the ability to make small tweaks including the screen orientation. The system will support displays in landscape, portrait or square, so different brands may choose different shapes. Powering Uconnect 5 is a processor Fiat Chrysler says is six times more powerful than what's in current systems. It features 6 gigabytes of RAM and 64 gigabytes of internal storage. The processor also supports screens as large as 12.3 inches with as many as 15 million pixels, or nearly twice that of a 4K resolution TV. The system can display information on up to four screens, too. Uconnect 5's firmware is built on Google's Android operating system, joining a few other automakers in using Android as a base for their infotainment systems. Uconnect 5 brings with it a number of new features. It brings full Alexa integration, so you can use it just like you do at home, provided you have a data plan for the car. Apple CarPlay and Android Auto continue to be standard, but now they can be used wirelessly. You can also now connect two phones via Bluetooth wirelessly so you can access content from both. Navigation gets real time information and updates from TomTom. Users can create five profiles with unique climate, radio and instrument settings, plus one for a valet.

Fiat Chrysler CEO says final merger talks with Peugeot going well

Thu, Jan 23 2020BRUSSELS — Fiat Chrysler's chief executive Michael Manley said on Wednesday that merger talks with Peugeot owner PSA to create the world's No. 4 carmaker are progressing well and he hopes to have a deal within 12-14 months. Speaking to Reuters on the sidelines of an industry meeting, he said he doesn't expect any major obstacles that could delay a final agreement. "Talks are progressing really well," Manley said about negotiations with the French carmaker ahead of a briefing by the European automotive association (ACEA), of which he is president. His comments come a month after the two carmakers agreed to a binding deal worth about $50 billion to combine forces in response to a slowdown in global demand and mounting costs of making cleaner vehicles amid tighter emissions regulations. Manley's timeline for completing the deal by early 2021 is in line with a forecast made by the companies in December. Fiat and Peugeot are now getting into the details of how the merger will work, including choosing which vehicle platforms — the technological underpinnings of a vehicle — will fit which products in a combined company. Because customers in different locations still prefer vastly different cars, there is room for multiple platforms in a combined group, Manley said. "That global platform is an elusive beast," he added. "This concept of a massive global platform in my mind is almost a myth, but that doesnÂ’t mean to say weÂ’re not going to recruit significant volume." Related Video:  Â

Dongfeng and PSA extend Chinese joint venture

Thu, Dec 19 2019BEIJING/PARIS — China's Dongfeng and Peugeot maker PSA are extending their business cooperation, despite the Chinese company reducing its stake in PSA to help smooth the French carmaker's merger with Fiat Chrysler Automobiles (FCA). Dongfeng said on Thursday it had agreed with PSA to extend the duration of their joint venture Dongfeng Peugeot Citroen Automobiles (DPCA). Under the deal, the venture could get the rights to PSA's new brands in China and will benefit from new technologies and intellectual properties, the Chinese company said. PSA was not immediately available for comment. The announcement comes a day after the companies said Dongfeng would reduce its 12.2% stake in PSA by selling 30.7 million shares to the French company. Analysts said the move could smooth U.S. regulatory approval for PSA's roughly $50 billion (GBP38.97 billion) merger with Italian-American carmaker FCA. The sale of Dongfeng's shares in PSA, worth around 680 million euros ($757 million), will leave the Chinese group holding around 4.5% of the merged PSA-FCA, which is set to become the world's fourth-biggest carmaker by sales volumes. "As the cooperation between Dongfeng and PSA deepens, we expect the joint venture to continue making good progress in China," a Dongfeng representative said. On a conference call, Dongfeng said DPCA would have exclusive rights to PSA's Opel cars should the partners agree to bring the brand to China, and enjoy lower prices on car parts imported from PSA. Earlier this year, a document seen by Reuters showed Dongfeng and PSA plan to cut jobs at Wuhan-based DPCA and reduce its number of car plants to try to make the venture more profitable. Chrysler Dodge Fiat Jeep RAM Citroen Peugeot China FCA PSA Dongfeng

FCA CEO Mike Manley will take undefined new role after PSA merger

Wed, Dec 18 2019MILAN — Fiat Chrysler Chief Executive Mike Manley will remain with the new group set to result from a planned merger with French rival PSA-Peugeot, Chairman John Elkann said on Wednesday. In a letter to Fiat Chrysler (FCA) employees on the day the two companies announced a binding agreement for a $50 billion tie-up to create the world's fourth-largest carmaker, Elkann said he was "delighted" that the combined group would be led by current PSA CEO Carlos Tavares. "And Mike Manley, who has led FCA with huge energy, commitment and success over the past year, will be there alongside him," he said. He did not say what position Manley would hold. Elkann — who will chair the new group — said there was still much to be done to complete the merger. "Over the coming months we must work tirelessly and determinedly to fulfill all the approval requirements needed to finalize the commitment we have signed," he said. Related Video:   Hirings/Firings/Layoffs Chrysler Dodge Fiat Jeep RAM Citroen Peugeot FCA PSA merger Mike Manley carlos tavares

Fiat Chrysler and Peugeot boards meet to finalize merger

Tue, Dec 17 2019MILAN/PARIS — The boards of Fiat Chrysler Automobiles and Peugeot will meet separately on Tuesday to discuss finalizing an initial agreement for a $50 billion merger to create the world's number four carmaker, sources said. A source close to FCA said the two companies could announce the signing of a binding memorandum early on Wednesday, followed by a conference call to explain further details later in the day. The two mid-sized carmakers announced plans six weeks ago for a tie-up to help them deal with big challenges in the industry, including a global demand downturn and the need to develop costly cleaner cars to meet looming anti-pollution rules. Ahead of the meetings, entities representing the Peugeot family, Etablissements Peugeot Freres (EPF) and FFP, unanimously approved a proposed memorandum of understanding for the planned merger, a source familiar with the situation said. FCA and PSA have said they would seek to finalize a deal by year-end to create a group with 8.7 million in annual vehicle sales. That would put it fourth globally behind Volkswagen, Toyota and the Renault-Nissan alliance. PSA's Carlos Tavares will be chief executive and FCA's John Elkann — the scion of Italy's Agnelli family, which controls FCA through their holding company Exor — chairman of the combined company. The group will include the Fiat, Jeep, Dodge, Ram, Chrysler, Alfa Romeo, Maserati, Peugeot, DS, Opel and Vauxhall brands, allowing it to serve mass and premium passenger car markets as well as those for trucks and light commercial vehicles. Related Video:    Chrysler Dodge Fiat Jeep RAM Citroen Peugeot

FCA and Peugeot reportedly agree on merger

Wed, Oct 30 2019Citing a Wall Street Journal report, the Detroit Free Press says "Fiat Chrysler and PSA Groupe have agreed to merge." The Journal reported on talks between the two car companies only yesterday. It's said that Peugeot's board met yesterday to approve the deal, FCA's board met today, and an announcement could come as soon as tomorrow, Thursday. Both automakers have released statements, but neither company has released any information beyond admitting to ongoing talks. If the merger happens, the combined entity would become the world's fourth-largest carmaker with a $50 billion valuation, slotting in behind Toyota, the Volkswagen Group, and the Renault Nissan Mitsubishi alliance. Among the merger options possible, "an all-stock merger of equals" is the one analysts and Moody's seem to give the best grade. The reported merger would come about four months after FCA walked away from merger talks with Renault. FCA said the French government scuppered those talks over the role of Nissan in a reformed entity, but there were also brewing issues with French unions, and ongoing turmoil among Renault and Nissan leadership thanks to continuing fallout from ex-CEO Carlos Ghosn's arrest last year. FCA makes most of its revenue in the U.S. and rules Italy, while Peugeot is the second-best-selling automaker in Europe with its own brand in France and Opel in Germany. The two companies already have a partnership in Europe making vans, one that FCA CEO Mike Manley has spoken highly of. Among the list of obvious benefits in a potential merger, FCA would get access to Peugeot's small, modern platforms, $10.2 billion in cash, and electrified and hybrid architecture developments, the latter especially important to FCA as those are fields where it lags. Peugeot would get much easier access to the U.S. market, and the money-printing brands Jeep and Ram. A merged carmaker would have combined sales of nearly 9 million a year, based on 2018 results. By comparison, both Volkswagen and Toyota sell over 10 million cars a year, while the Renault-Nissan-Mitsubishi alliance almost 11 million. Peugeot CEO Carlos Tavares has proved he knows how to do turnarounds and mergers. After leaving a position as Carlos Ghosn's right-hand man in 2012, Tavares took over Peugeot in 2014, navigated a bailout from the French government and China's Dongfeng Motors in 2015, and turned PSA into a regional powerhouse.

This 93-car Iowa auction is like a Big 3 classic muscle museum

Tue, Aug 27 2019Bill "Coyote" Johnson has been buying cars since high school and has amassed a collection totaling 113 vehicles, according to NBC 6 News. But time has changed his motivations and priorities, and he's decided to auction 93 of those cars, many of which are classic muscle from Ford, Chevrolet, Dodge, Plymouth and Pontiac. The megasale will take place Sept. 14, 2019, in Red Oak, Iowa, at the Montgomery County Fairgrounds. A 1969 Plymouth Road Runner infected Coyote with a love for Detroit muscle when he was just a teenager, and his desire quickly turned into an obsession. He's spent the past 40 years finding, buying and working on a variety of makes and models. Unlike some collectors, Coyote didn't discriminate against certain brands and has rides from each of the Big 3 automakers. Included in the auction are Camaros, Satellites, Super Bees, Chargers, Challengers, Barracudas, Coronets, GTOs, Mustangs, Cutlasses and others. Possibly the most intriguing aspect of the auction is that all of these cars will be sold as-is with no reserve. Many of them will need work, depending on quality standards, but this seems like a golden opportunity to find a classic car without leaving a bank account in shambles. The auctions are open for bidding online now, and the full auction will take place on September 14. Check out the full listings and bid at VanDerBrink Auctions.

Fiat Chrysler's profit boosted by Ram and Jeep in North America

Wed, Jul 31 2019MILAN/DETROIT — Fiat Chrysler took the market by surprise by sticking to its full-year profit guidance on Wednesday after a strong performance from its Ram pickup truck in North America helped it defy an industry slowdown. Chief Executive Mike Manley, in FCA's first earnings release since a failed attempt to merge with France's Renault, also left the door open to that or other deals. "We are open to opportunity," Manley said on a call with analysts. "I have no doubt why there still would be interest in it," he added, when pressed on what it would take to revive talks with Renault. Manley declined to comment further. FCA last month abandoned its $35 billion merger offer for Renault, blaming French politics for scuttling what would have been a landmark deal to create the world's third-biggest automaker. Manley said a merger was not a must-have and Fiat Chrysler's business plan was strong. The company said it remained confident its adjusted earnings before interest and tax (EBIT) would top last year's 6.7 billion euros ($7.5 billion). Given disappointing forecasts from other automakers this earnings season, FCA's confirmation of the outlook sent Milan-listed shares in the Italian-American automaker, whose other brands include Jeep, up over 4%. A broad-based auto sales downturn has rattled the sector, forcing FCA's competitors — including Renault, Daimler and Aston Martin — to cut their sales forecasts after second-quarter results, while U.S. carmaker Ford gave a weaker-than-expected 2019 profit outlook. Japan's Nissan, a long-term partner of Renault, said it would cut 12,500 jobs by 2023 after its earnings collapsed. In the second quarter FCA's adjusted EBIT totaled 1.52 billion euros, versus analysts' expectations of 1.43 billion euros, according to a Reuters poll. FCA's U.S. shipments were down 12% in the second quarter but the group said that the successful performance of its Ram brand resulted in an enhanced share of the large pickup truck market of 27.9%, up 7 percentage points from last year. Adjusted EBIT margin in North America rose to 8.9% from 6.5% in the first quarter, thanks to strong demand for the heavy-duty Ram and the new Jeep Gladiator pickup. Chief Financial Officer Richard Palmer also said FCA expected to report up to 10% margins in the region in both the third and fourth quarters.

Auto sales in March and first quarter down nearly across the board

Wed, Apr 3 2019Nearly every major automaker reported weak U.S. sales for March and the first quarter of 2019, citing a rough start to the year, but said a robust economy and strong labor market should encourage consumers to buy more vehicles as 2019 rolls on. GM, which no longer releases monthly sales figures, saw first-quarter sales fall 7 percent, with declines across all brands. Sales of Silverado pickup trucks fell nearly 16 percent and the high-margin Chevy Suburban large SUV dropped 25 percent. Ford also no longer releases monthly sales numbers, but is due to release its first-quarter sales figures on Thursday. According to industry data, Ford's sales fell 2 percent in the quarter and 5 percent in March. Ford representatives did not immediately respond to requests for comment. FCA reported a 7 percent fall in U.S. sales in March and a 3 percent drop for the first quarter. All of FCA's brands dropped in March, except for Ram, which saw a 15 percent increase in pickup truck sales. "The industry had a tough first quarter, but with spring finally starting to show its face and continued strong economic indicators ... we are confident that new vehicle sales demand will strengthen going forward," FCA's U.S. head of sales, Reid Bigland, said in a statement. Toyota reported a 3.5 percent fall in U.S. sales in March and 5 percent for the first quarter, hurt by declining demand for its Corolla sedans and Camry vehicles. "While some of our competitors are abandoning sedans, we remain optimistic about the future of the segment," Toyota said in a statement. Nissan posted a 5.3 percent drop in sales in March, and its first-quarter sales were down 11.6 percent. Honda and Hyundai bucked the trend. Honda's U.S. sales rose 4.3 percent in March and 2 percent in the quarter, while Hyundai's were up 1.7 percent and 2.1 percent, respectively. Passenger-car sales suffered throughout the January-March quarter compared with the same period in 2018 as Americans continued to abandon them in favor of larger, more comfortable pickup trucks and SUVs, which are far more profitable for automakers. The battle for market share in the particularly lucrative large-pickup truck market intensified in the quarter, as Fiat Chrysler Automobiles' Ram brand outsold the U.S.' No. 1 automaker General Motors' Chevrolet-brand trucks. The two automakers have both launched redesigned pickup trucks.