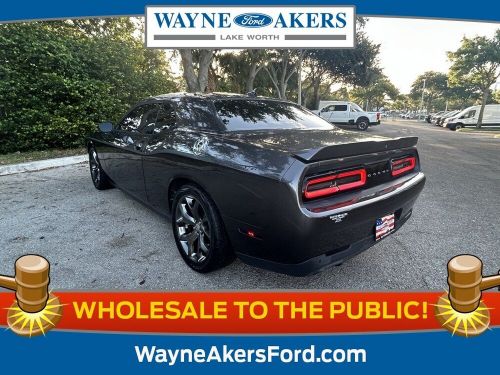

2018 Dodge Challenger Srt Demon on 2040-cars

Engine:Supercharged 6.2 Liter Hemi V8

Fuel Type:Gasoline

Body Type:coupe

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 00000000000000000

Mileage: 1051

Make: Dodge

Trim: SRT Demon

Drive Type: --

Features: --

Power Options: --

Exterior Color: Go Mango

Interior Color: Black

Warranty: Vehicle does NOT have an existing warranty

Model: Challenger

Dodge Challenger for Sale

2022 dodge challenger r/t(US $39,977.00)

2022 dodge challenger r/t(US $39,977.00) 2023 dodge challenger srt hellcat jailbreak(US $68,000.00)

2023 dodge challenger srt hellcat jailbreak(US $68,000.00) 2015 dodge challenger sxt(US $17,995.00)

2015 dodge challenger sxt(US $17,995.00) 2023 dodge challenger srt hellcat widebody(US $87,306.00)

2023 dodge challenger srt hellcat widebody(US $87,306.00) 2023 dodge challenger r/t scat pack(US $49,700.00)

2023 dodge challenger r/t scat pack(US $49,700.00) 2015 dodge challenger srt hellcat(US $49,915.00)

2015 dodge challenger srt hellcat(US $49,915.00)

Auto blog

Cruiser's close call caught on camera

Mon, Dec 21 2015A new recruit to the Kansas Highway Patrol experienced his first brush with danger on his first day when a semi truck clipped his cruiser during a traffic stop last week. Public relations officer Tod Hileman said in a Facebook post that the incident occurred when an officer and his brand-new trainee pulled over a black Dodge Charger on I-70 in Trego County, Kansas. Hileman said in the comments that the cruiser was parked two feet away from the white line on the shoulder. Not only did the driver not get over a lane when he saw the stopped cruiser per Kansas law, he seemed to have moved closer to the side of the road. The big rig managed to send the cruiser's side mirror and spotlight flying across the road. The truck could have easily injured one of the officers, perhaps fatally. The truck driver ignored Kansas' Move Over law, which requires "drivers approaching a stationary emergency vehicle displaying flashing lights, including towing and recovery vehicles, traveling in the same direction, to vacate the lane closest if safe and possible to do so, or slow to a speed safe for road, weather, and traffic conditions." With a clear lane to his left the trucker in this case had no excuse. He stopped after the crash and was cited by the officers for failing to change lanes when he saw the stopped vehicles. Being a cop is a risky job. So far this year, 28 officers have lost their lives in the line of duty due to car accidents, according to the Officer Down Memorial Page. News Source: Facebook Government/Legal Dodge Videos traffic traffic stop traffic tickets move over law

Fiat Chrysler's next-generation Uconnect is faster, built on Android

Mon, Jan 27 2020If you're a regular reader of Autoblog, you know that for a long time we've liked Fiat Chrysler's Uconnect infotainment system for its bright, clear, responsive touchscreen interface. Now, according to the company, it will be better than ever with Uconnect 5, the latest iteration of the system. It has upgraded hardware and a revamped graphic user interface (the stuff on the screen). Looking at sample screens shown above, there are characteristics shared with the old system, such as the time, status and shortcuts at the top and the menu icons at the bottom. In the middle, the major change is the addition of home screens that can be customized with favorite menus and readouts that are always available. Each of these home screens can have up to four functions and you can have five pages to flip through. The graphics themselves feature more legible fonts and updated icons. Each car brand will get its own set of icons, colors and textures to help create unique experiences. And while each Fiat Chrysler product will be able to have Uconnect, including Alfa Romeo that has until now lacked Uconnect, each brand has the ability to make small tweaks including the screen orientation. The system will support displays in landscape, portrait or square, so different brands may choose different shapes. Powering Uconnect 5 is a processor Fiat Chrysler says is six times more powerful than what's in current systems. It features 6 gigabytes of RAM and 64 gigabytes of internal storage. The processor also supports screens as large as 12.3 inches with as many as 15 million pixels, or nearly twice that of a 4K resolution TV. The system can display information on up to four screens, too. Uconnect 5's firmware is built on Google's Android operating system, joining a few other automakers in using Android as a base for their infotainment systems. Uconnect 5 brings with it a number of new features. It brings full Alexa integration, so you can use it just like you do at home, provided you have a data plan for the car. Apple CarPlay and Android Auto continue to be standard, but now they can be used wirelessly. You can also now connect two phones via Bluetooth wirelessly so you can access content from both. Navigation gets real time information and updates from TomTom. Users can create five profiles with unique climate, radio and instrument settings, plus one for a valet.

Weekly Recap: Toyota propels hydrogen fuel cells

Sat, Jan 10 2015Toyota is serious about hydrogen fuel cells, and it wants the auto industry to follow suit. The Japanese automaker said this week it's releasing 5,680 fuel cell patents from around the world, including technologies used on its upcoming sedan, the 2016 Mirai. The move is unusual, but not unprecedented, as Tesla similarly released its electric vehicle patents last year. The idea for Tesla, and now for Toyota, is to spur development of alternative propulsion. "By eliminating traditional corporate boundaries, we can speed the development of new technologies and move into the future of mobility more quickly, effectively and economically," said Bob Carter, Toyota Motor Sales senior vice president of automotive operations, in a statement. Toyota's fuel cell patents will be free to use through 2020, though patents related to producing and selling hydrogen will remain open forever. Toyota said it would like companies that use its patents to share their own hydrogen patents, but won't require it. "What Toyota's doing is really a logical move, and really a good move for the industry," Devin Lindsay, principal powertrain analyst with IHS Automotive, told Autoblog. The announcement was made at the Consumer Electronics Show in Las Vegas. It comes as Toyota prepares to launch the hydrogen-powered Mirai in a limited number late this year in California. The launch will be extended to the Northeastern United States next year. Toyota also has announced plans to support networks of fueling stations in each region to try to smooth consumer adoption. The Mirai has a 300-mile range on a tank of hydrogen, and it takes about five minutes to refill. Fuel cells have been receiving increased attention recently, and Audi and Volkswagen debuted hydrogen-powered cars at the 2014 Los Angeles Auto Show. Honda, another proponent of the technology, also showed its updated FCV concept in November in Japan. The company, however, has delayed its fuel cell sedan a year until 2016. Like Toyota, Honda says its hydrogen-powered car will have a range of 300 miles or more. Meanwhile, Hyundai currently offers leases for fuel-cell powered Tucsons, which have a 265-mile range, in Southern California. Despite the optimism some automakers have for fuel cells, the technology still faces barriers. A lack of filling stations has long held it back, and many consumers are not familiar with the potential benefits.