2010 Dodge Challenger Rt Hemi Plum Crazy!15,956 Milesspecial Ordered Car, Mint! on 2040-cars

Vicksburg, Michigan, United States

|

2010 Dodge Challenger RT Classic edition. Completely stock and original! I ordered this car myself in late 2009, Never driven in rain or snow..ever!. This car is like new in and out, never abused in any way..Ive treated this car like a baby! It also has the very cool hard drive stereo system that you can download music from CD's, mp3, or computer stick..very nice option and expensive, its a loaded car with leather, sunroof and every option. This car is already rare, very few built in 2010 in Plum Crazy pearlcoat..This is the one to buy..6 speed is awesome, the classic edition reminds of my 70 Challenger a lot. I have the original window sticker, $38,860, Please call for more info if needed Tim 269-870-0143 Thanks, Also i would like to add that there is no scratches dings of any kind, theres a couple pics that look like there is a scratch, or a defect, but it is just stuff from the cottonwood trees on the car. Thanks!

|

Dodge Challenger for Sale

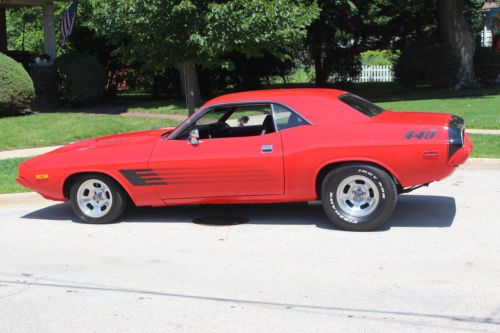

1973 dodge challenger 440 4 bbl 375 hp high impact red show or drive

1973 dodge challenger 440 4 bbl 375 hp high impact red show or drive '11 12k mi 6 speed manual navigation w/ 30gd hd sunroof premium sound leather

'11 12k mi 6 speed manual navigation w/ 30gd hd sunroof premium sound leather 5.7l hemi 6-speed navigation featured in modern mopar magazine! must read!!(US $35,988.00)

5.7l hemi 6-speed navigation featured in modern mopar magazine! must read!!(US $35,988.00) 2009 dodge challenger r/t coupe 2-door 5.7l(US $28,500.00)

2009 dodge challenger r/t coupe 2-door 5.7l(US $28,500.00) 1970 dodge challenger

1970 dodge challenger Custom 2014 dodge challenger r/t

Custom 2014 dodge challenger r/t

Auto Services in Michigan

Xtreme Sound & Performance ★★★★★

Westborn Chrysler Jeep ★★★★★

Welt Auto Parts & Service Co ★★★★★

Valvoline Instant Oil Change ★★★★★

Trojan Auto Connection ★★★★★

Todd`s Towing ★★★★★

Auto blog

FCA and Peugeot reportedly agree on merger

Wed, Oct 30 2019Citing a Wall Street Journal report, the Detroit Free Press says "Fiat Chrysler and PSA Groupe have agreed to merge." The Journal reported on talks between the two car companies only yesterday. It's said that Peugeot's board met yesterday to approve the deal, FCA's board met today, and an announcement could come as soon as tomorrow, Thursday. Both automakers have released statements, but neither company has released any information beyond admitting to ongoing talks. If the merger happens, the combined entity would become the world's fourth-largest carmaker with a $50 billion valuation, slotting in behind Toyota, the Volkswagen Group, and the Renault Nissan Mitsubishi alliance. Among the merger options possible, "an all-stock merger of equals" is the one analysts and Moody's seem to give the best grade. The reported merger would come about four months after FCA walked away from merger talks with Renault. FCA said the French government scuppered those talks over the role of Nissan in a reformed entity, but there were also brewing issues with French unions, and ongoing turmoil among Renault and Nissan leadership thanks to continuing fallout from ex-CEO Carlos Ghosn's arrest last year. FCA makes most of its revenue in the U.S. and rules Italy, while Peugeot is the second-best-selling automaker in Europe with its own brand in France and Opel in Germany. The two companies already have a partnership in Europe making vans, one that FCA CEO Mike Manley has spoken highly of. Among the list of obvious benefits in a potential merger, FCA would get access to Peugeot's small, modern platforms, $10.2 billion in cash, and electrified and hybrid architecture developments, the latter especially important to FCA as those are fields where it lags. Peugeot would get much easier access to the U.S. market, and the money-printing brands Jeep and Ram. A merged carmaker would have combined sales of nearly 9 million a year, based on 2018 results. By comparison, both Volkswagen and Toyota sell over 10 million cars a year, while the Renault-Nissan-Mitsubishi alliance almost 11 million. Peugeot CEO Carlos Tavares has proved he knows how to do turnarounds and mergers. After leaving a position as Carlos Ghosn's right-hand man in 2012, Tavares took over Peugeot in 2014, navigated a bailout from the French government and China's Dongfeng Motors in 2015, and turned PSA into a regional powerhouse.

Dodge bringing revamped Challenger, Charger to Big Apple

Mon, 07 Apr 2014The 2014 New York Auto Show will be a big one for Dodge, as the brand has announced that refreshed versions of the 2015 Challenger and 2015 Charger will debut at the show. This is a particularly big deal for the two-door Challenger which, visually, has remained unchanged since is burst back onto the scene in 2008 and helped reignite the muscle car wars.

As a sort of hint, this announcement was accompanied by the picture you see above - the Super Bee logo in the Challenger's new instrument cluster. According to Dodge, the New York debut of a new "powertrain combination" - possibly with the high-output Hellcat V8 - will leave enthusiasts "abuzz."

As for the Charger, Dodge is promising a full redesign that should be a significant departure from the blunt, angry looks of the current model. At this point, there's no indication that the Challenger's new powertrain could be fitted to the Charger, although considering how mechanically similar these two vehicles have been, it doesn't seem outside the realm of possibility.

Stellantis reports surprising 2020 results, is 'off to a flying start'

Wed, Mar 3 2021MILAN — Low global car inventories and cost cuts should boost Stellantis's profit margins this year, though a shortage of semiconductors and investments in electric vehicles could weigh on results, the newly-formed automaker said on Wednesday. The forecast came as Stellantis, created by the January merger of Peugeot-maker PSA and Fiat Chrysler (FCA), reported better-than-expected results for 2020 that sent its shares up around 3% in morning trading. "Stellantis gets off to a flying start and is fully focused on achieving the full promised synergies (from the merger)," Chief Executive Carlos Tavares said in a statement. Stellantis is the world's fourth largest carmaker, with 14 brands including Fiat, Peugeot, Opel, Jeep, Ram and Maserati. It said 2021 results should be helped by three new high-margin Jeep vehicles in North America and a strong pricing environment there. The U.S. market has driven profits for years at FCA and starts off as the strongest part of Stellantis. The group's guidance assumes no more significant lockdowns caused by the global COVID-19 pandemic, which shuttered auto plants around the world last spring. Stellantis should also get a lift as its starts to implement a plan aimed at delivering over 5 billion euros a year in savings, without closing any plants. Tavares has also pledged not to cut jobs. But a pandemic-related global shortage of semiconductors, used for everything from maximizing engine fuel economy to driver-assistance features, could hurt business. Auto industry executives have said the shortage should ease by the second half of 2021. Stellantis said its "electrification offensive" could also weigh on results this year. Automakers are racing to develop electric vehicles to meet tighter CO2 emissions targets in Europe and this week Volvo joined a growing number of carmakers aiming for a fully-electric line-up by 2030. Stellantis plans to have fully-electric or hybrid versions of all of its vehicles available in Europe by 2025, broadly in line with plans at top rivals such as Volkswagen and Renault-Nissan, although Stellantis has further to go to meet that goal. The carmaker is targeting an adjusted operating profit margin of 5.5%-7.5% this year. That compares with a 5.3% aggregated margin last year: 4.3% at FCA and 7.1% at PSA excluding a controlling stake in parts maker Faurecia, which is set to be spun-off from Stellantis shortly.