Used Chrysler Town & Country Minivan 7 Passenger Vans We Finance Dodge Autos 4dr on 2040-cars

Madison, North Carolina, United States

Fuel Type:Gasoline

For Sale By:Dealer

Engine:6

Transmission:Automatic

Body Type:Minivan/Van

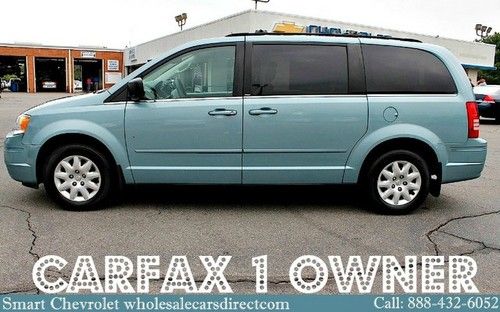

Make: Chrysler

Model: Town & Country

Disability Equipped: No

Mileage: 92,154

Warranty: Unspecified

Sub Model: For Sale 1 Owner Accident Free Carfax Certified

Doors: 4

Exterior Color: Blue

Drive Train: Front Wheel Drive

Interior Color: Tan

Options: CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Cab Type (For Trucks Only): Other

Chrysler Town & Country for Sale

Limited-1 owner-bruno disability seat-every option-new tires-lthr-dual pwr seats(US $5,350.00)

Limited-1 owner-bruno disability seat-every option-new tires-lthr-dual pwr seats(US $5,350.00) 2013 chrysler town & country(US $25,987.00)

2013 chrysler town & country(US $25,987.00) Wheelchair accessible 2007 chrysler town & country(US $23,000.00)

Wheelchair accessible 2007 chrysler town & country(US $23,000.00) Garage kept

Garage kept 2002 chrysler town & country van

2002 chrysler town & country van 2009 chrysler town & country wheelchair/handicap rampvan rear entry conversion(US $15,900.00)

2009 chrysler town & country wheelchair/handicap rampvan rear entry conversion(US $15,900.00)

Auto Services in North Carolina

Walkertown Tire Service ★★★★★

Victory Tire & Auto Svc ★★★★★

Valvoline Instant Oil Change ★★★★★

USA Paint & Body ★★★★★

Truth Automotive-Transmission ★★★★★

Triangle Window Tinting ★★★★★

Auto blog

Driving the Toyota Tacoma, BMW 430i and Chevy Corvette Convertible | Autoblog Podcast #671

Fri, Mar 26 2021In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by West Coast Editor James Riswick and Road Test Editor Zac Palmer. First, they talk about driving the Toyota Tacoma TRD Off-Road (equipped with a TRD Lift Kit), Mini Cooper S Hardtop 2-Dor, BMW 430i xDrive, Chevy Corvette Convertible and Chevy Suburban with the Duramax diesel engine. They discuss the news, including Toyota's desire to differentiate the 86 from the BRZ, the new Jeep Magneto concept and Greg's opinion piece on why Stellantis needs Chrysler. Last, but not least, they dig into the mailbag to help a listener figure out how to replace their Honda S2000 and Honda Fit. Autoblog Podcast #671 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars We're Driving 2021 Toyota Tacoma TRD Off-Road 2021 Mini Cooper S Hardtop 2 Door 2021 BMW 430i xDrive 2021 Chevy Corvette Convertible 2021 Chevy Suburban Duramax diesel News Toyota 86 reportedly delayed to differentiate it from Subaru BRZ Jeep Magneto: Electrifying the Easter Jeep Safari with a Wrangler EV Why Stellantis needs Chrysler Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related Video: Podcasts BMW Chevrolet Chrysler GM MINI Toyota Truck Coupe SUV Diesel Vehicles Luxury Off-Road Vehicles Performance

Federal grand jury issues subpoenas to U.S. FCA dealers

Wed, Jul 27 2016Despite an attempt to clarify and backtrack, it seems the investigation into Fiat Chrysler Automobile's false sales reporting is picking up steam. According to Automotive News, FCA dealers and regional offices have received subpoenas ordering them to supply documents and testimony to a grand jury in Detroit. Of course, the dealers are objecting to the request. They claim the subpoenas are too broad and would require them to hand over too much personal information, like personal phone numbers of dealer employees going back years. The group wants to make it clear that FCA has clarified its sales reporting and that the issue is with the manufacturer, not dealers. The dealers say that FCA employee records and testimony should be enough. It's rumored that a dealer group is the one that sparked the investigation in the first place. FCA confirmed on July 18 that it indeed was under investigation by a number of federal agencies. Although they've clarified their position regarding sales reporting, the fraud investigation continues full steam. Related Video:

A closer look at the 2015 Chrysler 200

Fri, 17 Jan 2014When the doors of the Detroit Auto Show open to the public tomorrow, there's no doubt that the Chevy, BMW and Lexus booths will attract plenty of foot traffic with flashy sports cars. But when it comes to relevance as it relates to sales volume and in-market shoppers, the 2015 Chrysler 200 could end up being one of the more important introductions from the show. Positioned in the highly competitive midsize sedan segment, Chrysler has quite the challenge ahead of it, so we asked Andy Love, product chief of the 200, to give us a closer look at the new sedan to see how it will stack up against cars like the Toyota Camry, Ford Fusion and Honda Accord.

All of the pertinent information about the new 200 was revealed during the on-stage introduction, but Love gave us a first-hand look at the sedan's more intricate details. This includes some of the exterior design elements such as the wide use of LED exterior lighting and the strategic placement of the side marker lights, and even interior cues like electronic shifter, which allowed for extra storage space in the center console. Aside from the name, the 2015 200 started from scratch riding on a similar platform as the Dodge Dart and Jeep Cherokee, based on the Alfa Romeo Giulietta.

Scroll down to watch Love talk us through the 2015 Chrysler 200, and you can find more information about it at our original post from earlier in the week.