2010 Chrysler Town & Country Lx on 2040-cars

1320 State Road 46 East, Batesville, Indiana, United States

Engine:3.3L V6 12V MPFI OHV Flexible Fuel

Transmission:4-Speed Automatic

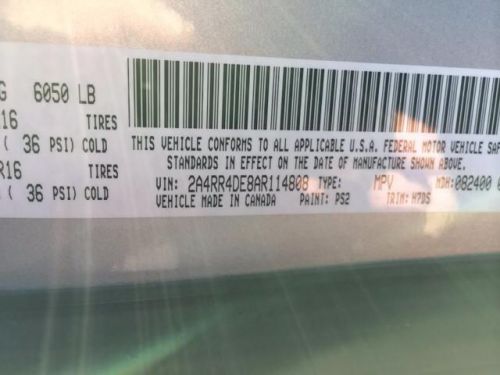

VIN (Vehicle Identification Number): 2A4RR4DE8AR114808

Stock Num: 17508

Make: Chrysler

Model: Town & Country LX

Year: 2010

Exterior Color: Bright Silver

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 65836

PRICE REDUCED, and REMAINDER OF FACTORY WARRANTY.READY FOR THE FAMILY Your satisfaction is our business! No games, just business! Creampuff! This attractive 2010 Chrysler Town Country is not going to disappoint. There you have it, short and sweet! Awarded Consumer Guide's rating of a Minivan Best Buy in 2010. This van will take you where you need to go every time...all you have to do is steer! Call Mike for more info 866-422-8948. SPEND LESS. DRIVE MORE.

Chrysler Town & Country for Sale

2013 chrysler town & country touring(US $23,251.00)

2013 chrysler town & country touring(US $23,251.00) 2005 chrysler town & country limited(US $6,443.00)

2005 chrysler town & country limited(US $6,443.00) 2014 chrysler town & country touring-l(US $37,880.00)

2014 chrysler town & country touring-l(US $37,880.00) 2014 chrysler town & country touring(US $32,855.00)

2014 chrysler town & country touring(US $32,855.00) 2013 chrysler town & country touring(US $22,987.00)

2013 chrysler town & country touring(US $22,987.00) 2014 chrysler town & country touring

2014 chrysler town & country touring

Auto Services in Indiana

West Side Auto Collision ★★★★★

V R Auto Repairs ★★★★★

Tri State Battery Supply ★★★★★

Tony Kinser Body Shop ★★★★★

Stanfa Tire & Auto ★★★★★

Speed Shop Motorsports ★★★★★

Auto blog

The next steps automakers could take after sales drop again in April

Tue, May 2 2017DETROIT (Reuters) - Major automakers on Tuesday posted declines in U.S. new vehicle sales for April in a sign the long boom cycle that lifted the American auto industry to record sales last year is losing steam, sending carmaker stocks down. The drop in sales versus April 2016 came on the heels of a disappointing March, which automakers had shrugged off as just a bad month. But two straight weak months has heightened Wall Street worries the cyclical industry is on a downward swing after a nearly uninterrupted boom since the Great Recession's end in 2010. Auto sales were a drag on U.S. first-quarter gross domestic product, with the economy growing at an annual rate of just 0.7 percent according to an advance estimate published by the Commerce Department last Friday. Excluding the auto sector the GDP growth rate would have been 1.2 percent. Industry consultant Autodata put the industry's seasonally adjusted annualized rate of sales at 16.88 million units for April, below the average of 17.2 million units predicted by analysts polled by Reuters. General Motors Co shares fell 2.9 percent while Ford Motor Co slid 4.3 percent and Fiat Chrysler Automobiles NV's U.S.-traded shares tumbled 4.2 percent. The U.S. auto industry faces multiple challenges. Sales are slipping and vehicle inventory levels have risen even as carmakers have hiked discounts to lure customers. A flood of used vehicles from the boom cycle are increasingly competing with new cars. The question for automakers: How much and for how long to curtail production this summer, which will result in worker layoffs? To bring down stocks of unsold vehicles, the Detroit automakers need to cut production, and offer more discounts without creating "an incentives war," said Mark Wakefield, head of the North American automotive practice for AlixPartners in Southfield, Michigan. "We see multiple weeks (of production) being taken out on the car side," he said, "and some softness on the truck side." Rival automakers will be watching each other to see if one is cutting prices to gain market share from another, he said, instead of just clearing inventory. INVESTORS DIGEST BAD NEWS Just last week GM reported a record first-quarter profit, but that had almost zero impact on the automaker's stock. The iconic carmaker, whose own interest was once conflated with that of America's, has slipped behind luxury carmaker Tesla Inc in terms of valuation.

Treasury says auto bailout tally drops to $20.3 billion

Tue, 12 Feb 2013In December, the US Treasury announced that it was going to sell all of its shares in General Motors within 12 to 15 months. The first tranche of the 500-million total shares was purchased by GM, which took 200 million of them at $27.50 per share. That price represents an eight-percent premium over the market price at the time. The remaining 300 million shares will be sold "through various means in an orderly fashion."

Of the $418 billion disbursed through the Troubled Asset Relief Program (TARP), a report in Automotive News indicates that "about 93 percent" has been paid back, and the latest figures put Treasury's loss from the program overall at $55.58 billion. That's a $4.1 billion improvement on the last figure, when the expected red ink added up to $59.68 billion. The auto industry's portion of that loss is estimated to be $20.3 billion, a 16-percent drop from the earlier estimate of $24.3 billion.

The Treasury now owns 19 percent of GM, but if all goes well, there will be no more cause for anyone to utter "Government Motors" by the end of Q1 next year. A loss of some kind is still expected, however. Although GM's stock price is close to $29 at the time of this writing, that's still $4 below its IPO price and well below the $72 share price necessary for the government to come out even on its GM investment. On second thought, maybe the ribbing will continue.

Marchionne says Fiat Chrysler can make 6 million cars per year

Tue, 01 Apr 2014The combined Fiat Chrysler Automobiles will see its production capacity increase from a projected 4.6 million in 2014 to 6 million units once it completes its integration, according to statements made by FCA CEO Sergio Marchionne.

"With the initiatives we will announce in May, six million is accessible," Marchionne said during a Fiat shareholders' meeting in Turin, according to The Detroit News. Marchionne is aiming to complete the merger between the Turin, Italy-based Fiat and the Auburn Hills, MI-based Chrysler by the end of this year.

Increasing production by 1.4 million units is no small order, particularly when combined Fiat and Chrysler sales have increased only modestly in the past few years - only 4.4 million units were sold in 2013, and while 4.6 million is projected for 2014, 4.5 million is also a distinct possibility. Six million units per year has been Marchionne's self-imposed goal for the combined automaker, according to The News, claiming that FCA would need to crest that point to achieve profitability.