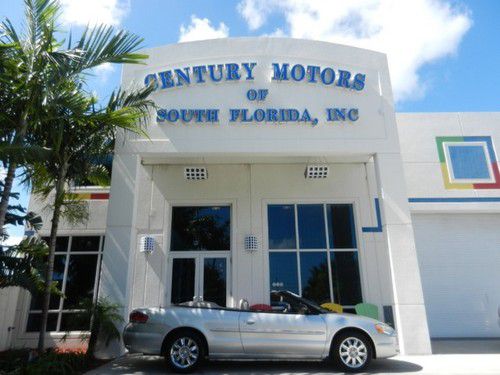

2005 Chrysler Sebring Limited Convertible 2-door 2.7l Iwth Very Low Miles on 2040-cars

New Hope, Pennsylvania, United States

Body Type:Convertible

Engine:2.7L 2700CC 167Cu. In. V6 FLEX DOHC Naturally Aspirated

Vehicle Title:Clear

Fuel Type:FLEX

Number of Cylinders: 6

Make: Chrysler

Model: Sebring

Trim: Limited Convertible 2-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: FWD

Options: Cassette Player, Leather Seats, CD Player, Convertible

Mileage: 70,501

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Sub Model: Limited

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Exterior Color: Silver

Interior Color: Gray

Number of Doors: 2

Chrysler Sebring for Sale

2003 chrysler sebring lx sedan 4-door 2.7l, no reserve

2003 chrysler sebring lx sedan 4-door 2.7l, no reserve 2010 chrysler sebring touring convertible 2-door 2.7l

2010 chrysler sebring touring convertible 2-door 2.7l Lx 2.4l a/c automatic

Lx 2.4l a/c automatic 2012 chrysler 200

2012 chrysler 200 2000 convertible~jxi~leather~new top~new transmission~cold a/c~pwr seat~florida~

2000 convertible~jxi~leather~new top~new transmission~cold a/c~pwr seat~florida~ 2005 chrysler sebring conv 2dr limited 1 owner low miles(US $8,900.00)

2005 chrysler sebring conv 2dr limited 1 owner low miles(US $8,900.00)

Auto Services in Pennsylvania

Wood`s Locksmithing ★★★★★

Wiscount & Sons Auto Parts ★★★★★

West Deptford Auto Repair ★★★★★

Waterdam Auto Service Inc. ★★★★★

Wagner`s Auto Service ★★★★★

Used Auto Parts of Southampton ★★★★★

Auto blog

Stellantis wants to outfit cars with AI software to drive revenue

Tue, Dec 7 2021MILAN — Carmaker Stellantis announced a strategy Tuesday to embed AI-enabled software in 34 million vehicles across its 14 brands, hoping the tech upgrade will help it bring in 20 billion euros ($22.6 billion) in annual revenue by 2030. CEO Carlos Tavares heralded the move as part of a strategy that would transform the car company into a “sustainable mobility tech company,” with business growth coming from features and services tied to the internet. That includes using voice commands to activate navigation, make payments and order products online. The company is expanding existing partnerships with BMW on partially automated driving, iPhone manufacturer Foxconn on customized cockpits and Waymo to push their autonomous driving work into light commercial vehicle delivery fleets. StellantisÂ’ embrace of artificial intelligence and expansion of software-enabled vehicles is part of a broad transformation in the auto industry, with a race toward more fully electric and hybrid propulsion systems, more autonomous driving features and increased connectivity in automobiles. Ford and General Motors also are banking on dramatically increased revenue from similar online subscription services. But the automakers face immense competition for monthly consumer spending from movie and music streaming services, news outlets, Amazon Prime and others. Stellantis, which was formed from the combination of PSA Peugeot and FCA Fiat Chrysler, said the software would seamlessly integrate into customers' lives, with the capability of live updates providing upgraded services over time. New products will include the possibility to subscribe to automated driving features, purchase usage-based car insurance or even increase the power of the vehicle with a tune-up to add horsepower. As a baseline, Stellantis generates 400 million euros in revenue on software-generated services installed in 12 million vehicles. To meet the targets, Stellantis will expand its software engineering team of 1,000 to 4,500 in North America, Asia and Europe. More than 1,000 of the expanded team will be retrained in house. Stellantis also announced a new partnership with Foxconn to develop semiconductors to cover 80% of the companyÂ’s needs and simplify the supply chain. The first microchips from the partnership are targeted to be installed in vehicles in 2024.

2015 Chrysler 200 snags EPA ratings of 18 mpg city and 29 highway

Tue, 25 Mar 2014While Chrysler hasn't officially announced fuel economy figures for its new 200 sedan, the information for one model has just leaked out thanks to the US Department of Energy's FuelEconomy.gov website. It certified the 200 with the 295-horsepower and 262-pound-feet 3.6-liter Pentastar V6, nine-speed automatic and all-wheel drive as getting 18-miles-per-gallon city, 29-mpg highway and 22-mpg combined.

Last year's front-wheel drive 200 with a less-powerful version of the Pentastar was rated at 19-mpg city, 29-mpg highway and 22-mpg combined. That means that buyers are getting more power and all-wheel drive traction at almost no loss in economy. However, compared to current, all-wheel drive sedan competitors, the Chrysler comes in the middle. The Ford Fusion with all-wheel drive with the 2.0-liter EcoBoost four-cylinder has 240 hp and 270 lb-ft of torque is somewhat down on power but bests it in economy at 22-mpg city, 31-mpg highway and 25-mpg combined. The current Subaru Legacy 3.6R loses in both metrics with 256 hp and 247 lb-ft and a rating of 18-mpg city, 25-mpg highway and 20-mpg combined. However, Subaru claims the next generation with the same engine will boast 20-mpg city, 28-mpg highway and 23-mpg combined. But these numbers are just estimates from the automaker at the moment, and they haven't yet been certified by the EPA yet.

The numbers for the four-cylinder and front-wheel drive 200 drivetrains are not yet available, but Chrysler has been promising the sedan gets an estimated 35-mpg highway with the 184-hp and 173-lb-ft Tigershark 2.4-liter four-cylinder engine. We won't know for sure until it's certified, but we'll keep you posted.

Chrysler recalling 49K Chargers for headlight components

Fri, 14 Mar 2014Chrysler has issued a recall for about 49,375 2011 and 2012 Dodge Chargers with halogen headlamps due to a problem with the lights. The automaker says that there could be an issue with the jumper harness and other related components.

The automaker says that 43,450 cars are affected in the US, 2,850 in Canada, 375 in Mexico and 2,700 outside of North America. The vehicles will have their headlight assemblies, including the jumper harnesses and bulbs, inspected and potentially replaced. Dodge says that its engineers investigated reports of that were similar to what was found when it recalled about 10,000 police Chargers in 2012 for overheating light components. There have been no injuries or accidents related to fault, according to Chrysler.

The automaker will be in contact with affected owners, and schedule the service. Naturally, any repairs will be free of charge. Scroll down for the company's full announcement.