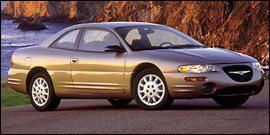

2000 Chrysler Sebring Jxi on 2040-cars

1609 S Main St, Laurinburg, North Carolina, United States

Engine:2.5L V6 24V MPFI SOHC

Transmission:4-Speed Automatic

VIN (Vehicle Identification Number): 3C3EL55H4YT292974

Stock Num: 292974

Make: Chrysler

Model: Sebring JXi

Year: 2000

Exterior Color: Silver

Options: Drive Type: FWD

Number of Doors: 2 Doors

We have a full service department able to handle all makes and models, and a car rental agency on site. We have relationships with several banks and finance companies to handle the financing needs of our customers.

Chrysler Sebring for Sale

2010 chrysler sebring touring(US $11,995.00)

2010 chrysler sebring touring(US $11,995.00) 2003 chrysler sebring gtc(US $4,964.00)

2003 chrysler sebring gtc(US $4,964.00) 2006 chrysler sebring touring(US $5,900.00)

2006 chrysler sebring touring(US $5,900.00) 2006 chrysler sebring limited(US $5,995.00)

2006 chrysler sebring limited(US $5,995.00) 2004 chrysler sebring lxi(US $4,888.00)

2004 chrysler sebring lxi(US $4,888.00) 2004 chrysler sebring(US $3,977.00)

2004 chrysler sebring(US $3,977.00)

Auto Services in North Carolina

Z-Mech Auto ★★★★★

Xtreme Detail ★★★★★

Wheels N Bumpers Car Wash ★★★★★

Weavers Body Shop & Front End ★★★★★

United Muffler Shop ★★★★★

Trotter Auto Glass Plus ★★★★★

Auto blog

2017 Chrysler Pacifica is perfect for town and country

Mon, Jan 11 2016The Pacifica has returned. In a surprising move, Chrysler revived the name of its old three-row CUV for the long-serving Town & Country's replacement. That's a bold strategy. Let's see if it pays off. Chrysler's new minivan offers a tremendous improvement on its predecessor in terms of interior and exterior design, available technology, and powertrain. Design inspiration is most clearly drawn from the brand's 200 sedan, both inside and out. Gone are the egg-crate grille, blocky headlights, and vertical taillights of the old van, all of which have been replaced with slim, stylish units. Doubtlessly destined for high-end trims, Chrysler will also offer a 200-style, two-tone interior with over 35 inches of screen real estate. 8.4 inches are reserved for the central UConnect display, while drivers have their own seven-inch display in the instrument cluster. As for the kiddies, they're the big winners, with a pair of ten-inch touchscreen displays in the back. Underhood, the big news is reserved for the new plug-in-hybrid powertrain. You can read all about that here. For right now, we'll focus on the familiar 3.6-liter Pentastar V6 and its accompanying nine-speed automatic transmission. There is 287 horsepower, 262 pound-feet of torque, and what will likely be a healthy improvement in fuel economy over the old Town & Country. You can read much more on the all-new Pacifica from our original post last night. We've also got a fresh gallery of live images from its big debut here at Detroit's Cobo Center, available up top.

Fiat Chrysler will pay $70M to settle safety disclosure suit

Thu, Dec 10 2015FCA US will pay a $70 million civil penalty to the National Highway Traffic Safety Administration for failing to submit Early Warning Report data going back to 2003. The automaker will also provide any missing data since that time, and an auditor will monitor future compliance. NHTSA says the failures to report this information "stem from problems in FCA's electronic system for monitoring and reporting safety data, including improper coding and failure to account for changes in brand names." There are no allegations of any intentional deception by the automaker. NHTSA will wrap up the latest fine with the previous consent order against FCA US earlier this year for the automaker's handling of 23 recalls. The company will know owe the safety regulator a total of $140 million in cash, and there will be possibility of $35 million more in deferred penalties if FCA doesn't comply with the agency's requests. In a statement about the fine to Autoblog, FCA US said the automaker "accepts these penalties and is revising its processes to ensure regulatory compliance." The company strongly believes that it didn't miss any safety problems over the time with this problem. Early Warning Reports include information on deaths, injuries, crashes, and other potential safety concerns, and NHTSA often uses the data in investigations for possible recalls. In September, the safety agency first announced the automaker failed to submit these documents. At the time, the regulator's administrator Mark Rosekind promised to "take appropriate action after gathering additional information on the scope and causes of this failure." FCA US also released a statement then about the lapse and said the company notified NHTSA immediately after discovering the problem. FCA US is not the first company to run afoul of NHTSA's reporting requirement. The agency fined Triumph Motorcycles and Honda this year for similar lapses. It also punished Ferrari in 2014. U.S. DOT Fines Fiat Chrysler $70 million for Failure to Provide Early Warning Report Data to NHTSA WASHINGTON – The U.S. Department of Transportation's National Highway Traffic Safety Administration has imposed a $70 million civil penalty on Fiat Chrysler Automobiles (FCA) for the auto manufacturer's failure to report legally required safety data. The penalty follows FCA's admission in September that it had failed, over several years, to provide Early Warning Report data to NHTSA as required by the TREAD Act of 2000.

Volkswagen Routan dead one last time

Wed, 25 Sep 2013Volkswagen halted production of the Routan minivan in late 2012 due to low sales volume, but there were reports swirling around that it would live on and continue production alongside the closely related Chrysler Town & Country and Dodge Grand Caravan. But now VW says that it will indeed stop Routan production for good, The Detroit Bureau reports.

As of our report in March, VW hadn't built a single Routan in 2013, and we can't imagine things have gotten much better for the minivan since then. The Detroit Bureau reports that VW produced some 2014 Routans, but they aren't for sale to the public - they are fleet-only affairs.

VW originally intended to sell between 45,000 and 50,000 Routans per year, but since it was introduced for the 2009 model year, annual sales of the minivan have averaged only 11,500 units. VW has sold 57,683 Routans total.