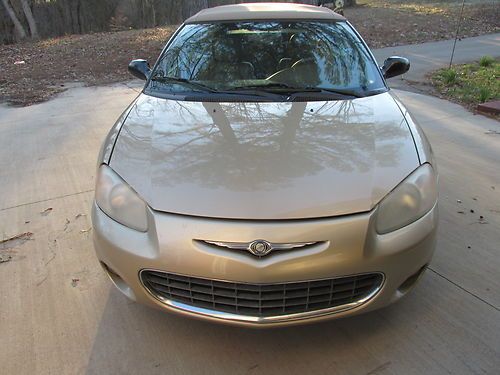

1998 Chrysler Sebring Convertible Gold - With Fresh New Battery, Plus Extras on 2040-cars

Woodland Hills, California, United States

Body Type:Convertible

Engine:2.5L 2497CC 152Cu. In. V6 GAS SOHC Naturally Aspirated

Vehicle Title:Clear

Fuel Type:GAS

Exterior Color: Gold

Make: Chrysler

Number of Cylinders: 6

Model: Sebring

Trim: JX Convertible 2-Door

Drive Type: FWD

Mileage: 156,514

Number of Doors: 2

Chrysler Sebring for Sale

2005 chrysler sebring sdn touring no reserve parts only

2005 chrysler sebring sdn touring no reserve parts only 2000 chrysler sebring jxi convertible 2-door 2.5l

2000 chrysler sebring jxi convertible 2-door 2.5l 1998 chrysler sebring 2dr conv jxi (cooper lanie 317-839-6541)(US $4,888.00)

1998 chrysler sebring 2dr conv jxi (cooper lanie 317-839-6541)(US $4,888.00) 2001 chrysler sebring lxi convertible 2-door 2.7l(US $3,750.00)

2001 chrysler sebring lxi convertible 2-door 2.7l(US $3,750.00) Power windows locks heated seats remote start navigation bluetooth ipod

Power windows locks heated seats remote start navigation bluetooth ipod 34k miles only, hard top convertible, excellent condition, $$ save(US $10,495.00)

34k miles only, hard top convertible, excellent condition, $$ save(US $10,495.00)

Auto Services in California

Z Auto Sales & Leasing ★★★★★

X-treme Auto Care ★★★★★

Wrona`s Quality Auto Repair ★★★★★

Woody`s Truck & Auto Body ★★★★★

Winter Chevrolet - Honda ★★★★★

Western Towing ★★★★★

Auto blog

Share price falls on skepticism of Chrysler-Fiat five-year plan

Thu, 08 May 2014Following this week's Fiat Chrysler extravaganza, where the Italian-American manufacturer announced its plans for the next five years, the Autoblog staff was cautiously optimistic of the company's future. Investors? Not so much.

Fiat saw its shares tumble 12 percent in Wednesday's trading, falling from 8.67 euros ($12.06 at today's rates) to 7.44 euros ($10.35) as of this writing, with blame partly going to the Italian half of the FCA marriage, which recorded a pretty significant drop in profits during the first quarter of this year.

The plan, which will cost around $77 billion over the next several years, is facing criticism from investors thanks in part to a 1.4-percent drop in Fiat's first-quarter profits, to 622 million euros ($862 million). That figure is also short of Bloomberg analysts' projections, which predicted $1.18 billion in profits before taxes, interest and one-time items.

What's in a trademark? Sometimes, the next iconic car name

Thu, 07 Aug 2014

The United States Patent and Trademark Office is a treasure trove for auto enthusiasts, especially those who double as conspiracy theorists.

Why has Toyota applied to trademark "Supra," the name of one of its legendary sports cars, even though it hasn't sold one in the United States in 16 years? Why would General Motors continue to register "Chevelle" long after one of the most famous American muscle cars hit the end of the road? And what could Chrysler possibly do with the rights to "313," the area code for Detroit?

Harsh words from senators over Chrysler's delay in reporting hack

Fri, Jul 24 2015The federal agency charged with protecting American motorists wants to know more about how hackers remotely commandeered and controlled a Jeep Cherokee. Hours after Fiat Chrysler Automobiles recalled 1.4 million cars affected by a flaw in their cellular connections, officials with the National Highway Traffic Safety Administration said Friday they'll further probe the defect by conducting a formal recall query investigation. "Opening this investigation will allow NHTSA to better assess the effectiveness of the remedy proposed," the agency said in a written statement. The remedy works, said Chris Valasek, one of the researchers who first discovered the security flaw. After testing for the vulnerability again Friday, he wrote on Twitter: "Looks like I can't get to @0xcharlie's Jeep from my house via my phone. Good job FCA/Sprint!" From his Pittsburgh home, Valasek had previously accessed and controlled co-worker Charlie Miller's Jeep along a St. Louis highway. Researchers have demonstrated remote hacks before, but the scope and severity of the Jeep vulnerability was unprecedented. The recall for a cyber threat was the first of its kind. Although a software patch and changes made by cellular provider Sprint appeared to fix the problem, news of the exploit and Chrysler's response brought a fresh round of consternation on Capitol Hill, where federal lawmakers had already expressed concerns about automotive cyber security. The Jeep hack elevated their concerns to a new level. "Cyber threats in cars are real and urgent, no figment of the imagination, as this huge recall demonstrates," said Sen. Richard Blumenthal (D-CT). "Incredibly, Chrysler delayed disclosing this chilling cyber-security danger egregiously and inexcusably, and strong sanctions are appropriate to send a message that other auto manufacturers will heed." Chrysler had known about the security gap since October, and Sen. Ed Markey (D-MA) wondered why it took the company so long to let customers know they were at risk. "Despite knowing about this security gap for nearly nine months, Chrysler is only now recalling 1.4 million vehicles to fix this vulnerability," he said. That's a potential pitfall for Chrysler, and something NHTSA will likely address in its investigation. Automakers are supposed to report safety-related defects to the agency within five days of discovery. But according to a chronology of events Chrysler submitted in its recall paperwork, it didn't inform NHTSA until July 15.