Vehicle Title:Clear

Engine:2.7 Litre fuel efficient

Fuel Type:Gasoline

For Sale By:Private Seller

Transmission:Automatic

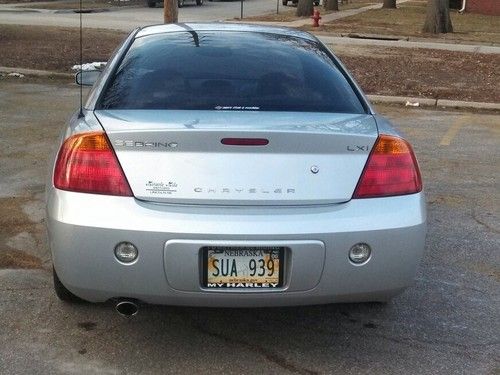

Make: Chrysler

Model: Sebring

Options: Keyless entry, Large trunk, Satellite radio, Aluminum wheels, Summer and Winter floor mats, Steering wheel radio controls, Rear Defroster, e85 Flex Fuel, Temerature gauge, Steering wheel radio control, Metric dash installed, Leather Seats, CD Player

Trim: Touring

Safety Features: Traction control, Stability Control, Fog Lights, Tilt Wheel, Summer & Winter tires, Automatic oil change sensor, Daytime running lights, Spare tire & Jack, Aluminum rims, Pannic button, Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Power Options: Power Heated Mirrors, Power Sunroof, Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Drive Type: Front wheel drive (FWD)

Mileage: 42,843

Exterior Color: Blue

Disability Equipped: No

Interior Color: Black

Number of Doors: 4

Number of Cylinders: 6

Warranty: Powertain & Manufacturers extended.

Chrysler Sebring for Sale

2005 chrysler sebring convertible 4cylinder gas saver runs fl car no rust(US $3,500.00)

2005 chrysler sebring convertible 4cylinder gas saver runs fl car no rust(US $3,500.00) 2002 chrysler sebring

2002 chrysler sebring Amazing 2002 chrysler sebring lxi with 58,000 miles!!!!

Amazing 2002 chrysler sebring lxi with 58,000 miles!!!! Chrysler sebring jxi convertible georgia owned leather seats no reserve

Chrysler sebring jxi convertible georgia owned leather seats no reserve 1998 chrysler sebring limited convertible - awesome!! no reserve!!

1998 chrysler sebring limited convertible - awesome!! no reserve!! 1998 chrysler sebring jxi convertible 2-door 2.5l

1998 chrysler sebring jxi convertible 2-door 2.5l

Auto blog

Conan releases extended cut of Chrysler's Super Bowl ad

Tue, 04 Feb 2014Chrysler's latest Super Bowl ad follows in the footsteps of its classic Imported From Detroit spot starring rapper Eminem and Half-Time in America ad starring Clint Eastwood. Featuring Bob Dylan's gravely voice asking, "Is there anything more American... than America?" the spot has been somewhat controversial, thanks to a few lines informing viewers that Germany can brew beer, Switzerland can make watches and Asia can assemble phones. The US, though, will build your car, Dylan tells us. When the ad aired, Shinola-wearing Detroiters simultaneously spit out their Atwater beer over the perceived slight.

Naturally, that controversy has spawned more than a few parodies, one of which comes from Conan O'Brien. Coco expands on the list of things that aren't made in the US, like French water, Danish cheese and Japanese animated, um, adult films. Beyond those examples, there are a number of other things that should be left to countries that aren't the United States. It's a chuckle-worthy parody, so scroll down and have a look, and compare it to the original Super Bowl ad below that.

2013 Dodge Dart gets all Moparized

Fri, 08 Feb 2013Last year, Chrysler announced it would be offering more than 150 Mopar parts and accessories on the 2013 Dodge Dart, and we got a look at some of these parts firsthand at the Chicago Auto Show. Showing off all the optional parts at once would surely create a gaudy monstrosity, so Chrysler chose to equip this particular Dart GT with just a handful of Mopar goodies, which still gave the car a nice and tasteful custom look that is available straight from the dealership (and with a full warranty, too).

Decked out in a factory color called Header Orange Clear Coat - also a very appropriate show car hue - this car added exterior styling parts such as the vented, carbon fiber hood, the bolt-on front chin spoiler and a matte black decklid spoiler. Looking inside the car, you'd think the red-accented interior is part of the Mopar parts bin, too, but this is actually what the standard Dart GT cabin will look like when it goes on sale.

FCA issuing software update for 1.4M vehicles to prevent hacking

Fri, Jul 24 2015In the wake of a Jeep Cherokee being hacked remotely while on the road through its Uconnect infotainment system, FCA US is now issuing a software update for 1.4 million vehicles in the United States. Affected customers will receive a USB stick in the mail with the improved version; owners can check this website to see if their cars are affected. A large variety of models with FCA's 8.4-inch touchscreen infotainment system are affected. They include the 2015 Chrysler 200, 2015 Chrysler 300, 2015 Dodge Charger, and 2015 Dodge Challenger; 2013-2015 Dodge Viper; 2013-2015 Ram 1500, 2500, and 3500; 2013-2015 Ram 3500, 4500, and 5500 chassis cab; 2014-2015 Jeep Grand Cherokee and Cherokee; and 2014-2015 Dodge Durango. According to FCA in its announcement, the new software "insulates connected vehicles from remote manipulation." As of July 23, the company also "fully tested and implemented within the cellular network" additional security to prevent access to many of a vehicle's systems. FCA US says that it's conducting this campaign out of an abundance of caution and disputes the notion that there's a defect with these vehicles. Beyond the demonstration of the hack in the Cherokee, the automaker says that it's unaware of any other reports of these attacks actually happening. Related Video: Statement: Software Update July 24, 2015 , Auburn Hills, Mich. - FCA US LLC is conducting a voluntary safety recall to update software in approximately 1,400,000 U.S. vehicles equipped with certain radios. The recall aligns with an ongoing software distribution that insulates connected vehicles from remote manipulation, which, if unauthorized, constitutes criminal action. Further, FCA US has applied network-level security measures to prevent the type of remote manipulation demonstrated in a recent media report. These measures – which required no customer or dealer actions – block remote access to certain vehicle systems and were fully tested and implemented within the cellular network on July 23, 2015. The Company is unaware of any injuries related to software exploitation, nor is it aware of any related complaints, warranty claims or accidents – independent of the media demonstration.