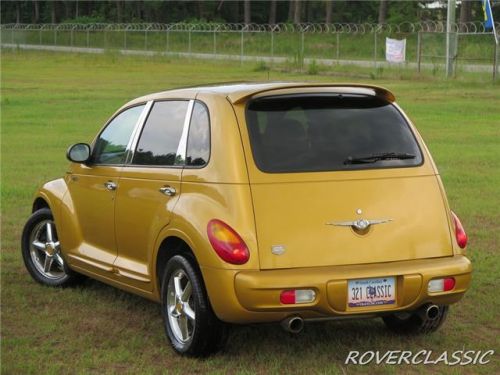

2002 Chrysler Pt Cruiser Dream Cruiser Series 1 on 2040-cars

Engine:4 Cylinder Engine

Fuel Type:Gasoline

Body Type:Station Wagon

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 3C8FY68B52T352037

Mileage: 103029

Make: Chrysler

Trim: Dream Cruiser Series 1

Drive Type: FWD

Horsepower Value: 150

Horsepower RPM: 5600

Net Torque Value: 162

Net Torque RPM: 4000

Style ID: 10191

Features: 2.4L (148) DOHC SMPI 16-VALVE L4 ENGINE

Power Options: Pwr rack & pinion steering

Exterior Color: Gold

Interior Color: Taupe/Pearl Beige

Warranty: Unspecified

Model: PT Cruiser

Chrysler PT Cruiser for Sale

2001 chrysler pt cruiser(US $5,000.00)

2001 chrysler pt cruiser(US $5,000.00) 2004 chrysler pt cruiser 80k sport premium 18s spoiler ground effects package(US $6,990.00)

2004 chrysler pt cruiser 80k sport premium 18s spoiler ground effects package(US $6,990.00) 2005 chrysler pt cruiser touring only 19k miles 1owner clean carfax(US $8,999.00)

2005 chrysler pt cruiser touring only 19k miles 1owner clean carfax(US $8,999.00) 2006 chrysler pt cruiser touring(US $3,995.00)

2006 chrysler pt cruiser touring(US $3,995.00) 2003 chrysler pt cruiser gt(US $27,500.00)

2003 chrysler pt cruiser gt(US $27,500.00) 2006 chrysler pt cruiser limited(US $3,600.00)

2006 chrysler pt cruiser limited(US $3,600.00)

Auto blog

This 1958 Chrysler Imperial Ultra 7 Pointer 1 is Japan's Batmobile

Sun, 02 Mar 2014It might be sacrilegious to admit among some auto enthusiasts, but there's more to driving than performance and speed. Sometimes it can be a matter of love, as it is for Yasushi Shiroi, who has spent the last 21 years building a faithful replica of a car from a '60s Japanese sci-fi show.

Shiroi's car is the star of the latest video from The Aficionauto and it's truly a labor of love. This machine, which is sort of like a Japanese Batmobile, is based on a 1958 Chrysler Imperial and is designed to recreate a car called the Pointer 1 from the series Ultra 7. The latter was apparently hugely popular when it ran in Japan in 1967 and 1968, and told the story a seven-member team that fought off aliens attacking Earth. While the car in the series never actually ran, Shiroi wanted one that would.

The Pointer 1 has been in constant development since Shiroi has owned it. All of the body modifications have been done in steel, but mechanically, it remains something of a mess. This replica might be slow - and to many people, ugly - but it has brought its owner about as much happiness as a car can, and that's something worth celebrating. Scroll down to check it out.

Editors' Picks March 2021 | Ford Mustang Mach-E, Polestar 2, Land Rover Defender and more

Thu, Apr 8 2021The month of March was unofficial minivan month here at Autoblog. We drove all of them but the Kia Carnival, but don’t worry, you wonÂ’t have to wait much longer to read that review. Among all the family-toting machines, we drove some more exciting vehicles including the Land Rover Defender and a pair of up-and-coming EVs. It was a month of excellent cars, meaning that this monthÂ’s litter of EditorsÂ’ Picks is stacked. In case you missed FebruaryÂ’s picks, hereÂ’s a quick refresher on whatÂ’s going on here. We rate all the new cars we drive with a 1-10 score. Cars that are exemplary or stand out in their respective segments get EditorsÂ’ Pick status. Those are the ones weÂ’d recommend to our friends, family and anybody whoÂ’s curious and asks the question. The list that youÂ’ll find below consists of every car we rated in March that earned the honor of being an EditorsÂ’ Pick. 2021 Ford Bronco Sport 2021 Ford Bronco Sport First Edition View 32 Photos Quick take: Ford's baby Bronco is an authentic foil to the big Bronco 2-Door and 4-Door. It brings rugged styling, better-than-average off-road capability and thoughtful utility features to a generic segment of cars. Score: 8 What it competes with: Jeep Compass, Jeep Cherokee, Mazda CX-30, Subaru Crosstrek, Kia Seltos, Chevrolet Trailblazer Pros: Stellar design, excellent off-road, clever interior details throughout Cons: Pricier than most, average transmission, underwhelming interior quality and ambiance in lowest trims From the editors: Road Test Editor Zac Palmer — “I genuinely enjoy driving this cute crossover. It feels like a mini truck on the road, and Ford admirably translated the design from its big Bronco over to this Escape-based crossover. News Editor Joel Stocksdale — "The Bronco Sport isn't perfect, the transmission could use some work, and it's a little bumpy, but it's a characterful little thing with loads of style, great visibility and space, and impressive capabilities on and off road in the powerful Badlands form." In-depth analysis: 2021 Ford Bronco Sport Review | Bronco for the masses  2021 Land Rover Defender 2021 Land Rover Defender 110 View 64 Photos Quick take: The Land Rover Defender provides everything you'd hope for in a modern Land Rover: superlative off-road capability, surprisingly plush on-road demeanor, abundant interior space and abundant character. The base four-cylinder is likely all you'll need and lower trim levels provide more than enough equipment.

Toyota tops Consumer Reports best, worst used car values

Tue, 18 Mar 2014We often mock Toyota for building boring, soulless cars, but a new study by Consumer Reports suggests that regardless of whether that's true, the company has some of the best used cars on the market. In its report on used cars from 2004-2013, the Japanese automaker had 11 vehicles among its brands on the list - more than any other automaker.

CR breaks the list down by cost and vehicle size, and Toyota has at least one entry at every price point and in nearly every segment. To score a recommendation, a vehicle had to perform well in the magazine's initial tests and score above-average reliability results. It also tried to only suggest cars with electronic stability control. Of the 28 recommended vehicles, Honda/Acura had the second most mentions at six, and Ford, Hyundai and Subaru managed two each.

The Detroit brands also made it to the list, but not in a positive way. Consumer Reports compiled a list of 22 vehicles it wouldn't recommend because "they have multiple years of much-worse-than-average overall reliability." General Motors had the most unrecommended models on the list at six, but Chrysler and Ford weren't far behind, with five cars each from their brands not making the grade. The full list of recommendations is available on CR's website.