2001 Chrysler Pt Cruiser Limited Wagon 4-door 2.4l on 2040-cars

River Grove, Illinois, United States

Body Type:Wagon

Vehicle Title:Clear

Engine:2.4L 2429CC 148Cu. In. l4 GAS DOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Dealer

Number of Cylinders: 4

Make: Chrysler

Model: PT Cruiser

Trim: Limited Wagon 4-Door

Drive Type: FWD

Mileage: 82,157

Options: Sunroof, Leather Seats, CD Player

Exterior Color: Burgundy

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Interior Color: Gray

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

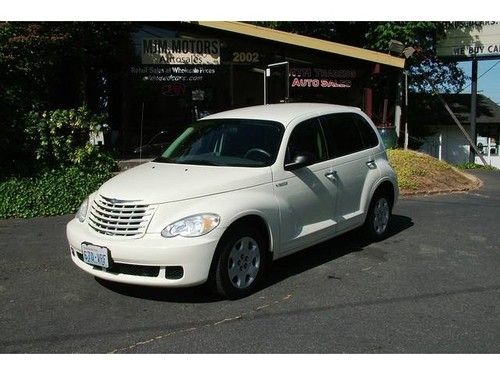

2001 Chrysler PT Cruiser! One Owner! Dark Red! Automatic! 4dr! 4cyl.! 2.4L Engine! Pwr.Windows/Seat/Door Locks! Sunroof! Leather! Cd Player! Cruise! Tilt! Alloys! Good Tires! Good/Bad/No Credit Financing Available! Remote Control Alarm! Looks and Runs Ecxellent! and Only 82k! 3month/4500mile Warranty Included Free! Style and Economy! Minor Dents and Dongs! but expected for this Age Vehicle! Look at Pictures! Do Not Miss This Vehicle! Call/Text 708.705.5515

Chrysler PT Cruiser for Sale

2001 chrysler pt cruiser custom show car premium wheels and adds 1 off auto

2001 chrysler pt cruiser custom show car premium wheels and adds 1 off auto Ultra low miles & excellent condition~loaded~leather~moonroof~turbo~heated seats(US $7,520.00)

Ultra low miles & excellent condition~loaded~leather~moonroof~turbo~heated seats(US $7,520.00) 2006 chrysler pt cruiser automatic 2-door wagon(US $6,245.00)

2006 chrysler pt cruiser automatic 2-door wagon(US $6,245.00) 2008 chrysler pt cruiser touring low reserve

2008 chrysler pt cruiser touring low reserve Gt automatic 2.4l cd/cassette turbocharged leather sunroof cruise control

Gt automatic 2.4l cd/cassette turbocharged leather sunroof cruise control Chrysler pt crusier

Chrysler pt crusier

Auto Services in Illinois

White Eagle Auto Body Shop ★★★★★

Tremont Car Connection ★★★★★

Toyota Of Naperville ★★★★★

Today`s Technology Auto Repair ★★★★★

Suburban Tire Auto Repair Center ★★★★★

Steve`s Tire & Service Center ★★★★★

Auto blog

Stellantis expects strike to cost it $795 million in third-quarter profits

Tue, Oct 31 2023MILAN — Automaker Stellantis said Tuesday that the autoworkers strike in North America is expected to cost the company around 750 million euros ($795 million) in profits — less than its North American competitors. The Europe-based maker of Jeep, Fiat and Peugeot reported a 7% boost in net revenues to 45.1 billion euros, with production halts caused by the strikes costing the company 3 billion euros in sales through October. The net revenue boost was due to higher volumes in all markets except Asia. Chief Financial Officer Natalie Knight told journalists that StellantisÂ’ strike impact was lower than the other Big Three automakers due to its global profile as well as some high-profile cost-cutting measures, calculating the hit at around 750 million euros ($795 million.) GM, the last carmaker to reach a deal to end the strike, reported an $800 million strike hit. Ford has put its impact at $1.3 billion. “We continue to be in a very strong position globally and in the U.S. This is an important market for us, and weÂ’re highly profitable and we are very committed to our future," Knight said. “But mitigation is core to how we act, and how we proceed.” Stellantis has canceled appearances at the CES technology show in Las Vegas next year as well as the LA Auto Show, due to the strike impact. Stellantis on Saturday reached a tentative agreement with the United Auto Workers Union to end a six-week strike by more than 14,000 workers at its assembly plants in Michigan and Ohio, and at parts warehouses across the nation. Stellantis does not report full earnings for the third quarter, instead providing shipments and revenues. It said that global sales of electric vehicles rose by 37% over a year earlier, powered by the Jeep Avenger and commercial vehicle sales. North America continued to be the revenue leader, contributing 21.5 billion euros, an increase of 2% over last year, and representing nearly half of global revenues. Europe, the next biggest performing region, saw revenues grow 5% to 14 billion euros, as sales rose 11%. Related video: Earnings/Financials UAW/Unions Alfa Romeo Chrysler Dodge Fiat Jeep Maserati RAM

What will the next Presidential limo look like?

Thu, 25 Jul 2013With recent news that the Secret Service has begun soliciting proposals for a new armored limousine, we've been wondering what the next presidential limo might look like. The current machine, nicknamed "The Beast", has a design based on a car that's no longer sold: the Cadillac DTS. If General Motors gets the job again, which wouldn't be a surprise considering the government still owns a chunk of the company, the next limo's shape would likely resemble the new XTS (below, left). But Cadillac hasn't always been the go-to car company for presidential whips.

Lincoln has actually provided far more presidential limousines throughout history than Cadillac. In fact, the first car modified for Commander-in-Chief-carrying duty was a 1939 Lincoln K-Series called "Sunshine Special" used by Franklin D. Roosevelt, and the last Lincoln used by a president was a 1989 Town Car ordered for George H.W. Bush. If President Obama wanted a Lincoln today, it would likely be an amalgam of the MKS sedan and MKT crossover, as illustrated above.

And what about Chrysler? The only record we could find of a President favoring the Pentastar is Nixon, who reportedly ordered two limos from the company during his administration in the '70s, and then another one, known today as the "K-Car limo," in the '80s after he left office. Obama, however, has a personal - if modest - connection to Chryslers, having owned a 300 himself before he took office. A 300-based Beast (above, right) would certainly earn the U.S. some style points.

Total auto recalls already on record pace in 2014

Tue, 08 Apr 2014If you've noticed that there have been more recalls than usual this year, you may be on to something. According to a report from the National Highway Traffic Safety Administration, the US market is on pace to break a record for recalls. In 2013, 22 million cars were recalled. We're only a third of the way through 2014, though, and we've already halved that figure, with 11 million units recalled. That's wild.

Considering the past few months, it shouldn't be a surprise that General Motors is leading the charge, with six million of the 11 million units recalled coming from one of the General's four brands. Between truck recalls, CUV recalls and the ignition switch recall, 2014 hasn't been a great year for GM.

Other recall leaders include Nissan (one million Sentra and Altima sedans), Honda (900,000 Odyssey minivans), Toyota (over one million units in a few recalls), Volkswagen (150,000 Passat sedans), Chrysler (644,000 Dodge Durango and Jeep Grand Cherokee SUVs) and most recently, Ford (434,000 units, the bulk of which were early Ford Escape CUVs). So while it's been a bad year for GM so far, its competitors aren't doing too well, either.