06 Silver Manual:5-speed 2.4l I4 Touring Edition Suv *low Mi *one Florida Owner on 2040-cars

Delray Beach, Florida, United States

Body Type:SUV

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Number of Cylinders: 4

Make: Chrysler

Model: PT Cruiser

Mileage: 20,166

Warranty: No

Sub Model: Touring Ed *MILES:20K *FL

Exterior Color: Silver

Interior Color: Gray

Chrysler PT Cruiser for Sale

2006 chrysler pt cruiser warranty guaranteed credit approval cd player nice ride

2006 chrysler pt cruiser warranty guaranteed credit approval cd player nice ride 2004 chrysler pt cruiser gt wagon 4-door 2.4l(US $3,995.00)

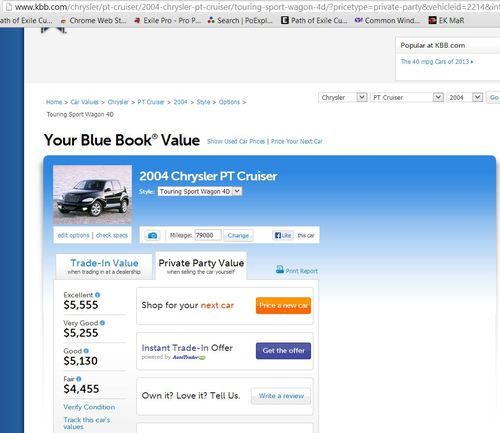

2004 chrysler pt cruiser gt wagon 4-door 2.4l(US $3,995.00) 2004 chrysler pt cruiser touring wagon 4-door 2.4l

2004 chrysler pt cruiser touring wagon 4-door 2.4l One owner, 79.5k miles, well maintained

One owner, 79.5k miles, well maintained 2005 chrysler pt cruiser convertible super clean warranty automatic

2005 chrysler pt cruiser convertible super clean warranty automatic 2009 cd player heated seats tint we finance 866-428-9374

2009 cd player heated seats tint we finance 866-428-9374

Auto Services in Florida

Zeigler Transmissions ★★★★★

Youngs Auto Rep Air ★★★★★

Wright Doug ★★★★★

Whitestone Auto Sales ★★★★★

Wales Garage Corp. ★★★★★

Valvoline Instant Oil Change ★★★★★

Auto blog

Renault delays decision on merger with Fiat Chrysler

Wed, Jun 5 2019PARIS — Renault has delayed a decision on whether to merge with Fiat Chrysler Automobiles, a deal that could reshape the global auto industry as carmakers race to make electric and autonomous vehicles for the masses. The deal still looks likely, but faced new criticism Tuesday from Renault's leading union and questions from its Japanese alliance partner Nissan. The French government is also putting conditions on the deal, including job guarantees and an operational headquarters based in France. The French carmaker's board will meet again at the end of the day Wednesday to "continue to study with interest" last week's merger proposal from FCA, Renault said in a statement. A Renault board meeting Tuesday to study the deal was inconclusive. The company didn't explain why, but a French government official said board members don't want to rush into a deal and are seeking agreement on all parts of the potential merger. The official, who spoke on condition of anonymity in line with government policy, told The Associated Press the conditions outlined by France's finance minister still "need to be met." France and Italy are both painting themselves as winners in the deal, which could save both companies 5 billion euros ($5.6 billion) a year. But workers worry a merger could lead to job losses, and analysts warn it could bog down in the challenges of managing such a hulking company across multiple countries. And a possible loser is Japan's Nissan, whose once-mighty alliance with Renault and Mitsubishi is on the rocks since star CEO Carlos Ghosn's arrest in November. Nissan CEO Hiroto Saikawa cast doubt Tuesday on whether his company will be involved in a Renault-Fiat Chrysler merger — and suggested adding Fiat Chrysler to the looser Renault-Nissan-Mitsubishi alliance instead. Saikawa said in a statement that the Renault-Fiat Chrysler deal would "significantly alter" the structure of Nissan's longtime partnership with Renault, and Nissan would analyze its contractual relationships to protect the company's interests. If Renault's board says "yes" to Fiat Chrysler, that would open the way for a non-binding memorandum of understanding to start exclusive merger negotiations. The ensuing process — including consultations with unions, the French government, antitrust authorities and other regulators — would take about a year. A merger would create the world's third-biggest automaker, worth almost $40 billion and producing some 8.7 million vehicles a year.

The USPS needs 180,000 new delivery vehicles, automakers gearing up to bid

Wed, Feb 18 2015Winning the New York City Taxi of Tomorrow tender was a huge prize for Nissan, even though the company is still working through the process of claiming its prize. The United States Postal Service has begun the process to take bids for a new delivery vehicle to replace the all-too-familiar Grumman Long Life Vehicle, and that will be a much larger plum for the automaker who wins it, perhaps worth more than six billion dollars. The Grumman LLV is an aluminum body covering a Chevrolet S-10 pickup chassis and General Motors' Iron Duke four-cylinder engine. The USPS bought them from 1987 to 1994, and the 163,000 of them still in service are a monumental drain on postal resources: they get roughly ten miles to the gallon instead of the quoted 16 mpg, drink up more than $530 million in fuel each year, and their constant repair needs like the balky sliding door and leaky windshields have led the service to increase the annual maintenance budget from $100 million to $500 million. A seat belt is about as modern as it gets for safety technology, and the USPS says that assuming things stay the same, it can't afford to run them beyond 2017. Last year it put out two triage requests for proposals seeking 10,000 new chassis and drivetrains for the Grumman and 10,000 new vehicles. The LLV is also too small for the modern mail system in which package delivery is growing and letter delivery is declining. The service says it doesn't have a fixed idea of the ideal "next-generation delivery vehicles," but it listed a number of requirements in its initial request and is open to any proposal. Carriers have some suggestions, though, saying they want better cupholders, sun visors that they can stuff letters behind, a driver's compartment free of slits that can swallow mail, and a backup camera. The request for information sent to automakers pegs the tender at 180,000 vehicles that would cost between $25,000 and $35,000 apiece, and it will hold a conference on February 18 to answer questions about the contract. GM is the only domestic maker to avow an interest, while Ford and Fiat-Chrysler have remained cagey. Yet with a possible $6.3 billion up for grabs and some new vans for sale that would be advertised on every block in the country, we have a feeling everyone will be listening closely come February 18. We also have a feeling the LeMons series is going to be flooded with Grummans come 2017. News Source: Wall Street Journal, Automotive News - sub.

Stellantis moves to set up its own lending unit

Sat, Sep 4 2021Stellantis is buying Houston-based auto lender First Investors Financial Services Group to set up its own finance arm in the U.S., a move that should support sales and eventually boost profit. The only major traditional automaker in the U.S. without its own finance company agreed to pay $285 million to a group of investors led by Gallatin Point Capital and Jacobs Asset Management, according to a statement. The transaction is expected to close by year-end. Stellantis was formed via the merger between Fiat Chrysler and PSA Group early this year. Carlos Tavares, the PSA boss who became the combined company’s chief executive officer, called the deal to acquire First Investors a milestone that will increase earnings and enhance customer loyalty. “Direct ownership of a finance company in the U.S. is a white-space opportunity which will allow Stellantis to provide our customers and dealers a complete range of financing options,” Tavares said Wednesday in the statement. Having an in-house finance company has helped rivals General Motors Co. and Ford Motor Co. pad profits, especially during the global semiconductor shortage that has limited production and crimped sales. GM bought subprime lender AmeriCredit Corp. in 2010 and renamed it GM Financial. The operation generated a $2.76 billion profit in the first half -- roughly a third of the companyÂ’s adjusted earnings before interest and taxes. Trouble for Santander? The First Investors acquisition could spell trouble for Chrysler Capital, the operation that Santander Consumer USA Holdings Inc. and Chrysler set up in 2013 before the U.S. automaker completed its merger with Fiat. In a statement, Santander Consumer said itÂ’s committed to supporting Stellantis through the term of their existing agreement and its transition. Santander Consumer will also have “ongoing conversations with Stellantis about long-term mutually beneficial opportunities beyond 2023,” the company said, adding that its consumer business remains strong and has “delivered solid results for our shareholders.” This, along with support from its parent company, will allow the lender to “pursue additional opportunities as they arise.” The lenderÂ’s U.S.-listed stock fell 1.5% in New York trading Wednesday after Bloomberg reported Stellantis was preparing to announce a new finance partner. Stellantis shares rose as much as 1.3% in Paris trading Thursday.